Us Savings Bonds FormsDaily Catalog 2021-2026

Understanding the FS Form 1851

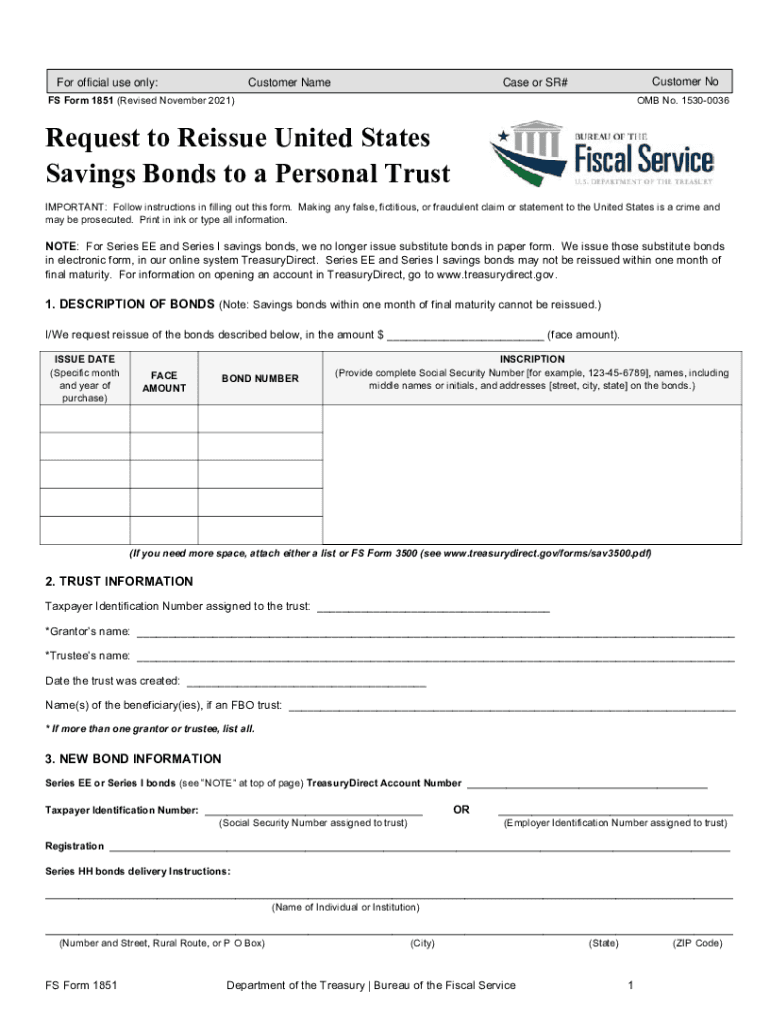

The FS Form 1851, also known as the Request for Reissue of United States Savings Bonds, is a crucial document for individuals seeking to manage their savings bonds. This form is primarily used to request the reissue of bonds that have been lost, stolen, or damaged. Understanding the specifics of this form is essential for ensuring that your request is processed smoothly and efficiently.

The form requires detailed information about the bonds in question, including bond serial numbers, issue dates, and the names of the bondholders. Accuracy in filling out the FS Form 1851 is vital, as any discrepancies can lead to delays in processing your request.

Steps to Complete the FS Form 1851

Completing the FS Form 1851 involves several key steps to ensure that your request is correctly submitted. Begin by gathering all necessary information about your savings bonds, including serial numbers and issue dates. This information can typically be found on the bonds themselves or in your financial records.

Next, fill out the form carefully, ensuring that all sections are completed accurately. Pay special attention to the identification of the bondholders and the details of the bonds being reissued. After completing the form, review it for any errors before submission. This careful approach helps prevent processing delays.

Legal Use of the FS Form 1851

The FS Form 1851 is legally binding when completed and submitted in accordance with the relevant regulations. It is important to understand that the form must be signed by the bondholder or an authorized representative. This signature affirms the accuracy of the information provided and the legitimacy of the request.

Compliance with legal requirements ensures that the reissue process is valid. The form must be submitted to the appropriate financial institution or the U.S. Department of the Treasury, depending on the nature of the request. Adhering to these legal standards protects the interests of all parties involved.

Form Submission Methods

Submitting the FS Form 1851 can be done through various methods, including online, by mail, or in person. For those who prefer digital convenience, many users opt to complete and submit the form electronically. This method often expedites processing times and provides immediate confirmation of submission.

If you choose to submit the form by mail, ensure that you send it to the correct address as specified by the U.S. Department of the Treasury. In-person submissions may also be made at designated financial institutions. Each method has its own advantages, so selecting the one that best suits your needs is important.

Required Documents for FS Form 1851

When submitting the FS Form 1851, certain documents are required to support your request. These typically include proof of identity, such as a government-issued photo ID, and any relevant documentation related to the bonds, such as purchase receipts or previous correspondence regarding the bonds.

Having these documents ready can streamline the process and help ensure that your request is processed without unnecessary delays. It is advisable to keep copies of all submitted documents for your records.

Eligibility Criteria for FS Form 1851

To successfully submit the FS Form 1851, applicants must meet specific eligibility criteria. The bondholder must be the individual named on the bonds or an authorized representative. In cases where the bondholder is deceased, the executor of the estate may submit the form on behalf of the estate.

Additionally, the bonds must be eligible for reissue, meaning they should not have been previously redeemed or matured. Understanding these criteria is essential for ensuring that your request is valid and can be processed without complications.

Quick guide on how to complete us savings bonds formsdaily catalog

Prepare Us Savings Bonds FormsDaily Catalog effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly and without hindrances. Manage Us Savings Bonds FormsDaily Catalog on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Us Savings Bonds FormsDaily Catalog with ease

- Find Us Savings Bonds FormsDaily Catalog and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for such purposes.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your selection. Edit and eSign Us Savings Bonds FormsDaily Catalog and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct us savings bonds formsdaily catalog

Create this form in 5 minutes!

People also ask

-

What is FS Form 1851?

FS Form 1851 is a document used to apply for a permit related to various services offered by the U.S. government. Utilizing airSlate SignNow can streamline the signing and submission process of the FS Form 1851, making it easier for businesses to manage important approvals electronically.

-

How does airSlate SignNow help with FS Form 1851?

airSlate SignNow provides an efficient platform to electronically sign and send FS Form 1851. This solution not only saves time by eliminating the need for paper documents but also enhances security with encrypted eSignatures, ensuring your submissions are safe and compliant.

-

Is there a cost associated with using airSlate SignNow for FS Form 1851?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you're a small business or a large enterprise, you'll find a cost-effective solution for managing your FS Form 1851 efficiently, without breaking the bank.

-

Can I track the status of my FS Form 1851 submissions?

Absolutely! airSlate SignNow allows users to track the status of their FS Form 1851 submissions in real-time. You will receive notifications regarding the signing process, ensuring that you are always up-to-date with your document's progress.

-

What features does airSlate SignNow offer for FS Form 1851 users?

airSlate SignNow includes features like custom templates, automated workflows, and audit trails specifically designed for FS Form 1851. These tools enhance usability and help you maintain compliance by documenting each step of the signing process.

-

Can I integrate airSlate SignNow with other software for my FS Form 1851 processing?

Yes, airSlate SignNow offers various integrations with popular software applications. This means you can easily connect your existing tools with airSlate SignNow to streamline your FS Form 1851 processes, improving efficiency and data management.

-

What are the benefits of using airSlate SignNow for FS Form 1851?

The main benefits of using airSlate SignNow for FS Form 1851 include enhanced efficiency, reduced paperwork, and improved compliance. By enabling electronic signatures, airSlate SignNow speeds up the entire process, allowing for quicker approvals and smoother operations.

Get more for Us Savings Bonds FormsDaily Catalog

- Plumbing contract for contractor arizona form

- Brick mason contract for contractor arizona form

- Roofing contract for contractor arizona form

- Electrical contract for contractor arizona form

- Sheetrock drywall contract for contractor arizona form

- Flooring contract for contractor arizona form

- Agreement a land form

- Notice of intent to enforce forfeiture provisions of contact for deed arizona form

Find out other Us Savings Bonds FormsDaily Catalog

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application