Nebraska Resale or Exempt Sale Certificate, Form 13 2022-2026

What is the Nebraska Resale Or Exempt Sale Certificate, Form 13

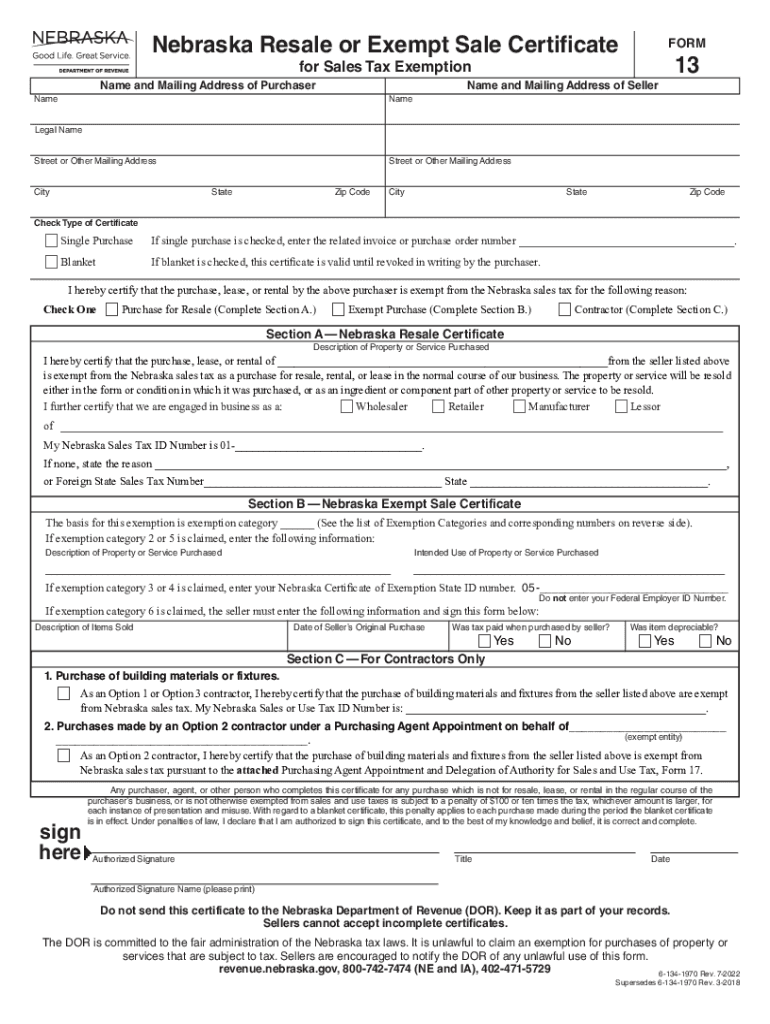

The Nebraska Resale or Exempt Sale Certificate, commonly referred to as Form 13, is a crucial document used by businesses in Nebraska to claim exemption from sales tax on purchases intended for resale or specific exempt purposes. This form allows sellers to avoid charging sales tax on items that will be resold or used in a manner that qualifies for tax exemption under Nebraska law. Understanding the purpose and function of this form is essential for businesses aiming to comply with state tax regulations while optimizing their financial operations.

How to use the Nebraska Resale Or Exempt Sale Certificate, Form 13

Using the Nebraska Form 13 involves several steps to ensure compliance with state tax laws. First, the buyer must complete the form by providing their business name, address, and the type of goods being purchased. The seller retains the completed certificate as proof of the tax-exempt sale. It is important for both parties to understand that this form should only be used for qualifying purchases, as misuse can lead to penalties. Businesses should also keep records of all exempt sales for auditing purposes.

Steps to complete the Nebraska Resale Or Exempt Sale Certificate, Form 13

Completing the Nebraska Form 13 requires careful attention to detail. Here are the steps to follow:

- Begin by entering the buyer's name and address at the top of the form.

- Specify the type of goods being purchased and indicate whether they are for resale or exempt use.

- Provide the seller's name and address to ensure proper documentation.

- Sign and date the form to validate the exemption claim.

- Submit the completed form to the seller, who will keep it on file for their records.

Key elements of the Nebraska Resale Or Exempt Sale Certificate, Form 13

Several key elements are essential for the Nebraska Form 13 to be valid. These include:

- Buyer Information: Accurate business name and address of the buyer.

- Seller Information: Name and address of the seller.

- Description of Goods: Clear indication of the items being purchased and their intended use.

- Signature: The buyer must sign and date the form to authenticate the exemption claim.

Legal use of the Nebraska Resale Or Exempt Sale Certificate, Form 13

The legal use of Form 13 is governed by Nebraska tax laws, which stipulate that the certificate must only be used for qualifying purchases. This form is intended for transactions where the buyer intends to resell the goods or where the goods are exempt from sales tax for other specified reasons. Misuse of the form, such as using it for personal purchases or non-qualifying items, can result in penalties and interest on unpaid taxes. It is crucial for businesses to understand the legal implications of using this certificate to avoid compliance issues.

Examples of using the Nebraska Resale Or Exempt Sale Certificate, Form 13

There are several scenarios where the Nebraska Form 13 can be effectively utilized:

- A retail store purchasing inventory for resale can present Form 13 to suppliers to avoid paying sales tax on those items.

- A contractor buying materials for a project intended for a tax-exempt organization may use the form to claim exemption.

- Wholesalers selling to retailers can require Form 13 to ensure that their sales are exempt from tax, as the retailers will be reselling the products.

Quick guide on how to complete nebraska resale or exempt sale certificate form 13

Manage Nebraska Resale Or Exempt Sale Certificate, Form 13 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Nebraska Resale Or Exempt Sale Certificate, Form 13 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Nebraska Resale Or Exempt Sale Certificate, Form 13 with ease

- Obtain Nebraska Resale Or Exempt Sale Certificate, Form 13 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Resale Or Exempt Sale Certificate, Form 13 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska resale or exempt sale certificate form 13

Create this form in 5 minutes!

People also ask

-

What is Nebraska Form 13 and how can airSlate SignNow help?

Nebraska Form 13 is a specific document required for certain business and legal processes within Nebraska. AirSlate SignNow streamlines the signing and sending of this form, allowing users to complete their transactions quickly and securely, while ensuring compliance with local regulations.

-

How do I fill out Nebraska Form 13 using airSlate SignNow?

To fill out Nebraska Form 13 with airSlate SignNow, simply upload the form to the platform, fill in the required fields, and add your electronic signature. The user-friendly interface makes it easy to complete the form efficiently, reducing the hassle associated with traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for Nebraska Form 13?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses. The plans include features specifically geared towards document signing and management, including Nebraska Form 13, ensuring you get value for your investment.

-

What integrations does airSlate SignNow support for handling Nebraska Form 13?

AirSlate SignNow integrates with multiple applications, including CRM and document management tools, facilitating seamless workflows for Nebraska Form 13. This allows businesses to connect their existing systems and manage documents in one place, improving overall efficiency.

-

Can I track the status of Nebraska Form 13 after sending it through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for documents sent, including Nebraska Form 13. Users can easily monitor when the document has been viewed and signed, allowing for better management of timelines and legal requirements.

-

What features does airSlate SignNow offer for Nebraska Form 13?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and comprehensive audit trails specifically for Nebraska Form 13. These features ensure legal compliance and save time, making it easier to manage important documents.

-

Is airSlate SignNow secure for signing Nebraska Form 13?

Absolutely. AirSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive information on Nebraska Form 13. Our compliance with industry standards ensures that your documents are safe and legally valid.

Get more for Nebraska Resale Or Exempt Sale Certificate, Form 13

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children montana form

- Mutual wills or last will and testaments for unmarried persons living together with minor children montana form

- Non marital cohabitation living together agreement montana form

- Paternity case package establishment of paternity montana form

- Paternity law and procedure handbook montana form

- Bill of sale in connection with sale of business by individual or corporate seller montana form

- Petition for dissolution of marriage no children montana form

- Montana social security form

Find out other Nebraska Resale Or Exempt Sale Certificate, Form 13

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT