Petition for Certificate Releasing Connecticut Probate Fee 2019-2026

Understanding the Petition for Certificate Releasing Connecticut Probate Fee

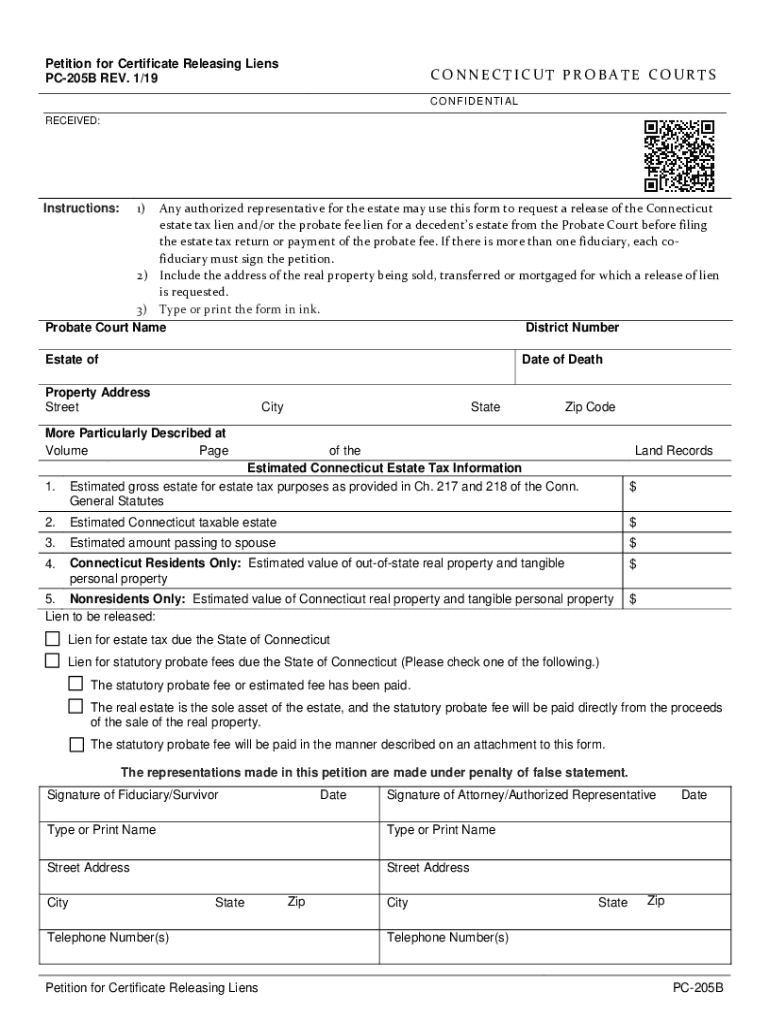

The Petition for Certificate Releasing Connecticut Probate Fee is a legal document used to formally request the release of liens associated with probate fees in Connecticut. This petition is essential for individuals or entities seeking to clear any financial obligations tied to the probate process. Understanding the purpose and implications of this form is crucial for ensuring compliance with state regulations and facilitating the smooth transfer of assets.

Steps to Complete the Petition for Certificate Releasing Connecticut Probate Fee

Completing the Petition for Certificate Releasing Connecticut Probate Fee involves several key steps:

- Gather necessary information regarding the probate case, including case number and involved parties.

- Fill out the petition form accurately, ensuring all required fields are completed.

- Attach any supporting documents that may be needed, such as proof of payment of probate fees.

- Review the completed petition for accuracy and completeness.

- Submit the petition to the appropriate probate court, either in person or via mail.

Key Elements of the Petition for Certificate Releasing Connecticut Probate Fee

The petition should include several critical elements to be considered valid:

- Petitioner's Information: Full name and contact details of the individual or entity submitting the petition.

- Case Information: The probate case number and details of the deceased, if applicable.

- Reason for Release: A clear explanation of why the release of the lien is being requested.

- Supporting Documentation: Any documents that substantiate the request, such as payment receipts.

Legal Use of the Petition for Certificate Releasing Connecticut Probate Fee

The legal use of this petition is to formally request the release of liens that may impede the distribution of assets in a probate case. It is important to ensure that the petition is filed correctly, as improper submissions can lead to delays or denials. The document serves as a legal record of the request and must adhere to state regulations to be enforceable.

Required Documents for the Petition for Certificate Releasing Connecticut Probate Fee

When submitting the petition, certain documents are typically required to support the request:

- Completed Petition for Certificate Releasing Connecticut Probate Fee form.

- Proof of payment of any probate fees associated with the case.

- Any additional documentation that may be relevant to the case, such as court orders or previous filings.

Filing Methods for the Petition for Certificate Releasing Connecticut Probate Fee

The petition can be filed through various methods:

- In-Person: Submit the petition directly at the local probate court.

- By Mail: Send the completed petition and supporting documents to the appropriate court address.

- Online: Some jurisdictions may offer electronic filing options, allowing for a more streamlined process.

Quick guide on how to complete petition for certificate releasing connecticut probate fee

Complete Petition For Certificate Releasing Connecticut Probate Fee seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents rapidly without delays. Handle Petition For Certificate Releasing Connecticut Probate Fee on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest method to modify and eSign Petition For Certificate Releasing Connecticut Probate Fee without effort

- Locate Petition For Certificate Releasing Connecticut Probate Fee and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure confidential information with tools designed for that specific purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal standing as a traditional ink signature.

- Verify all the information and click the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in a few clicks from a device of your selection. Modify and eSign Petition For Certificate Releasing Connecticut Probate Fee while ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct petition for certificate releasing connecticut probate fee

Create this form in 5 minutes!

People also ask

-

What is the process of Connecticut releasing liens?

Connecticut releasing liens involves a legal process where a lien is officially removed from a property. This may require submitting specific documentation to a court or a county office. Using airSlate SignNow, you can streamline this process by electronically signing and sending required documents efficiently.

-

How can airSlate SignNow help with Connecticut releasing liens?

airSlate SignNow allows you to manage the documentation needed for Connecticut releasing liens effectively. With features like eSigning and document tracking, you can ensure that every step is completed accurately and promptly. This helps to facilitate faster lien releases and maintain clear communication with involved parties.

-

What are the costs associated with Connecticut releasing liens?

The costs associated with Connecticut releasing liens can vary depending on local government fees and specific legal requirements. Using airSlate SignNow for document preparation and signing can reduce overhead costs, making it a budget-friendly option. Our pricing plans are designed to fit various business needs, ensuring you have access to affordable solutions.

-

What features does airSlate SignNow offer for handling liens?

AirSlate SignNow offers several features that simplify handling Connecticut releasing liens, including customizable templates, secure document storage, and real-time notifications. These tools help ensure compliance with local regulations and keep your lien documentation organized. Additionally, you can integrate with other platforms for a seamless experience.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with liens?

Yes, airSlate SignNow is suitable for businesses of all sizes dealing with Connecticut releasing liens. Whether you’re a small business or a large corporation, our platform scales to meet your needs. The user-friendly interface and powerful features make it accessible to everyone, simplifying the lien release process.

-

How does airSlate SignNow ensure the security of lien documents?

AirSlate SignNow prioritizes the security of your documents, including those related to Connecticut releasing liens. Our platform employs advanced encryption and security protocols to protect sensitive information. Additionally, you have control over access permissions, ensuring that only authorized personnel can view or edit important lien-related documents.

-

Can airSlate SignNow integrate with other software used for lien management?

Yes, airSlate SignNow can integrate with various software solutions to enhance your lien management capabilities. This means that you can easily connect existing systems and streamline processes related to Connecticut releasing liens. By integrating with your current tools, airSlate SignNow helps maintain efficiency and consistency in your workflow.

Get more for Petition For Certificate Releasing Connecticut Probate Fee

- Breach of contract to provide steel and work mississippi form

- Mississippi claim file form

- Plaintiffs answer to counter claim mississippi form

- Order dismissing case for want of prosecution mississippi form

- Complaint mississippi 497314116 form

- Motion change venue 497314118 form

- Opposition motion form

- Arkansas better chance program manual form

Find out other Petition For Certificate Releasing Connecticut Probate Fee

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy