Www Taxformfinder Orgnewjerseyform a 5052 TcNew Jersey Form a 5052 TC Estimated Summary Tax Return 2022-2026

Understanding the New Jersey Form A 5052 TC Estimated Summary Tax Return

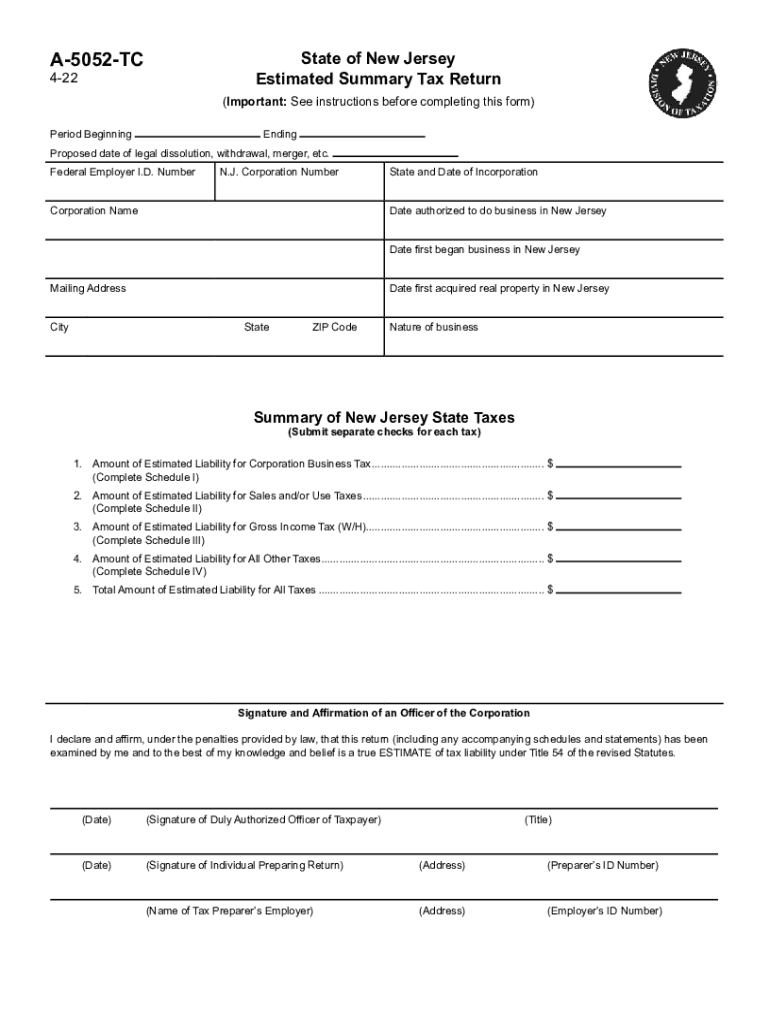

The New Jersey Form A 5052 TC, also known as the estimated summary tax return, is a crucial document for taxpayers in New Jersey. This form is designed for individuals and businesses who need to report their estimated tax liabilities for the year. It is particularly important for those who expect to owe tax of $500 or more when filing their annual return. Understanding the purpose and requirements of this form can help ensure compliance with state tax laws.

Steps to Complete the New Jersey Form A 5052 TC

Completing the New Jersey Form A 5052 TC involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on your expected income for the year.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for the New Jersey Form A 5052 TC

To successfully complete the New Jersey Form A 5052 TC, you will need several documents:

- Income statements, such as W-2s for employees or 1099s for independent contractors.

- Records of any deductions or credits you plan to claim.

- Previous tax returns to help estimate your current tax liability.

- Any other relevant financial documents that can aid in accurate reporting.

Filing Deadlines for the New Jersey Form A 5052 TC

Timely filing of the New Jersey Form A 5052 TC is essential to avoid penalties. The deadlines for submitting this form typically align with quarterly estimated tax payment dates:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Legal Use of the New Jersey Form A 5052 TC

The New Jersey Form A 5052 TC is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. Utilizing electronic tools for submission can enhance the security and efficiency of the filing process.

Form Submission Methods for the New Jersey Form A 5052 TC

Taxpayers have several options for submitting the New Jersey Form A 5052 TC:

- Online submission through the New Jersey Division of Taxation website.

- Mailing a printed version of the form to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete wwwtaxformfinderorgnewjerseyform a 5052 tcnew jersey form a 5052 tc estimated summary tax return

Prepare Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly and without delays. Manage Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return effortlessly

- Obtain Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and possesses the same legal force as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgnewjerseyform a 5052 tcnew jersey form a 5052 tc estimated summary tax return

Create this form in 5 minutes!

People also ask

-

What is an NJ estimated tax return?

An NJ estimated tax return is a form that New Jersey residents use to calculate and pay estimated taxes throughout the year. This is particularly important for those who have income not subject to withholding tax. Completing the NJ estimated tax return helps ensure you meet your tax obligations and avoid penalties.

-

How can airSlate SignNow help with NJ estimated tax returns?

airSlate SignNow provides a secure and efficient way to send and eSign your NJ estimated tax return documents. Its easy-to-use platform ensures that you can complete and manage your tax documents quickly, reducing the risk of errors and improving compliance with state tax regulations.

-

What features does airSlate SignNow offer for NJ estimated tax returns?

AirSlate SignNow offers features such as customizable document templates, secure electronic signatures, and real-time tracking for your NJ estimated tax returns. These tools help streamline the filing process and ensure that your documents are received and processed in a timely manner.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your NJ estimated tax return ensures a hassle-free, paperless experience. It saves time and reduces the risk of lost paperwork, enabling you to focus on what matters most—your business. Enhanced security features also protect your sensitive financial information.

-

How much does airSlate SignNow cost for handling NJ estimated tax returns?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing to manage NJ estimated tax returns. With affordable monthly subscription options and the ability to pay only for the features you need, it’s a cost-effective solution for eSigning and document management.

-

Can I integrate airSlate SignNow with other accounting software for my NJ estimated tax return?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your NJ estimated tax return documents. This integration allows for a smoother workflow, enabling automatic syncing of tax-related data and reducing the likelihood of errors.

-

Is it safe to sign my NJ estimated tax return documents using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your NJ estimated tax return documents. You can sign with confidence, knowing that your sensitive information is secure.

Get more for Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return

- Dedication property form

- Temporary easement form

- Street easement form

- Mississippi easement 497315613 form

- Mississippi easements form

- Roadway easement form

- Assumption agreement of deed of trust and release of original mortgagors mississippi form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497315617 form

Find out other Www taxformfinder orgnewjerseyform a 5052 tcNew Jersey Form A 5052 TC Estimated Summary Tax Return

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free