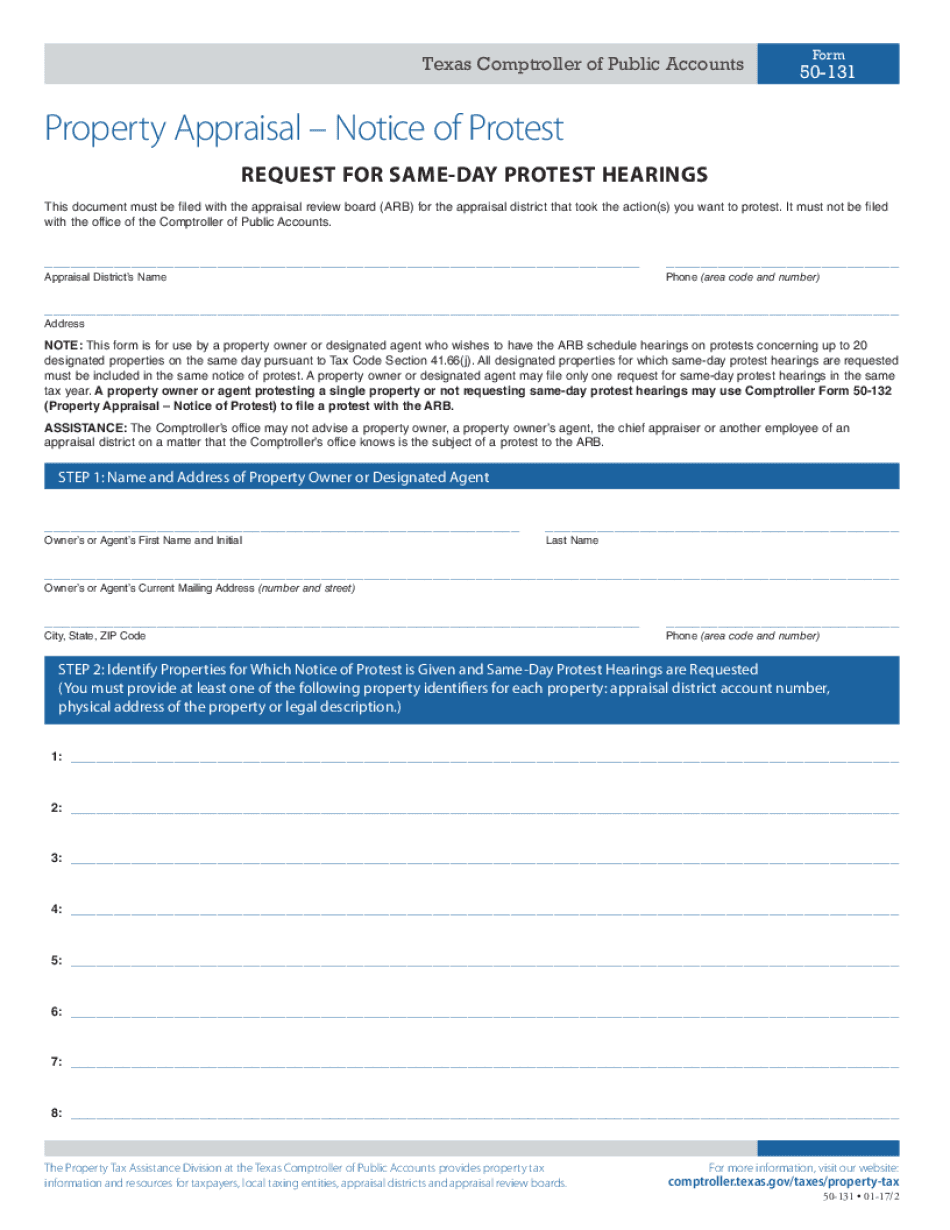

REQUEST for SAME DAY PROTEST HEARINGS Form

What is the Request for Same Day Protest Hearings?

The Request for Same Day Protest Hearings is a formal document used by property owners in Texas to challenge the appraised value of their property on the same day as their appraisal review board (ARB) hearing. This request allows taxpayers to expedite the process of contesting their property taxes, ensuring that they have a timely opportunity to present their case to the ARB. The form is essential for those who believe that their property has been overvalued and wish to seek a fair reassessment.

Steps to Complete the Request for Same Day Protest Hearings

Completing the Request for Same Day Protest Hearings involves several key steps:

- Gather necessary information, including your property details and the basis for your protest.

- Obtain the form, which can typically be found on the Texas Comptroller's website or through your local appraisal district.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form to the appropriate appraisal district office, either online, by mail, or in person, depending on the submission methods available.

- Keep a copy of the submitted form for your records.

Key Elements of the Request for Same Day Protest Hearings

When completing the Request for Same Day Protest Hearings, certain key elements must be included to ensure its validity:

- Property Identification: Clearly state the property address and identification number.

- Reason for Protest: Provide a detailed explanation of why you believe the appraised value is incorrect.

- Signature: The form must be signed by the property owner or an authorized representative.

- Date of Submission: Ensure that the form is submitted on the same day as the hearing.

Legal Use of the Request for Same Day Protest Hearings

The legal use of the Request for Same Day Protest Hearings is governed by Texas property tax laws. This form must be submitted in compliance with the deadlines set by the Texas Property Tax Code. It is essential for property owners to understand their rights and the legal framework surrounding property tax protests to effectively utilize this form. Failure to adhere to these regulations may result in the denial of the protest.

Form Submission Methods

The Request for Same Day Protest Hearings can be submitted through various methods, depending on the local appraisal district's policies. Common submission methods include:

- Online: Many appraisal districts offer electronic submission through their websites.

- Mail: The completed form can be sent via postal service to the appraisal district office.

- In-Person: Property owners may also submit the form directly at the appraisal district office during business hours.

Eligibility Criteria

To be eligible to file the Request for Same Day Protest Hearings, property owners must meet specific criteria, including:

- Ownership of the property in question.

- Submission of the request on the same day as the scheduled ARB hearing.

- Compliance with local appraisal district requirements and deadlines.

Quick guide on how to complete request for same day protest hearings

Complete REQUEST FOR SAME DAY PROTEST HEARINGS seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hindrances. Manage REQUEST FOR SAME DAY PROTEST HEARINGS on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign REQUEST FOR SAME DAY PROTEST HEARINGS effortlessly

- Find REQUEST FOR SAME DAY PROTEST HEARINGS and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign REQUEST FOR SAME DAY PROTEST HEARINGS to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 50 and how does it work with airSlate SignNow?

Form 50 is a specific type of document that can be efficiently managed using airSlate SignNow's platform. Our solution allows businesses to create, send, and eSign Form 50 seamlessly, ensuring a quick turnaround and better document management.

-

Is there a cost associated with using airSlate SignNow for Form 50?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. With affordable options available, you can easily implement Form 50 into your workflows without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 50?

AirSlate SignNow provides a range of features for managing Form 50, including customizable templates, automated workflows, and secure eSigning. These tools help streamline the process, making it more efficient for businesses.

-

Can I integrate Form 50 with other software using airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to connect your Form 50 workflows with your favorite tools. This enhances productivity and helps manage documents across platforms.

-

What are the benefits of using airSlate SignNow for Form 50?

Using airSlate SignNow for Form 50 offers numerous benefits, including faster processing times, reduced paper usage, and enhanced document security. Our user-friendly solution ensures that completing and signing Form 50 is simpler than ever.

-

How secure is my Form 50 data when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your Form 50 data by employing advanced encryption and compliance with industry standards. You can trust that your sensitive information will remain confidential and protected.

-

Can I access my Form 50 documents on mobile with airSlate SignNow?

Yes, airSlate SignNow is accessible on mobile devices, enabling you to manage your Form 50 documents on the go. This flexibility ensures that you can send and eSign documents anytime, anywhere.

Get more for REQUEST FOR SAME DAY PROTEST HEARINGS

- Bill of sale for watercraft or boat mississippi form

- Bill of sale of automobile and odometer statement for as is sale mississippi form

- Construction contract cost plus or fixed fee mississippi form

- Painting contract for contractor mississippi form

- Trim carpenter contract for contractor mississippi form

- Fencing contract for contractor mississippi form

- Hvac contract for contractor mississippi form

- Landscape contract for contractor mississippi form

Find out other REQUEST FOR SAME DAY PROTEST HEARINGS

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF