File, Adjust or Review Quarterly Tax & Wage ReportDES NCFile, Adjust or Review Quarterly Tax & Wage ReportDES NC 2021-2026

Understanding the Florida RT-6 Form

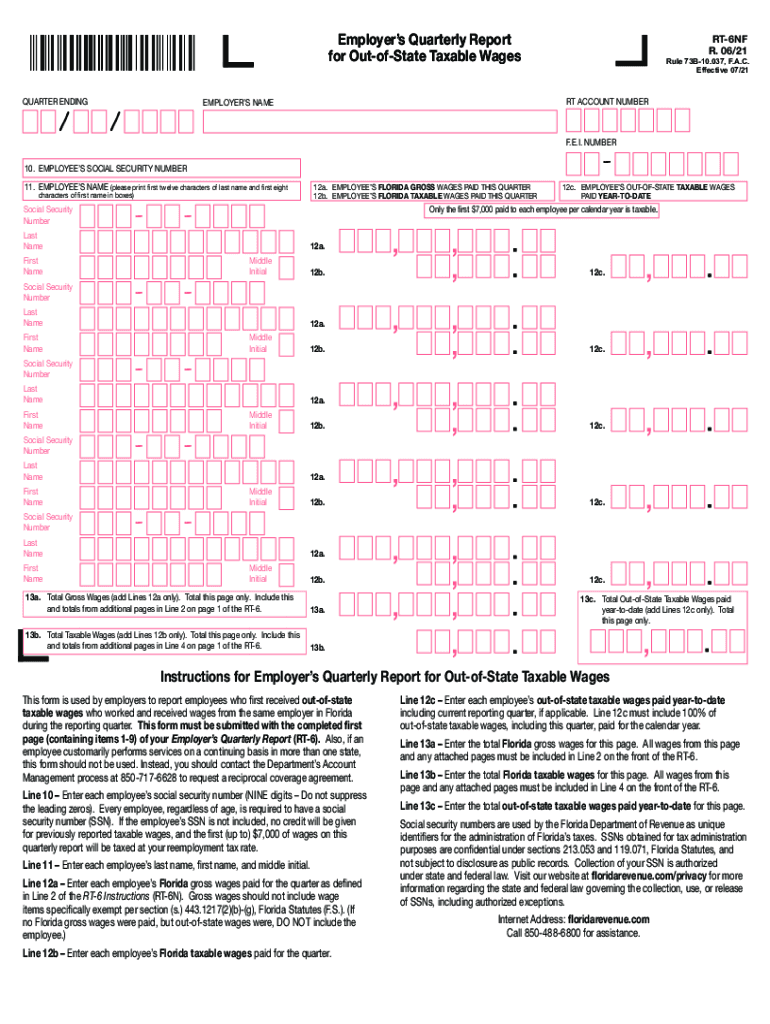

The Florida RT-6 form, also known as the Employer's Quarterly Report, is a crucial document for employers in Florida. This form is used to report wages paid to employees and the associated unemployment tax owed to the state. It is essential for maintaining compliance with Florida's tax regulations and ensuring that employees receive the benefits they are entitled to under the state's unemployment insurance program.

Steps to Complete the RT-6 Form

Completing the RT-6 form involves several key steps:

- Gather necessary information, including employee wages and hours worked during the quarter.

- Calculate the total taxable wages for each employee, ensuring to include any bonuses or commissions.

- Determine the unemployment tax owed based on the taxable wages reported.

- Fill out the RT-6 form accurately, ensuring all calculations are correct.

- Review the form for completeness and accuracy before submission.

Filing Deadlines for the RT-6 Form

Employers must adhere to specific deadlines for submitting the RT-6 form to avoid penalties. The form is due on the last day of the month following the end of each quarter. For example:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Required Documents for RT-6 Submission

To complete the RT-6 form, employers need to have the following documents ready:

- Payroll records for the reporting quarter.

- Employee identification details, including Social Security numbers.

- Any previous RT-6 forms filed for reference.

Penalties for Non-Compliance

Failure to file the RT-6 form on time can result in significant penalties. Employers may face fines, interest on unpaid taxes, and potential legal action. It is vital to stay informed about filing requirements and deadlines to avoid these consequences.

Digital vs. Paper Submission of the RT-6 Form

Employers have the option to submit the RT-6 form either digitally or via paper. Digital submission is often more efficient, allowing for quicker processing and confirmation of receipt. However, some employers may prefer paper submissions for record-keeping purposes. Regardless of the method chosen, it is crucial to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete file adjust or review quarterly tax ampamp wage reportdes ncfile adjust or review quarterly tax ampamp wage reportdes ncfile

Effortlessly Prepare File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC on Any Device

Managing documents online has gained popularity among both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC Seamlessly

- Locate File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC and then click Get Form to begin.

- Make use of the tools available to submit your document.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal authority as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file adjust or review quarterly tax ampamp wage reportdes ncfile adjust or review quarterly tax ampamp wage reportdes ncfile

Create this form in 5 minutes!

People also ask

-

What is the Florida RT6 form and why is it important?

The Florida RT6 form is a crucial document used for reporting employee wages and job costs to the state of Florida. Filing this form accurately ensures compliance with state regulations, helping businesses avoid potential fines. Using airSlate SignNow, you can easily eSign and send your Florida RT6 form securely and efficiently.

-

How much does it cost to use airSlate SignNow for submitting the Florida RT6 form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting from a cost-effective monthly subscription. This ensures you can manage all your documents, including the Florida RT6 form, within your budget. The value gained from increased efficiency and compliance can provide substantial savings in the long run.

-

What features does airSlate SignNow provide for the Florida RT6 form?

airSlate SignNow provides several features to streamline the process of sending and eSigning the Florida RT6 form, including customizable templates, real-time status tracking, and secure cloud storage. These features empower businesses to manage their documentation seamlessly, reducing turnaround time and enhancing productivity.

-

Can I integrate airSlate SignNow with other software I use for handling the Florida RT6 form?

Yes, airSlate SignNow integrates smoothly with various third-party applications such as CRMs, HR software, and cloud storage systems. This allows you to manage the Florida RT6 form alongside your existing tools, streamlining workflows and enhancing collaboration across your team.

-

Is airSlate SignNow suitable for small businesses needing to file the Florida RT6 form?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. With its easy-to-use platform, small business owners can efficiently manage the filing of the Florida RT6 form without overwhelming complications.

-

What are the benefits of eSigning the Florida RT6 form with airSlate SignNow?

eSigning the Florida RT6 form with airSlate SignNow offers numerous benefits, such as improved speed, accuracy, and security. With electronic signatures being legally binding, you can feel confident that your documents are compliant while reducing the need for physical paperwork.

-

How do I get started with airSlate SignNow for the Florida RT6 form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose a suitable pricing plan, and you can begin creating, sending, and eSigning your Florida RT6 form within minutes. Our user-friendly interface and resources will guide you through the process.

Get more for File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC

- Employment hiring process package mississippi form

- Mississippi authorization form

- Ms revocation 497315687 form

- Employment or job termination package mississippi form

- Newly widowed individuals package mississippi form

- Employment interview package mississippi form

- Employment employee personnel file package mississippi form

- Assignment of mortgage package mississippi form

Find out other File, Adjust Or Review Quarterly Tax & Wage ReportDES NCFile, Adjust Or Review Quarterly Tax & Wage ReportDES NC

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF