Arizona Form 290 Request for Penalty Abatement 2022-2026

What is the Arizona Form 290 Request For Penalty Abatement

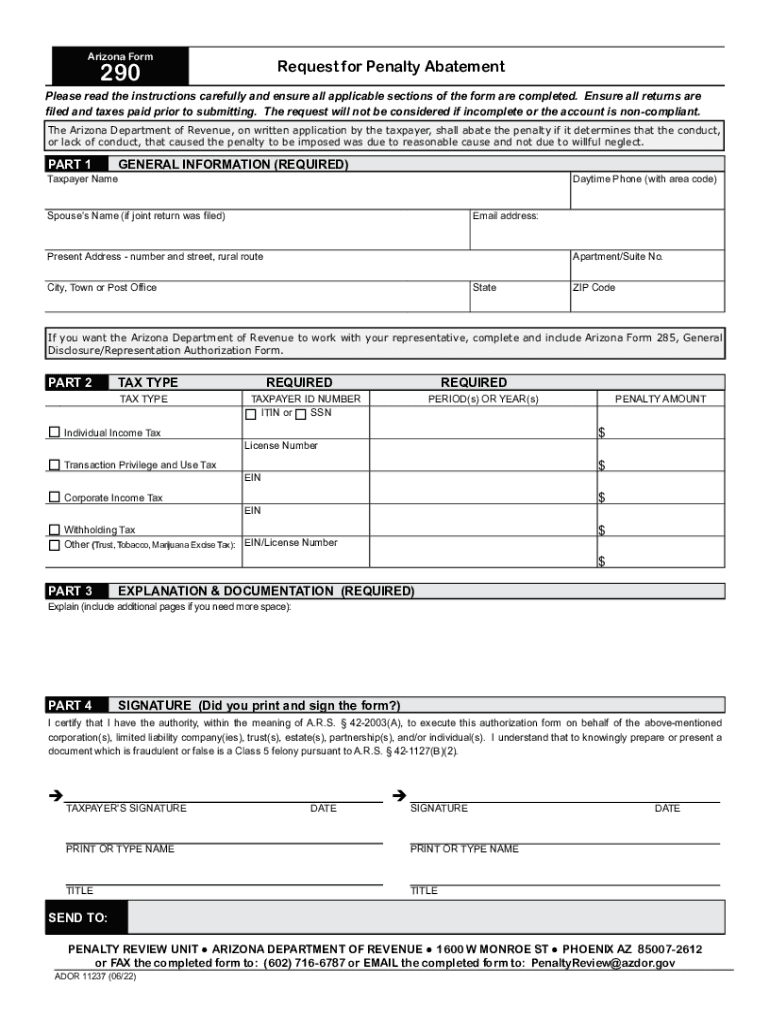

The Arizona Form 290, also known as the Request for Penalty Abatement, is a crucial document used by taxpayers in Arizona to request the removal of penalties imposed by the Arizona Department of Revenue (ADOR). This form is particularly relevant for individuals or businesses seeking relief from penalties due to reasonable cause, such as unforeseen circumstances that prevented timely tax payments. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and for effectively managing tax liabilities.

How to use the Arizona Form 290 Request For Penalty Abatement

Using the Arizona Form 290 involves several key steps to ensure that the request is properly submitted and considered. Taxpayers must first complete the form accurately, providing necessary information such as their name, address, and tax identification number. It is important to clearly explain the reason for the penalty abatement request, detailing the circumstances that led to the inability to meet tax obligations. Once completed, the form can be submitted to the ADOR through the designated channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the Arizona Form 290 Request For Penalty Abatement

Completing the Arizona Form 290 requires careful attention to detail. Follow these steps for successful submission:

- Download the form from the Arizona Department of Revenue website or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide a detailed explanation of the circumstances that led to the penalty, ensuring to include any supporting documentation.

- Review the form for accuracy and completeness before submission.

- Submit the form through the appropriate method as outlined by the ADOR.

Eligibility Criteria for Arizona Form 290 Request For Penalty Abatement

To qualify for penalty abatement using the Arizona Form 290, taxpayers must meet specific eligibility criteria. Generally, the request is considered if the taxpayer can demonstrate reasonable cause for failing to comply with tax obligations. This may include situations such as serious illness, natural disasters, or other significant life events that hindered timely payment. It is essential to provide adequate documentation to support the claim, as the ADOR reviews these requests on a case-by-case basis.

Required Documents for Arizona Form 290 Submission

When submitting the Arizona Form 290, certain documents may be required to support the request for penalty abatement. These may include:

- Proof of the circumstances that led to the penalty, such as medical records or disaster declarations.

- Any correspondence with the ADOR regarding the penalties.

- Tax returns or payment records that demonstrate compliance with tax obligations prior to the incident.

Including these documents can strengthen the case for abatement and increase the likelihood of a favorable outcome.

Form Submission Methods for Arizona Form 290

The Arizona Form 290 can be submitted through various methods, allowing taxpayers flexibility in how they choose to file their requests. The available submission methods include:

- Online submission through the Arizona Department of Revenue's eServices portal.

- Mailing the completed form to the appropriate ADOR address.

- In-person delivery at local ADOR offices.

Choosing the right submission method can depend on personal preference and urgency, as online submissions may provide quicker processing times.

Quick guide on how to complete arizona form 290 request for penalty abatement

Complete Arizona Form 290 Request For Penalty Abatement effortlessly on any device

Online document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents swiftly without delays. Handle Arizona Form 290 Request For Penalty Abatement on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Arizona Form 290 Request For Penalty Abatement with ease

- Locate Arizona Form 290 Request For Penalty Abatement and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Arizona Form 290 Request For Penalty Abatement and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 290 request for penalty abatement

Create this form in 5 minutes!

People also ask

-

What is AZ Form 290 and how can airSlate SignNow assist with it?

AZ Form 290 is a crucial document required for various applications in Arizona. airSlate SignNow simplifies the process of filling, signing, and managing AZ Form 290, providing a user-friendly interface that ensures quick and efficient document handling.

-

How does airSlate SignNow ensure the security of AZ Form 290?

airSlate SignNow employs bank-level encryption to protect all documents, including AZ Form 290. This high level of security ensures that sensitive information remains private and safe from unauthorized access.

-

What are the pricing options for using airSlate SignNow for AZ Form 290?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, with options suitable for individuals and teams. These cost-effective solutions make it easy to integrate AZ Form 290 into your workflow without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing AZ Form 290?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow management for AZ Form 290. Whether you’re using CRM systems or productivity tools, you can streamline your post-signing processes effectively.

-

What features does airSlate SignNow provide for filling out AZ Form 290?

airSlate SignNow includes features like customizable templates, drag-and-drop editing, and real-time collaboration to enhance the process of filling out AZ Form 290. These tools help users create accurate documents quickly and efficiently.

-

Is airSlate SignNow user-friendly for new customers filling out AZ Form 290?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes it easy for new customers to navigate through the process of filling out AZ Form 290. The intuitive features ensure that anyone can use the platform without prior training.

-

Are electronic signatures on AZ Form 290 legally binding with airSlate SignNow?

Yes, electronic signatures created with airSlate SignNow are legally binding and compliant with government regulations. This means that your completed AZ Form 290 will hold up in legal contexts, providing peace of mind when signing documents.

Get more for Arizona Form 290 Request For Penalty Abatement

- Written revocation of will montana form

- Last will and testament for other persons montana form

- Notice to beneficiaries of being named in will montana form

- Estate planning questionnaire and worksheets montana form

- Document locator and personal information package including burial information form montana

- Demand to produce copy of will from heir to executor or person in possession of will montana form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497316719 form

- Bill of sale of automobile and odometer statement north carolina form

Find out other Arizona Form 290 Request For Penalty Abatement

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form