Tax Paid Request Form 2022-2026

What is the Tax Paid Request Form

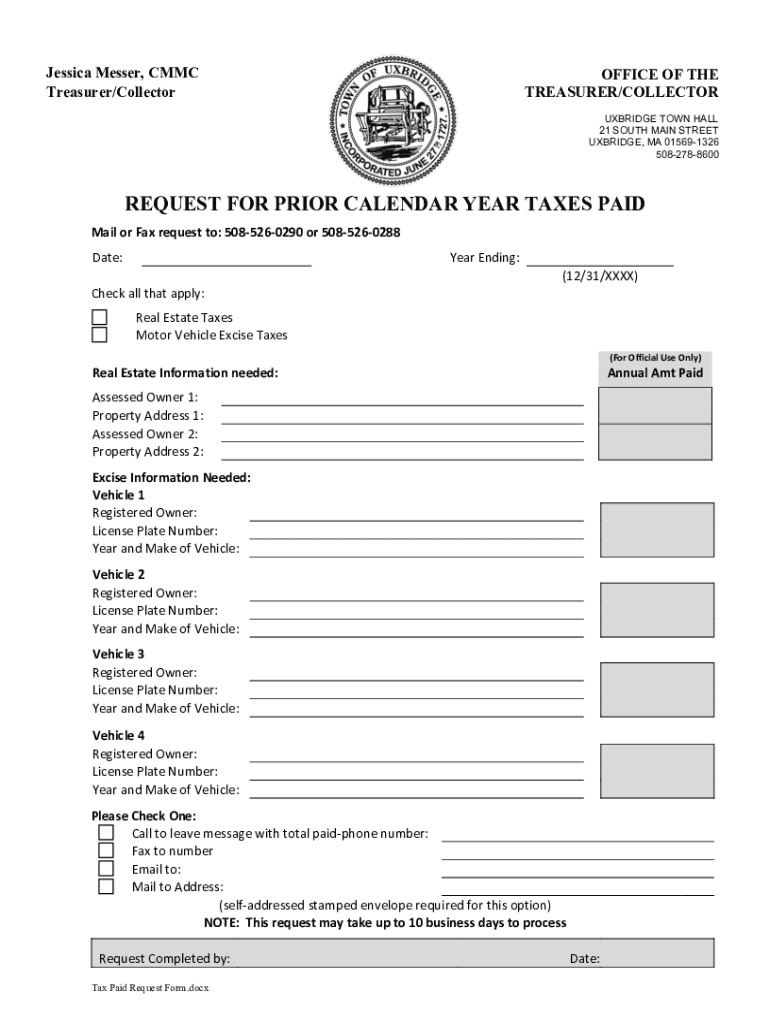

The Tax Paid Request Form is an essential document used by individuals and businesses to request information about taxes that have been paid. This form is particularly important for those who need to verify their tax payments for various purposes, such as applying for loans, financial audits, or tax returns. By completing this form, taxpayers can ensure they have accurate records of their tax payments, which can be crucial for financial planning and compliance with IRS regulations.

Steps to complete the Tax Paid Request Form

Completing the Tax Paid Request Form involves several straightforward steps. First, gather all necessary personal and financial information, including your Social Security number or Employer Identification Number. Next, accurately fill out the form by providing details about the tax year in question and the specific taxes you are inquiring about. After completing the form, review it for accuracy to prevent any delays in processing. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on your preference and the options available.

How to obtain the Tax Paid Request Form

The Tax Paid Request Form can typically be obtained from the official IRS website or through your local tax office. Many states also provide this form on their respective tax agency websites. For convenience, you can download a printable version of the form, which allows you to fill it out by hand if preferred. Ensure you are using the most current version of the form to avoid any compliance issues.

Legal use of the Tax Paid Request Form

The Tax Paid Request Form is legally recognized and can be used to request official documentation of tax payments. When completed correctly, it serves as a formal request to the appropriate tax authority. This form must be filled out in accordance with IRS guidelines to ensure it is valid. Failure to comply with these regulations may result in delays or denial of your request, making it crucial to understand the legal implications of using this form.

Required Documents

When filling out the Tax Paid Request Form, certain documents may be required to support your request. These typically include identification, such as a driver's license or Social Security card, as well as any previous tax returns relevant to the tax year in question. Having these documents readily available can expedite the process and ensure that your request is processed without unnecessary complications.

Form Submission Methods

The Tax Paid Request Form can be submitted through various methods, depending on the guidelines set by the IRS or your state tax authority. Common submission methods include online submission through the tax authority's website, mailing a physical copy of the form to the appropriate office, or delivering it in person. Each method may have different processing times, so it is advisable to choose the one that best fits your needs and timeline.

IRS Guidelines

It is essential to follow IRS guidelines when completing and submitting the Tax Paid Request Form. These guidelines outline the necessary information required, acceptable submission methods, and any deadlines that must be adhered to. Familiarizing yourself with these guidelines can help ensure that your request is processed efficiently and that you receive the necessary documentation in a timely manner.

Quick guide on how to complete tax paid request form

Complete Tax Paid Request Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely save it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents promptly without delays. Handle Tax Paid Request Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Tax Paid Request Form with ease

- Obtain Tax Paid Request Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redacted sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Tax Paid Request Form and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tax Paid Request Form?

A Tax Paid Request Form is a document used to request proof of payment for taxes. This form is essential for individuals and businesses that need to confirm their tax obligations have been met. By utilizing airSlate SignNow, you can quickly create, send, and eSign your Tax Paid Request Form with ease.

-

How does airSlate SignNow simplify the Tax Paid Request Form process?

airSlate SignNow streamlines the process of handling Tax Paid Request Forms by providing a user-friendly interface that allows for easy document creation and electronic signatures. You can customize your forms, send them for signature, and receive completed documents without any hassle. This enhances efficiency and saves valuable time for your business.

-

Is there a cost associated with using the Tax Paid Request Form on airSlate SignNow?

Yes, while airSlate SignNow offers a variety of pricing plans, the actual cost will depend on the features and volume of documents you require. However, considering the simplicity and efficiency offered by the platform, investing in it can lead to signNow cost savings on document management, including your Tax Paid Request Form.

-

Can I integrate the Tax Paid Request Form with other software platforms?

Absolutely! airSlate SignNow supports integrations with various software platforms, making it easier to manage your Tax Paid Request Form alongside other business tools. Whether you use CRM, accounting, or project management software, you can seamlessly connect these systems to enhance your workflow.

-

What are the benefits of using airSlate SignNow for my Tax Paid Request Form?

Using airSlate SignNow for your Tax Paid Request Form provides several benefits, including increased efficiency, reduced paperwork, and ease of access. The electronic signature feature ensures your documents are legally binding, while templates allow for quick setup. Overall, it simplifies the process for both you and your recipients.

-

How secure is my Tax Paid Request Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Tax Paid Request Form and all associated data are protected through advanced encryption methods and secure storage. You can confidently manage sensitive information without worrying about unauthorized access or data bsignNowes.

-

Can I track the status of my Tax Paid Request Form?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Tax Paid Request Form in real time. You will receive notifications when the form is sent, viewed, and signed, ensuring you are always informed about the document's progress.

Get more for Tax Paid Request Form

- Delaware corporation form

- Delaware subcontractor form

- Quitclaim deed from individual to corporation delaware form

- Warranty deed from individual to corporation delaware form

- Subcontractors list corporation delaware form

- Delaware waiver form

- De llc company form

- Warranty deed from individual to llc delaware form

Find out other Tax Paid Request Form

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer