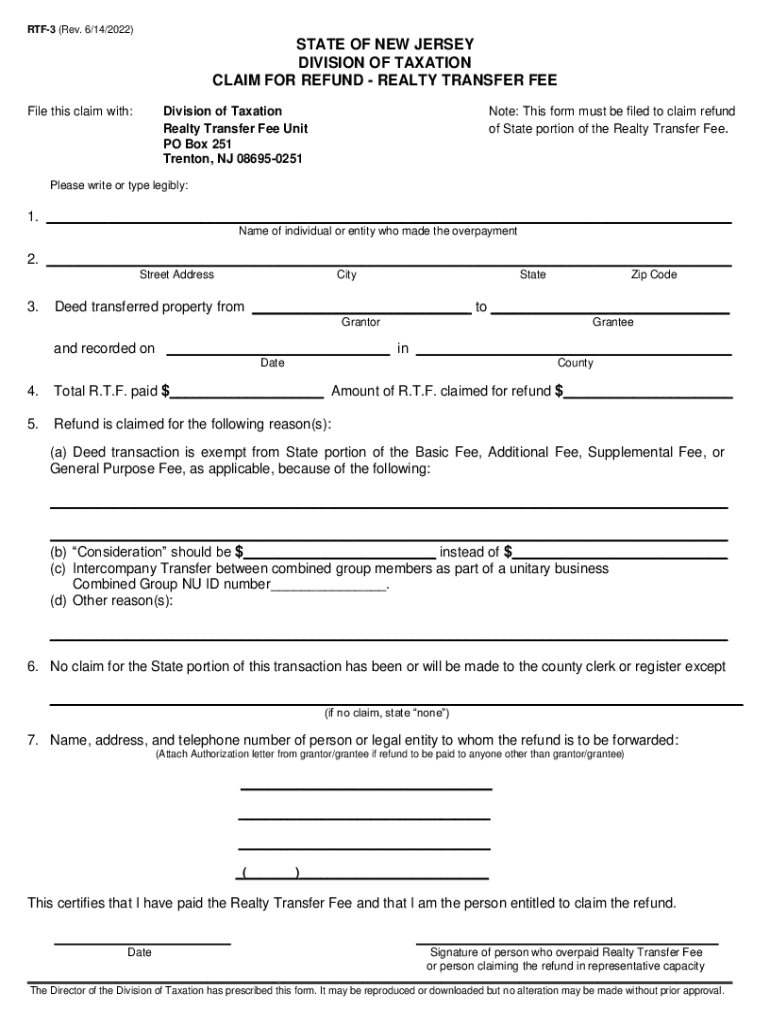

State of New Jersey Division of Taxation Claim for Refund 2022-2026

What is the State Of New Jersey Division Of Taxation Claim For Refund

The State Of New Jersey Division Of Taxation Claim For Refund is a formal request submitted by taxpayers seeking to recover overpaid taxes. This claim can be relevant for various tax types, including property taxes, sales taxes, and income taxes. The process is designed to ensure that taxpayers can reclaim funds that they are entitled to, following the appropriate legal guidelines established by the state.

Steps to complete the State Of New Jersey Division Of Taxation Claim For Refund

Completing the State Of New Jersey Division Of Taxation Claim For Refund involves several key steps:

- Gather all necessary documentation, including proof of overpayment and previous tax returns.

- Fill out the appropriate claim form accurately, ensuring all required fields are completed.

- Attach supporting documents that validate your claim, such as receipts or correspondence from the tax authority.

- Review your submission for accuracy and completeness before sending it.

- Submit the claim via the designated method, either online, by mail, or in person, depending on your preference.

Legal use of the State Of New Jersey Division Of Taxation Claim For Refund

The legal framework surrounding the State Of New Jersey Division Of Taxation Claim For Refund ensures that taxpayers have the right to seek refunds for overpayments. It is essential to understand that claims must be filed within specific time limits, as outlined by state law. Failure to comply with these regulations may result in the denial of the claim.

Eligibility Criteria

To be eligible for the State Of New Jersey Division Of Taxation Claim For Refund, taxpayers must meet certain criteria. This includes having made an overpayment of taxes and being able to provide adequate documentation supporting the claim. Additionally, the claim must be filed within the stipulated time frame, which varies depending on the type of tax involved.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the State Of New Jersey Division Of Taxation Claim For Refund. The methods include:

- Online Submission: Many forms can be completed and submitted electronically through the New Jersey Division of Taxation website.

- Mail: Claims can be printed, filled out, and sent to the appropriate tax office by postal service.

- In-Person: Taxpayers may also choose to submit their claims in person at designated tax offices for immediate processing.

Required Documents

When filing a Claim For Refund, certain documents are typically required to support the claim. These may include:

- Proof of payment, such as receipts or bank statements.

- Copies of relevant tax returns.

- Any correspondence with the tax authority regarding the overpayment.

- Completed claim form, accurately filled out.

Filing Deadlines / Important Dates

Filing deadlines for the State Of New Jersey Division Of Taxation Claim For Refund are critical to ensure that claims are processed. Generally, claims must be filed within three years from the date of the original tax payment. It is advisable to check the specific deadlines for each tax type, as they may vary. Keeping track of these dates helps taxpayers avoid missing the opportunity to reclaim overpaid taxes.

Quick guide on how to complete state of new jersey division of taxation claim for refund

Effortlessly Prepare State Of New Jersey Division Of Taxation Claim For Refund on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage State Of New Jersey Division Of Taxation Claim For Refund on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign State Of New Jersey Division Of Taxation Claim For Refund with Ease

- Find State Of New Jersey Division Of Taxation Claim For Refund and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information using the tools available from airSlate SignNow specifically designed for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and electronically sign State Of New Jersey Division Of Taxation Claim For Refund and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of new jersey division of taxation claim for refund

Create this form in 5 minutes!

People also ask

-

What is a refund form recorded template in airSlate SignNow?

A refund form recorded template in airSlate SignNow is a pre-designed document that allows businesses to create and manage refund requests efficiently. With this template, you can customize your refund policies and automate the eSigning process, enhancing overall productivity.

-

How much does the refund form recorded template cost?

The refund form recorded template is included in airSlate SignNow's various pricing plans, making it a cost-effective choice for businesses of all sizes. You can choose from monthly or annual subscriptions, with options that suit your budget and needs.

-

Can I customize the refund form recorded template?

Yes, you can easily customize the refund form recorded template to fit your business's specific requirements. airSlate SignNow allows you to modify fields, add branding elements, and adjust the layout, ensuring that the template aligns with your company's identity.

-

What are the benefits of using a refund form recorded template?

Using a refund form recorded template helps streamline your refund process by providing a structured format for requests. This not only speeds up the handling of refunds but also minimizes errors, leading to improved customer satisfaction and operational efficiency.

-

Is the refund form recorded template easy to use?

Absolutely! The refund form recorded template in airSlate SignNow is designed for ease of use. Even users without extensive technical knowledge can navigate the platform to create, send, and eSign documents effortlessly.

-

Does the refund form recorded template integrate with other apps?

Yes, the refund form recorded template seamlessly integrates with various CRM and accounting software. This allows you to synchronize customer data and manage financial transactions effectively, enhancing your overall workflow.

-

Can I track the status of my refund form recorded template?

Yes, airSlate SignNow offers tracking features for your refund form recorded template. You can easily monitor when documents are sent, viewed, and signed, providing real-time updates on the status of refund requests.

Get more for State Of New Jersey Division Of Taxation Claim For Refund

- Annual minutes mississippi mississippi form

- Notices resolutions simple stock ledger and certificate mississippi form

- Minutes for organizational meeting mississippi mississippi form

- Mississippi letter state form

- Js 44 civil cover sheet federal district court mississippi form

- Lead based paint disclosure for sales transaction mississippi form

- Lead based paint disclosure for rental transaction mississippi form

- Notice of lease for recording mississippi form

Find out other State Of New Jersey Division Of Taxation Claim For Refund

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online