Form 373 STATE of DELAWARE DIVISION of REVENUE Revenue Delaware 2013-2026

What is the Form 373?

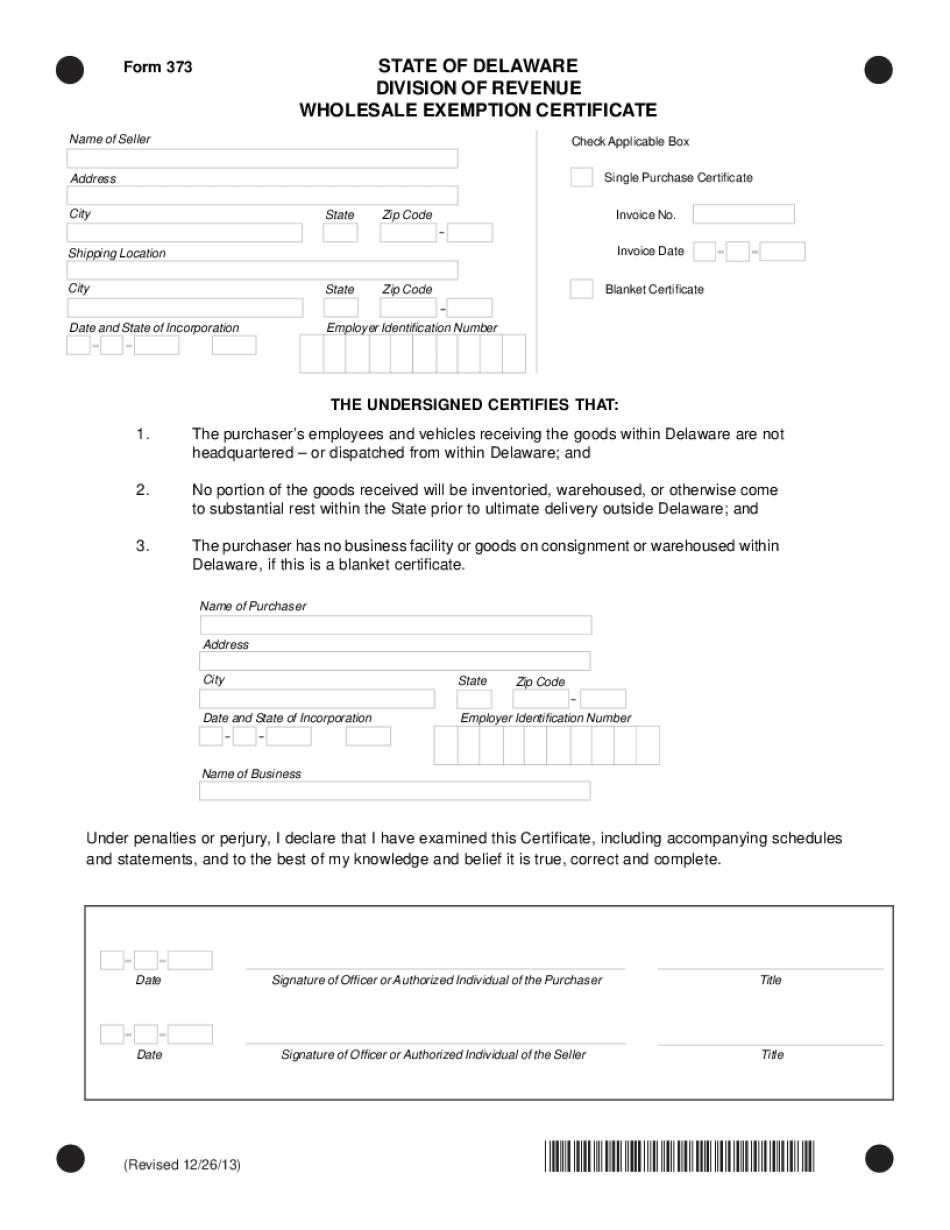

The Form 373, officially known as the Delaware Wholesale Exemption Certificate, is a crucial document issued by the State of Delaware Division of Revenue. This form allows businesses to claim exemption from sales tax on purchases intended for resale. It is primarily used by wholesalers and retailers to document their tax-exempt status when buying goods that will be resold in the normal course of business. Understanding the purpose and legal implications of the Form 373 is essential for compliance with Delaware tax regulations.

Steps to Complete the Form 373

Completing the Form 373 involves several key steps to ensure accuracy and compliance. First, gather necessary business information, including your legal business name, address, and tax identification number. Next, clearly indicate the type of products you intend to purchase for resale. It is important to provide accurate details to avoid potential issues with tax authorities. Finally, ensure that all signatures are completed, as an unsigned form may not be considered valid. Once completed, the form can be submitted to suppliers to facilitate tax-exempt purchases.

Legal Use of the Form 373

The legal validity of the Form 373 hinges on its proper completion and adherence to Delaware tax laws. To be recognized as a legitimate exemption certificate, the form must be filled out accurately and signed by an authorized representative of the business. This ensures that the purchasing entity is indeed eligible for tax exemption. Additionally, businesses should maintain copies of the completed Form 373 for their records, as they may be required to present it during audits or inspections by tax authorities.

Obtaining the Form 373

To obtain the Form 373, businesses can visit the Delaware Division of Revenue's official website or contact their office directly. The form is typically available for download in a printable format, allowing for easy access. It is advisable to ensure that the most recent version of the form is being used to comply with current regulations. If assistance is needed, businesses can reach out to tax professionals or the Division of Revenue for guidance on obtaining and completing the form.

Examples of Using the Form 373

Businesses commonly use the Form 373 in various scenarios. For instance, a retailer purchasing inventory for resale would present the form to suppliers to avoid paying sales tax on those items. Similarly, wholesalers who supply goods to retailers can use the Form 373 to document their tax-exempt purchases. These examples illustrate the form's essential role in facilitating tax compliance and ensuring that businesses operate within the legal framework established by Delaware tax laws.

Filing Deadlines / Important Dates

While the Form 373 itself does not have specific filing deadlines, it is crucial for businesses to be aware of the timing of their purchases and the relevant tax periods. Businesses should ensure that they present the Form 373 to suppliers at the time of purchase to avoid sales tax charges. Additionally, staying informed about any changes in Delaware tax laws or regulations is important for maintaining compliance and understanding any potential impacts on the use of the form.

Quick guide on how to complete form 373 state of delaware division of revenue revenue delaware

Complete Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware without any hassle

- Find Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware and click Get Form to initiate the process.

- Utilize the tools we provide to finish your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 373 state of delaware division of revenue revenue delaware

Create this form in 5 minutes!

People also ask

-

What is de 373 and how does it relate to airSlate SignNow?

De 373 refers to our advanced electronic signature capabilities offered by airSlate SignNow. This feature enables users to securely eSign documents online, ensuring compliance and facilitating smooth business transactions.

-

What are the pricing plans for airSlate SignNow?

We offer competitive pricing plans for airSlate SignNow that cater to different business needs. Our plans feature options for single users, small teams, and larger organizations, all packaged to provide the best value for those needing de 373 functionality.

-

How can de 373 enhance my document signing process?

De 373 simplifies and speeds up the document signing process by allowing users to eSign directly from their devices. This enhanced functionality reduces turnaround time for important contracts and agreements, boosting overall productivity.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing the usability of de 373 features. Popular integrations include CRM systems, cloud storage services, and productivity applications, making it a versatile choice for businesses.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow uses robust security measures to protect all documents signed using de 373. Our platform complies with industry standards and regulations to ensure the utmost confidentiality and safety of your documents.

-

Can I use de 373 for recurring documents?

Yes, airSlate SignNow allows users to create templates for recurring documents, utilizing the de 373 functionality. This feature ensures that you can quickly generate and eSign documents for ongoing processes, saving time and reducing errors.

-

What support options are available for airSlate SignNow users?

We offer comprehensive support options for our users, including resources, tutorials, and dedicated customer service to assist with any questions about de 373. Our support team is readily available to ensure you get the most out of your airSlate SignNow experience.

Get more for Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware

- Jury instruction contributory negligence for minor mississippi form

- Jury instruction complaint injury by power lines mississippi form

- Aviso al empleadoseccin 2810 5 del cdigo de trabaj form

- Application for employment the ups store 6619 form

- Exhibit 354350 3 rev1exhibit 35 sample citizenshi form

- Fincen suspicious activity report fincen sar electronic filing form

- You may choose up to two accounts at unify financial credit union to receive your deposits form

- Statement of certifying physician for therapeutic shoes 786914835 form

Find out other Form 373 STATE OF DELAWARE DIVISION OF REVENUE Revenue Delaware

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online