MONEY INSURANCE PROPOSAL FORM

What is the MONEY INSURANCE PROPOSAL FORM

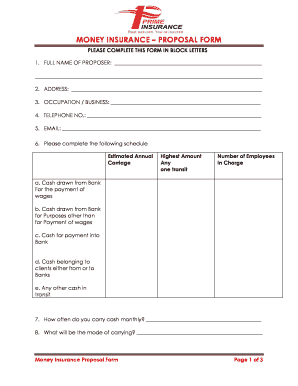

The money insurance proposal form is a document used by individuals or businesses to apply for insurance coverage that protects against financial loss. This form collects essential information about the applicant, including personal details, financial status, and the specific type of coverage being requested. It serves as a formal request to an insurance provider, initiating the underwriting process. Understanding the purpose and components of this form is crucial for ensuring accurate and complete submissions.

Steps to complete the MONEY INSURANCE PROPOSAL FORM

Completing the money insurance proposal form involves several key steps to ensure that all necessary information is accurately provided. Follow these steps for a successful submission:

- Gather required documents, such as identification, financial statements, and previous insurance policies.

- Fill out personal information, including your name, address, and contact details.

- Provide details about the type of insurance coverage you are seeking, specifying the amount and nature of coverage.

- Review the terms and conditions associated with the insurance policy to ensure understanding.

- Sign the form electronically or in print, depending on the submission method.

Legal use of the MONEY INSURANCE PROPOSAL FORM

The legal validity of the money insurance proposal form hinges on compliance with relevant regulations governing electronic signatures and documentation. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that certain criteria are met. This includes ensuring that the signer has consented to use electronic records and that the signature is linked to the document. Utilizing a secure platform for signing, such as signNow, enhances the legal standing of the completed form.

Key elements of the MONEY INSURANCE PROPOSAL FORM

Several key elements are essential to include in the money insurance proposal form to ensure completeness and clarity. These elements typically include:

- Applicant Information: Full name, address, and contact details.

- Insurance Coverage Details: Type of coverage requested, including amounts and specific risks.

- Financial Information: Income details, assets, and liabilities to assess risk.

- Signature: A signature or electronic signature affirming the accuracy of the information provided.

How to obtain the MONEY INSURANCE PROPOSAL FORM

The money insurance proposal form can typically be obtained directly from the insurance provider's website or office. Many insurance companies offer downloadable versions of the form for convenience. Additionally, potential applicants may request a physical copy by contacting their insurance agent or customer service. It is important to ensure that the correct version of the form is used, as different insurance products may require specific forms.

Form Submission Methods (Online / Mail / In-Person)

Submitting the money insurance proposal form can be done through various methods, depending on the insurance provider's policies. Common submission methods include:

- Online Submission: Many providers allow applicants to fill out and submit the form electronically through their website.

- Mail: Applicants can print the completed form and send it via postal mail to the insurance company.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at a local insurance office is an option.

Quick guide on how to complete money insurance proposal form

Effortlessly complete MONEY INSURANCE PROPOSAL FORM on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle MONEY INSURANCE PROPOSAL FORM on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign MONEY INSURANCE PROPOSAL FORM with ease

- Obtain MONEY INSURANCE PROPOSAL FORM and then click Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign MONEY INSURANCE PROPOSAL FORM and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the money insurance proposal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MONEY INSURANCE PROPOSAL FORM?

A MONEY INSURANCE PROPOSAL FORM is a document that you fill out to apply for money insurance coverage. It typically outlines the details of the coverage you seek, including amounts, beneficiaries, and specific terms. This form is crucial for ensuring that your coverage needs are met effectively.

-

How can airSlate SignNow help with the MONEY INSURANCE PROPOSAL FORM?

airSlate SignNow simplifies the process of submitting your MONEY INSURANCE PROPOSAL FORM by allowing you to eSign and send documents quickly. This platform eliminates delays caused by manual signatures, ensuring your proposal signNowes insurers faster. With its user-friendly interface, you can manage and track your proposals efficiently.

-

What features does airSlate SignNow offer for handling insurance forms?

airSlate SignNow provides various features that streamline the completion and submission of your MONEY INSURANCE PROPOSAL FORM. These include customizable templates, automated workflows, and secure cloud storage. Additionally, it enables real-time collaboration, so you can easily share and review proposals with stakeholders.

-

Is there a cost associated with using airSlate SignNow for the MONEY INSURANCE PROPOSAL FORM?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including those focusing on the MONEY INSURANCE PROPOSAL FORM. These plans are cost-effective and designed to provide maximum value, with no hidden fees. You can choose a plan that best aligns with your usage and budget.

-

Can I integrate airSlate SignNow with other tools for processing insurance proposals?

Absolutely! airSlate SignNow is designed to integrate seamlessly with a variety of tools and applications commonly used in the insurance industry. This means you can connect your MONEY INSURANCE PROPOSAL FORM process with CRM systems, accounting software, and more, enhancing efficiency and data management.

-

What are the benefits of using airSlate SignNow for my MONEY INSURANCE PROPOSAL FORM?

Using airSlate SignNow for your MONEY INSURANCE PROPOSAL FORM adds both speed and security to your application process. It allows you to easily eSign documents, track their status, and store them securely online. These benefits reduce paperwork and improve compliance, making insurance management much easier.

-

How secure is the handling of my MONEY INSURANCE PROPOSAL FORM with airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that your MONEY INSURANCE PROPOSAL FORM is handled securely. The platform employs advanced encryption, secure cloud storage, and user authentication to safeguard your data. You can trust that your sensitive information is protected throughout the document management process.

Get more for MONEY INSURANCE PROPOSAL FORM

Find out other MONEY INSURANCE PROPOSAL FORM

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now