Massachusetts Department of Revenue Form PTE EX Withholding Exemption 2016-2026

Understanding the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

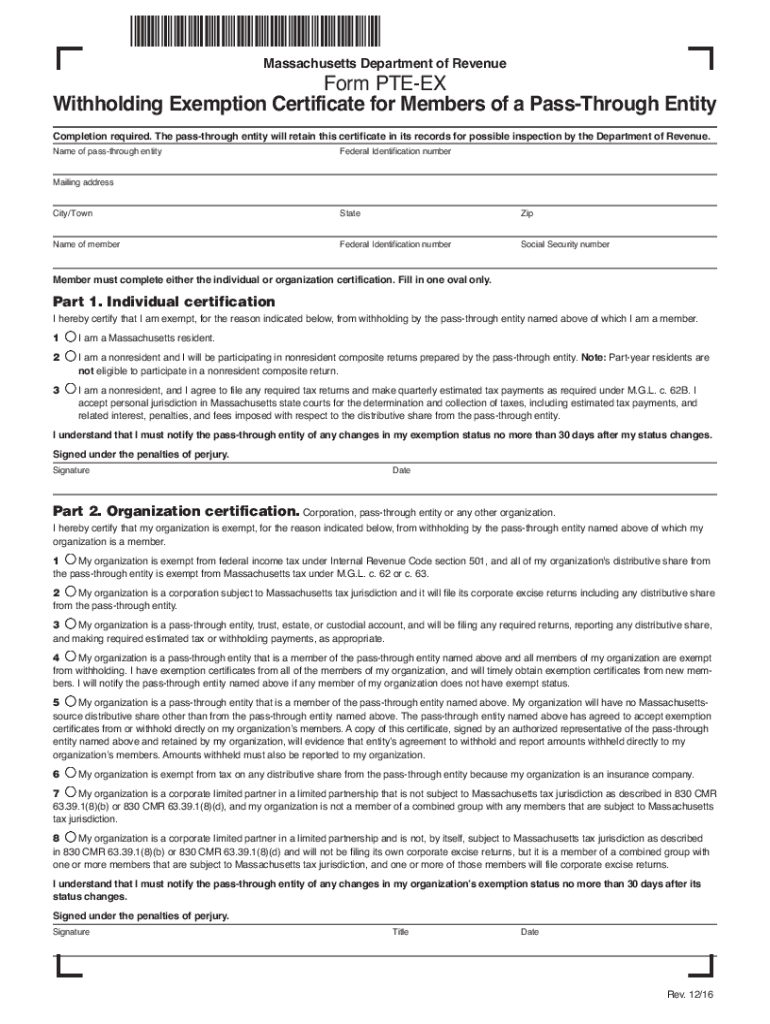

The Massachusetts Department of Revenue Form PTE EX is designed for pass-through entities seeking a withholding exemption. This form allows entities such as partnerships, S corporations, and limited liability companies to apply for an exemption from withholding tax on certain distributions to non-resident members. Understanding this form is crucial for ensuring compliance with state tax regulations while maximizing tax efficiency for both the entity and its members.

Steps to Complete the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

Completing the Massachusetts Form PTE EX involves several key steps:

- Gather necessary information about the entity, including its name, address, and federal employer identification number (EIN).

- Identify the non-resident members who will benefit from the withholding exemption and collect their relevant information.

- Fill out the form accurately, ensuring all required sections are completed, including the reason for the exemption request.

- Review the completed form for accuracy and completeness before submission.

Each step is vital to ensure that the form is processed smoothly and that the entity remains compliant with Massachusetts tax laws.

Eligibility Criteria for the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

To qualify for the withholding exemption using Form PTE EX, entities must meet specific criteria. These include:

- The entity must be classified as a pass-through entity under Massachusetts law.

- Non-resident members must be eligible for the exemption based on their income and residency status.

- The entity must demonstrate that it meets any additional requirements outlined by the Massachusetts Department of Revenue.

Understanding these criteria helps ensure that only eligible entities apply for the exemption, reducing the risk of non-compliance.

Key Elements of the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

Several key elements must be included when filling out Form PTE EX. These elements typically consist of:

- The entity's name and contact information.

- The federal EIN of the entity.

- Details of the non-resident members requesting the exemption.

- The specific grounds for requesting the exemption.

Providing complete and accurate information in these sections is essential for the approval of the exemption request.

Form Submission Methods for the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

Entities can submit the Massachusetts Form PTE EX through various methods, including:

- Online submission via the Massachusetts Department of Revenue website, which offers a streamlined process.

- Mailing the completed form to the appropriate address specified by the Department of Revenue.

- In-person submission at designated state offices, if preferred.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Legal Use of the Massachusetts Department of Revenue Form PTE EX Withholding Exemption

The legal use of Form PTE EX is governed by Massachusetts tax laws. This form must be used appropriately to ensure that the withholding exemption is valid. Key legal considerations include:

- Adhering to all state guidelines and requirements for pass-through entities.

- Maintaining accurate records of all members and their eligibility for the exemption.

- Understanding the implications of non-compliance, which may include penalties or additional tax liabilities.

Entities should consult with tax professionals to ensure they navigate the legal landscape effectively when using this form.

Quick guide on how to complete massachusetts department of revenue form pte ex withholding exemption

Complete Massachusetts Department Of Revenue Form PTE EX Withholding Exemption effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Massachusetts Department Of Revenue Form PTE EX Withholding Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Massachusetts Department Of Revenue Form PTE EX Withholding Exemption effortlessly

- Obtain Massachusetts Department Of Revenue Form PTE EX Withholding Exemption and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to finalize your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from the device of your choice. Edit and eSign Massachusetts Department Of Revenue Form PTE EX Withholding Exemption and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form pte ex withholding exemption

Create this form in 5 minutes!

People also ask

-

What is ma form pte ex and how does it work?

Ma form pte ex is a feature offered by airSlate SignNow that allows users to create and manage electronic forms seamlessly. It simplifies the process of collecting signatures and data efficiently. With this solution, businesses can streamline their workflows by integrating eSignature capabilities directly into their documents.

-

How much does the ma form pte ex feature cost?

The pricing for ma form pte ex varies based on the plan selected. airSlate SignNow offers flexible pricing options to fit different business needs. You can visit the pricing page on our website to find a specific plan that provides access to ma form pte ex and other essential features.

-

What are the main features of ma form pte ex?

Ma form pte ex includes features such as customizable templates, real-time tracking of document status, and secure eSigning capabilities. These features enable businesses to enhance their document workflows and improve productivity signNowly. Additionally, users can integrate this solution with various other tools for a more streamlined experience.

-

How can ma form pte ex benefit my business?

Ma form pte ex can signNowly benefit your business by reducing the time spent on document processing and improving efficiency. With easy eSigning and form management, you can ensure faster approvals and enhanced customer satisfaction. Moreover, it eliminates the need for paper-based processes, contributing to cost savings and environmental sustainability.

-

Is ma form pte ex easy to integrate with existing software?

Yes, ma form pte ex is designed for easy integration with existing software solutions. airSlate SignNow offers various APIs and pre-built connectors for popular applications, making it seamless to incorporate into your current systems. This ensures your team can continue using familiar tools while benefiting from advanced eSignature capabilities.

-

Can I customize my ma form pte ex documents?

Absolutely! With ma form pte ex, users can customize their documents to suit their specific needs. You can add branding elements, include necessary fields, and tailor the layout of your forms for a professional look. This level of customization helps businesses foster a consistent brand identity throughout their documentation process.

-

Is ma form pte ex secure for sensitive information?

Yes, ma form pte ex prioritizes security to safeguard sensitive information. airSlate SignNow employs robust encryption, secure cloud storage, and compliance with regulations such as GDPR and HIPAA. You can confidently use this feature for any business transactions involving confidential data, knowing it’s protected.

Get more for Massachusetts Department Of Revenue Form PTE EX Withholding Exemption

- Warranty deed from two individuals to one individual montana form

- Gift deed from husband and wifetwo individuals to husband and wifetwo individuals montana form

- Heirship affidavit descent montana form

- Response to subcontractors request corporation or llc montana form

- Quitclaim deed from individual to two individuals in joint tenancy montana form

- Montana renunciation and disclaimer of property nontestamentary instrument or contract montana form

- Continuation statement individual montana form

- Quitclaim deed by two individuals to husband and wife montana form

Find out other Massachusetts Department Of Revenue Form PTE EX Withholding Exemption

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors