About UsReferenceFAQFREQUENTLY ASKED QUESTIONS on NATIONAL PENSION SYSTEM AL 2022-2026

Understanding the NPS Subscriber Registration Form

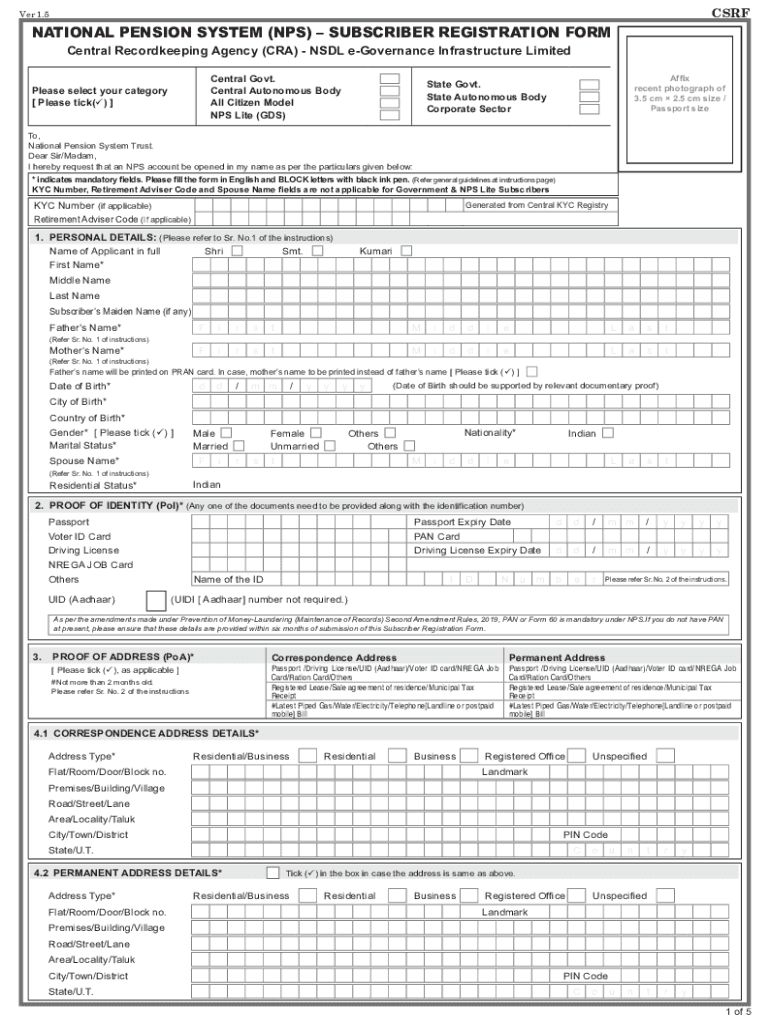

The national pension system subscriber registration form is essential for individuals looking to secure their financial future through a structured pension plan. This form collects personal information, including identity and financial details, necessary for enrollment in the NPS. Completing this form accurately ensures that your contributions are properly recorded and managed, allowing you to benefit from the pension scheme.

Steps to Complete the NPS Subscriber Registration Form

Filling out the NPS subscriber registration form involves several key steps:

- Gather necessary documents, such as identification proof and address proof.

- Provide personal details, including your name, date of birth, and contact information.

- Fill in financial information, including your income and investment preferences.

- Review all entries for accuracy before submission.

- Submit the form online or through designated channels as per your preference.

Required Documents for NPS Subscriber Registration

To complete the NPS subscriber registration form, you will need to provide specific documents. These typically include:

- A government-issued photo ID (e.g., driver's license, passport).

- Proof of address (e.g., utility bill, bank statement).

- Passport-sized photographs.

- Bank account details for direct debit of contributions.

Legal Considerations for NPS Registration

When completing the NPS subscriber registration form, it is important to understand the legal implications. The information provided must be accurate and truthful, as any discrepancies can lead to penalties or denial of benefits. The form is governed by regulations that ensure compliance with financial laws, protecting both the subscriber and the pension fund.

Digital vs. Paper Version of the NPS Subscriber Registration Form

The NPS subscriber registration form can be completed both digitally and on paper. The digital version offers convenience and faster processing times, while the paper version may be preferred by those who are less comfortable with technology. Regardless of the method chosen, it is crucial to ensure that all information is correctly filled out to avoid delays in registration.

Common Issues When Filling Out the NPS Subscriber Registration Form

While completing the NPS subscriber registration form, individuals may encounter common issues, such as:

- Missing documentation, which can delay the registration process.

- Inaccurate personal information, leading to potential legal complications.

- Technical difficulties when submitting the form online.

Addressing these issues promptly can help ensure a smooth registration experience.

Quick guide on how to complete about usreferencefaqfrequently asked questions on national pension system al

Effortlessly Prepare About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed files, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL on any device using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to Edit and eSign About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL with Ease

- Find About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about usreferencefaqfrequently asked questions on national pension system al

Create this form in 5 minutes!

People also ask

-

What is the nps subscriber registration form?

The nps subscriber registration form is a tool provided by airSlate SignNow that allows businesses to easily collect and manage subscriber data. It streamlines the registration process, ensuring that all necessary information is captured securely and efficiently.

-

How much does the nps subscriber registration form cost?

The nps subscriber registration form is part of airSlate SignNow's comprehensive features, which are available through various pricing plans. You can choose a plan that fits your business needs, whether you're a small startup or a large enterprise, offering flexibility and value.

-

What features does the nps subscriber registration form offer?

The nps subscriber registration form includes customizable fields, automated workflows, and secure data storage. It enables businesses to create tailored forms that meet their specific needs, thus enhancing user experience and data collection efficiency.

-

How can the nps subscriber registration form benefit my business?

By using the nps subscriber registration form, your business can improve subscriber engagement and retention. It simplifies the sign-up process, leading to increased conversion rates and a more organized database for your marketing efforts.

-

Is it easy to integrate the nps subscriber registration form with other tools?

Yes, airSlate SignNow ensures that the nps subscriber registration form can easily integrate with various third-party applications. This flexibility allows you to connect with CRM systems, email marketing software, and other platforms, enhancing workflow efficiency.

-

Can I customize the nps subscriber registration form?

Absolutely! The nps subscriber registration form is highly customizable, allowing you to modify fields and display logic according to your specifications. This ensures that the form aligns with your branding and business requirements.

-

What security features does the nps subscriber registration form include?

The nps subscriber registration form incorporates robust security measures, including data encryption and secure access controls. This ensures that subscriber information is protected, giving both you and your users peace of mind.

Get more for About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL

- Affidavit statement form

- Affidavit of service of mechanics lien statement by certified mail form 4042 minnesota

- Assignor whether one or more hereby sells assigns and transfers to assignee whether one or more a mechanic s lien the verified form

- Self assessment tax returns govuk form

- Minnesota mechanic lien form

- Minnesota entity form

- Notice of lis pendens general form

- Justia notice of lis pendens foreclosure of mechanics form

Find out other About UsReferenceFAQFREQUENTLY ASKED QUESTIONS ON NATIONAL PENSION SYSTEM AL

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now