Sales and Use Tax FormsDOR

Understanding the Sales and Use Tax Forms DOR

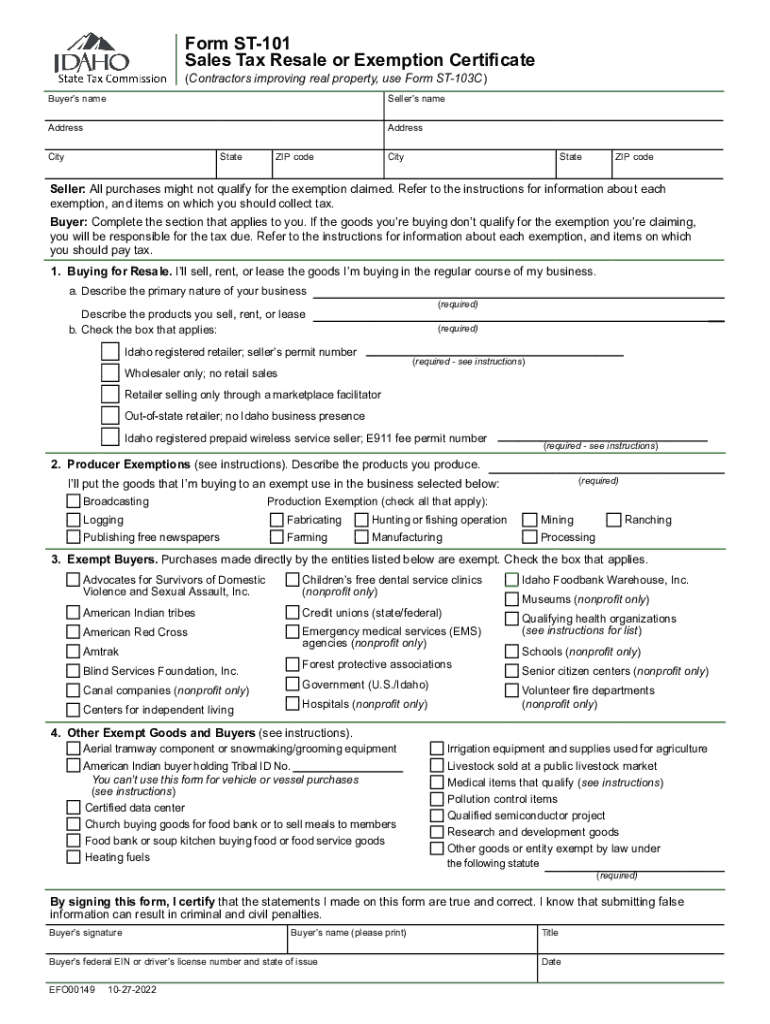

The Sales and Use Tax Forms DOR are essential documents used for reporting and paying sales tax in the state of Idaho. These forms are designed for businesses and individuals who engage in taxable sales or purchases. The 2022 ST-101 PDF is a specific version of this form, which must be completed accurately to ensure compliance with state tax regulations. Understanding the purpose and requirements of these forms is critical for avoiding penalties and ensuring proper tax reporting.

Steps to Complete the Sales and Use Tax Forms DOR

Completing the Sales and Use Tax Forms DOR requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including sales records and tax exemption certificates.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total sales tax due based on your taxable sales.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid late fees.

Legal Use of the Sales and Use Tax Forms DOR

Using the Sales and Use Tax Forms DOR legally involves understanding the regulations surrounding sales tax in Idaho. These forms must be filed by businesses that sell goods or services subject to sales tax. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to audits or penalties. Compliance with state laws ensures that businesses can operate without legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Sales and Use Tax Forms DOR are crucial for maintaining compliance. Generally, these forms must be submitted quarterly, with specific due dates set by the state. Missing a deadline can result in penalties and interest on unpaid taxes. It is advisable to keep a calendar of important dates to ensure timely submissions.

Form Submission Methods

The Sales and Use Tax Forms DOR can be submitted through various methods, including:

- Online submission via the Idaho State Tax Commission website.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices.

Choosing the right submission method can streamline the process and ensure that your form is received on time.

Key Elements of the Sales and Use Tax Forms DOR

Key elements of the Sales and Use Tax Forms DOR include:

- Taxpayer Information: Name, address, and identification number.

- Sales Information: Total sales made during the reporting period.

- Tax Calculations: Detailed calculations showing how the tax amount was determined.

- Signature: Required to validate the form and affirm the accuracy of the information provided.

Each of these elements plays a vital role in ensuring the form is complete and compliant with state requirements.

Quick guide on how to complete sales and use tax formsdor

Prepare Sales And Use Tax FormsDOR effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Sales And Use Tax FormsDOR on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Sales And Use Tax FormsDOR effortlessly

- Find Sales And Use Tax FormsDOR and then click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Sales And Use Tax FormsDOR and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 st 101 pdf and why is it important?

The 2022 st 101 pdf is a standardized document used for reporting state taxes in various jurisdictions. It is crucial for businesses to understand this form as it ensures compliance with state tax laws and regulations.

-

How can airSlate SignNow help with the 2022 st 101 pdf?

airSlate SignNow streamlines the process of completing and eSigning the 2022 st 101 pdf. With its user-friendly interface, businesses can easily fill out, sign, and send this important document securely.

-

What are the pricing options for using airSlate SignNow to manage the 2022 st 101 pdf?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to the essential features for managing the 2022 st 101 pdf, ensuring affordability without compromising on quality.

-

Can I integrate airSlate SignNow with other applications for handling the 2022 st 101 pdf?

Yes, airSlate SignNow offers robust integrations with popular applications like Google Drive, Dropbox, and various CRM tools, making it easy to access and manage the 2022 st 101 pdf from your preferred platforms.

-

What features does airSlate SignNow offer for eSigning the 2022 st 101 pdf?

airSlate SignNow provides a range of features designed for efficient eSigning of the 2022 st 101 pdf, including document tracking, template storage, and customizable workflows that enhance the signing experience.

-

Is the 2022 st 101 pdf secure when using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to ensure that your 2022 st 101 pdf and any associated data are kept safe from unauthorized access.

-

Why should businesses choose airSlate SignNow for their 2022 st 101 pdf needs?

Businesses should choose airSlate SignNow for its ease of use, affordability, and comprehensive features tailored to manage the 2022 st 101 pdf efficiently. The platform saves time and enhances productivity while ensuring compliance.

Get more for Sales And Use Tax FormsDOR

- Mississippi 13 form

- Reaffirmation agreement form

- Reaffirmation agreement form

- Verification of creditors matrix mississippi form

- Verification of creditors matrix mississippi 497315573 form

- Correction statement and agreement mississippi form

- Closing statement mississippi form

- Flood zone statement and authorization mississippi form

Find out other Sales And Use Tax FormsDOR

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement