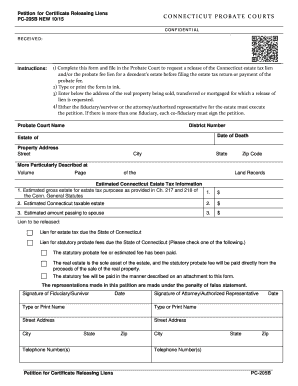

Petition for Certificate Releasing Liens 2015

What is the Petition for Certificate Releasing Liens

The Petition for Certificate Releasing Liens is a formal document used to request the removal of a lien placed on a property or asset. Liens can arise from various situations, including unpaid debts or obligations. This petition serves as a legal means to assert that the underlying debt has been satisfied or that the lien was improperly placed. Understanding the purpose of this form is crucial for individuals or businesses seeking to clear their financial records and regain full ownership of their property.

Steps to Complete the Petition for Certificate Releasing Liens

Completing the Petition for Certificate Releasing Liens involves several key steps to ensure accuracy and compliance with legal requirements. Start by gathering all necessary information, including details of the lien, the property in question, and any supporting documentation that proves the debt has been settled. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the petition to the appropriate authority, which may vary by state or jurisdiction.

Legal Use of the Petition for Certificate Releasing Liens

The legal use of the Petition for Certificate Releasing Liens is governed by specific laws and regulations that vary by state. It is essential to understand these legal frameworks to ensure that the petition is valid and enforceable. This document must be filed correctly to comply with local laws, and it may require notarization or additional signatures. Failure to adhere to these legal requirements could result in delays or rejections of the petition, impacting the ability to release the lien effectively.

Required Documents for the Petition for Certificate Releasing Liens

When preparing to file the Petition for Certificate Releasing Liens, certain documents are typically required to support your request. These may include:

- Proof of payment or settlement of the debt associated with the lien.

- Copies of any prior correspondence regarding the lien.

- Identification documents to verify the petitioner's identity.

- Any relevant legal documents that establish the basis for the lien's release.

Having these documents ready can streamline the process and help ensure that your petition is processed without unnecessary delays.

How to Obtain the Petition for Certificate Releasing Liens

The Petition for Certificate Releasing Liens can typically be obtained from the office of the local government or the relevant authority responsible for lien management. This may include county clerks, tax offices, or other regulatory bodies. Many jurisdictions also offer downloadable versions of the petition on their official websites, making it easier for individuals to access the form. It is important to ensure that you are using the correct version of the petition applicable to your specific situation and jurisdiction.

Examples of Using the Petition for Certificate Releasing Liens

Examples of situations where the Petition for Certificate Releasing Liens may be used include:

- A homeowner who has paid off a mortgage and needs to release the lien held by the lender.

- A business that has settled a tax debt and wishes to remove the tax lien from its property records.

- An individual who disputes a lien placed due to a billing error and seeks to have it removed.

These examples highlight the practical applications of the petition and the importance of understanding when and how to use it effectively.

Quick guide on how to complete petition for certificate releasing liens

Effortlessly Prepare Petition For Certificate Releasing Liens on Any Device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Petition For Certificate Releasing Liens on any device using airSlate SignNow’s Android or iOS applications and enhance your document-focused operations today.

The easiest method to alter and eSign Petition For Certificate Releasing Liens with ease

- Locate Petition For Certificate Releasing Liens and click on Get Form to begin.

- Utilize the tools we provide to complete your form effectively.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfils all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Petition For Certificate Releasing Liens while ensuring exceptional communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct petition for certificate releasing liens

Create this form in 5 minutes!

People also ask

-

What is a releasing form in airSlate SignNow?

A releasing form in airSlate SignNow is a digital document that allows users to grant permission or transfer rights over certain assets or decisions. This feature streamlines the eSignature process, enabling businesses to quickly create, send, and manage their releasing forms securely.

-

How much does it cost to use airSlate SignNow for releasing forms?

The pricing for using airSlate SignNow varies based on the selected plan, with options for businesses of all sizes. Our affordable plans include features for creating and managing releasing forms, ensuring that businesses can find a solution that fits their budget.

-

What features does airSlate SignNow offer for creating releasing forms?

airSlate SignNow provides a user-friendly interface for creating releasing forms, including customizable templates, drag-and-drop fields, and automated workflows. Additionally, it supports various file formats, making it easy to design and send your releasing forms effectively.

-

Can I integrate airSlate SignNow with other applications for my releasing forms?

Yes, airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Salesforce, and Dropbox, allowing for efficient management of your releasing forms. These integrations help streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for releasing forms?

Using airSlate SignNow for releasing forms offers numerous benefits, including faster turnaround times and improved document security. The platform ensures compliance with legal standards while providing an efficient way to manage permissions and approvals electronically.

-

Is it possible to track the status of my releasing forms in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your releasing forms, allowing you to see who has viewed, signed, or completed the document. This feature ensures transparency and helps you stay informed throughout the signing process.

-

Can I customize my releasing forms to match my brand?

Yes, airSlate SignNow allows you to fully customize your releasing forms to align with your brand's identity. You can add your logo, change colors, and modify the layout to create a professional and consistent look for all your documents.

Get more for Petition For Certificate Releasing Liens

- Request for amendment notice of denial letter form

- Authorization for access use and disclosure form

- Querying the database queries and views form

- Guide 1 training package assessment materials kit form

- Date from form

- Standard form 1 sf 1 printing and binding requisition

- Hong kong zip code 00000 form

- Competitive hiring opm form

Find out other Petition For Certificate Releasing Liens

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online