Www Dfa Arkansas Govincome Taxfiduciary AndFiduciary and Estate Income Tax Forms Arkansas

IRS Guidelines

The 2022 estimated tax payment form is governed by specific IRS guidelines that taxpayers must follow to ensure compliance. The IRS requires individuals and businesses to pay estimated taxes if they expect to owe at least one thousand dollars in tax for the year. This form is essential for those who receive income that is not subject to withholding, such as self-employment income, rental income, or dividends.

Taxpayers should familiarize themselves with the IRS Form 1040-ES, which is the official estimated tax payment form. It provides instructions on calculating the estimated tax payments based on expected income, deductions, and credits. Understanding these guidelines helps in accurately estimating tax liabilities and avoiding penalties for underpayment.

Filing Deadlines / Important Dates

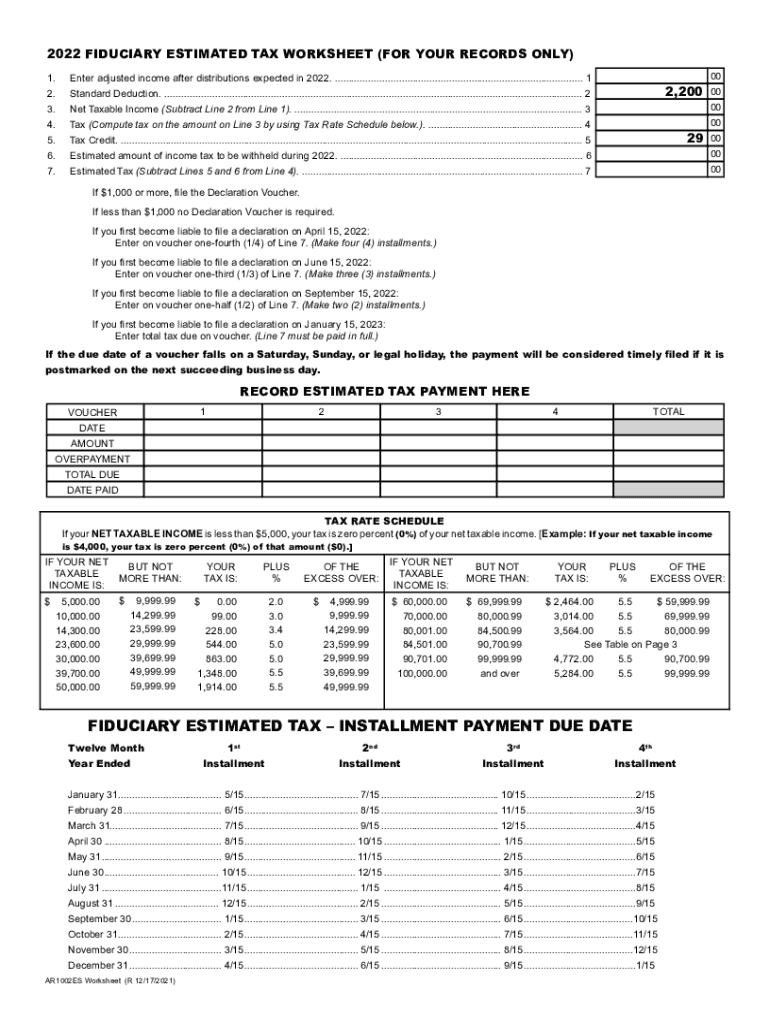

For the 2022 estimated tax payment form, there are specific deadlines that taxpayers must adhere to in order to avoid penalties. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. For 2022, the deadlines are as follows:

- First payment: April 18, 2022

- Second payment: June 15, 2022

- Third payment: September 15, 2022

- Fourth payment: January 17, 2023

It is crucial to meet these deadlines to ensure compliance with IRS regulations and to avoid incurring interest and penalties on late payments.

Required Documents

To complete the 2022 estimated tax payment form, taxpayers need to gather specific documents that reflect their income and deductions. Key documents include:

- Last year’s tax return, which provides a baseline for estimating income and tax liabilities.

- Income statements, such as W-2s for employees or 1099s for independent contractors.

- Records of any other income sources, including rental income or investment earnings.

- Documentation of deductions and credits that may apply, such as mortgage interest statements or education expenses.

Having these documents on hand ensures accurate calculations and compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the 2022 estimated tax payment form. These methods include:

- Online: The IRS allows taxpayers to make estimated payments electronically through the Electronic Federal Tax Payment System (EFTPS) or directly via the IRS website.

- Mail: Taxpayers can also print the completed form and mail it to the appropriate IRS address based on their location. It is important to check the latest IRS guidelines for the correct mailing address.

- In-Person: Payments can be made in person at designated IRS offices or authorized payment locations. This option may be suitable for those who prefer face-to-face interactions.

Choosing the right submission method can enhance convenience and ensure timely payments.

Penalties for Non-Compliance

Failure to submit the 2022 estimated tax payment form or to pay the required estimated taxes can result in significant penalties. The IRS imposes a penalty for underpayment of estimated taxes if the taxpayer owes more than one thousand dollars when filing their return. Additionally, interest accrues on any unpaid balance from the due date until payment is made.

To avoid these penalties, taxpayers should ensure they make timely payments and accurately estimate their tax liabilities throughout the year. Regularly reviewing income and adjusting payments as necessary can help mitigate the risk of non-compliance.

Quick guide on how to complete wwwdfaarkansasgovincome taxfiduciary andfiduciary and estate income tax forms arkansas

Complete Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents quickly and efficiently. Manage Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas without any hassle

- Obtain Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas and click Get Form to initiate the process.

- Make use of the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive data using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to confirm your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of misplaced or lost documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your selected device. Modify and electronically sign Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas while ensuring effective communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 estimated tax payment form and who needs it?

The 2022 estimated tax payment form is a document used by self-employed individuals and those with signNow income not subject to withholding. It's essential for estimating tax obligations throughout the year, ensuring taxpayers avoid penalties. If your income fluctuates or is irregular, this form helps manage your tax responsibilities effectively.

-

How do I fill out the 2022 estimated tax payment form using airSlate SignNow?

Filling out the 2022 estimated tax payment form with airSlate SignNow is straightforward. You can upload the form to our platform, edit it as needed, and add your eSignature. Our user-friendly interface simplifies the process, helping you complete and submit your tax forms quickly.

-

Is there a cost associated with using airSlate SignNow for the 2022 estimated tax payment form?

Yes, using airSlate SignNow comes with a subscription fee, but it's budget-friendly and designed to suit small businesses and individuals alike. This investment provides access to unlimited document signing and eSigning capabilities, making your tax preparation efficient. The ease of managing the 2022 estimated tax payment form is truly worth the cost.

-

What features does airSlate SignNow offer for managing the 2022 estimated tax payment form?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage. These tools help you easily manage your 2022 estimated tax payment form and streamline the submission process. With reminders and notifications, you can ensure you never miss a tax deadline.

-

Can I save my 2022 estimated tax payment form for future use with airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your completed 2022 estimated tax payment form securely in your account. You can easily retrieve it for future reference or updates, ensuring you have all your tax forms organized and accessible when needed.

-

How does airSlate SignNow improve the signature process for the 2022 estimated tax payment form?

With airSlate SignNow, the signature process for the 2022 estimated tax payment form is efficient and secure. Our eSignature feature allows you to sign documents electronically, reducing the time spent on paperwork. This not only speeds up your submission but also ensures compliance with legal standards.

-

Are there any integrations with other platforms for the 2022 estimated tax payment form?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and accounting software. This means you can easily pull in necessary data when completing your 2022 estimated tax payment form. These integrations simplify your workflow and keep your financial documents organized.

Get more for Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas

- In forma pauperis affidavit and order montana

- Montana proof service form

- Instructions city justice court civil actions montana form

- Interpleader affidavit and order montana form

- Notice and acknowledgment of receipt of summons and complaint montana form

- Notice of appeal montana form

- Montana praecipe form

- Judgment confession form

Find out other Www dfa arkansas govincome taxfiduciary andFiduciary And Estate Income Tax Forms Arkansas

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online