Nebraska Form 13 2018

What is the Nebraska Form 13

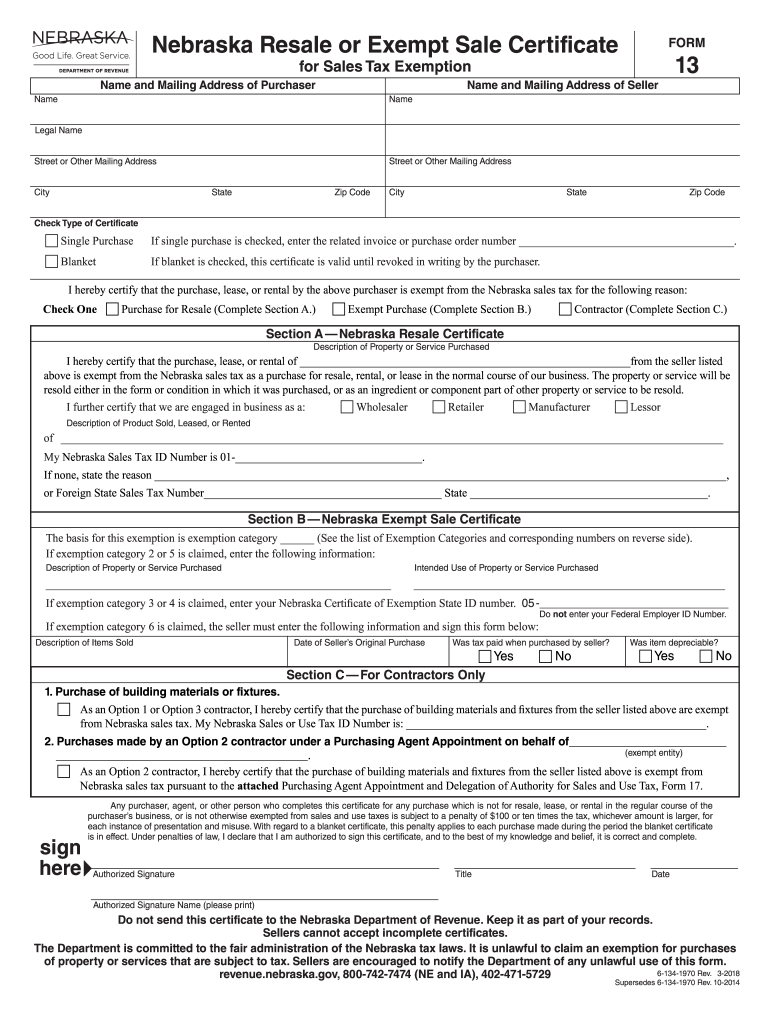

The Nebraska Form 13, also known as the Nebraska tax exemption form, is a document used by individuals and businesses to claim tax exemptions in the state of Nebraska. This form is essential for those seeking to establish eligibility for various tax benefits, including exemptions from sales and use taxes. It is particularly relevant for organizations that qualify as nonprofit entities or for specific purchases that are exempt under Nebraska law.

Steps to complete the Nebraska Form 13

Completing the Nebraska Form 13 involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your organization’s legal name, address, and tax identification number. Next, provide details about the specific exemption being claimed, along with any supporting documentation required to substantiate the claim. After filling out the form, review it carefully for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online, by mail, or in person.

Legal use of the Nebraska Form 13

The legal use of the Nebraska Form 13 is governed by state tax laws, which outline the conditions under which tax exemptions can be claimed. To be considered valid, the form must be filled out completely and accurately. Furthermore, it should be submitted to the appropriate state agency, such as the Nebraska Department of Revenue, to ensure that the exemption is recognized. Failure to comply with these legal requirements may result in penalties or denial of the exemption.

How to obtain the Nebraska Form 13

Obtaining the Nebraska Form 13 is straightforward. The form is available through the Nebraska Department of Revenue's official website, where users can download a fillable PDF version. Additionally, physical copies may be requested from local tax offices or the Department of Revenue directly. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods

There are several methods available for submitting the Nebraska Form 13. Taxpayers can choose to file the form online through the Nebraska Department of Revenue's e-filing system, which provides a convenient and efficient way to submit documents. Alternatively, the form can be mailed directly to the appropriate department or delivered in person at designated tax offices. Each method has its own processing times and requirements, so it is advisable to check the latest guidelines before submission.

Key elements of the Nebraska Form 13

The Nebraska Form 13 includes several key elements that must be completed accurately. These elements typically encompass the applicant's identification information, details regarding the exemption being claimed, and any necessary supporting documentation. Additionally, the form may require signatures from authorized representatives of the organization or individual claiming the exemption. Ensuring that all sections are filled out correctly is crucial for the successful approval of the exemption request.

Quick guide on how to complete nebraska form 13 445698829

Complete Nebraska Form 13 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Nebraska Form 13 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

The easiest way to modify and eSign Nebraska Form 13 with ease

- Access Nebraska Form 13 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Leave behind concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Form 13 and guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska form 13 445698829

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 13 445698829

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Nebraska Form 13 and how does airSlate SignNow support it?

The Nebraska Form 13 is a crucial document often used for various business and legal purposes in Nebraska. airSlate SignNow offers a user-friendly interface to effortlessly complete and eSign this form. By digitizing the process, businesses can save time and ensure that the document is properly executed and stored.

-

How much does it cost to use airSlate SignNow for Nebraska Form 13?

airSlate SignNow provides a cost-effective solution for handling the Nebraska Form 13. Pricing varies based on the plan you select, but it generally offers affordable options suitable for businesses of all sizes. Check our website for detailed pricing that fits your needs.

-

What features does airSlate SignNow offer for managing Nebraska Form 13?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure eSigning for the Nebraska Form 13. These tools enhance efficiency and accuracy, helping you manage your documents seamlessly. Additionally, it supports various file formats, making it versatile for all users.

-

Is airSlate SignNow suitable for small businesses needing the Nebraska Form 13?

Absolutely! airSlate SignNow is designed with small businesses in mind, making it an ideal choice for those needing access to the Nebraska Form 13. Its intuitive interface and affordable pricing empower small businesses to streamline their document workflows without a steep learning curve.

-

Can I integrate airSlate SignNow with other applications for Nebraska Form 13?

Yes, airSlate SignNow supports integrations with various applications to enhance your workflow while processing the Nebraska Form 13. Popular integrations include CRM systems, cloud storage, and productivity tools, allowing you to easily manage your documents across platforms.

-

What benefits can I expect from using airSlate SignNow for the Nebraska Form 13?

Using airSlate SignNow for the Nebraska Form 13 provides signNow benefits such as time savings, reduced paper usage, and enhanced security. You can eSign documents from anywhere, on any device, ensuring that you are always in control of your important paperwork. This flexibility can lead to increased productivity and quicker turnaround times.

-

How secure is the handling of Nebraska Form 13 with airSlate SignNow?

airSlate SignNow prioritizes security for all documents, including the Nebraska Form 13. Our platform utilizes advanced encryption and complies with various regulatory standards to keep your information safe. You can confidently manage sensitive documents, knowing they are protected throughout the signing process.

Get more for Nebraska Form 13

Find out other Nebraska Form 13

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile