Form DR 601G "Governmental Leasehold Intangible Personal Property Tax 2022-2026

What is the Form DR 601G?

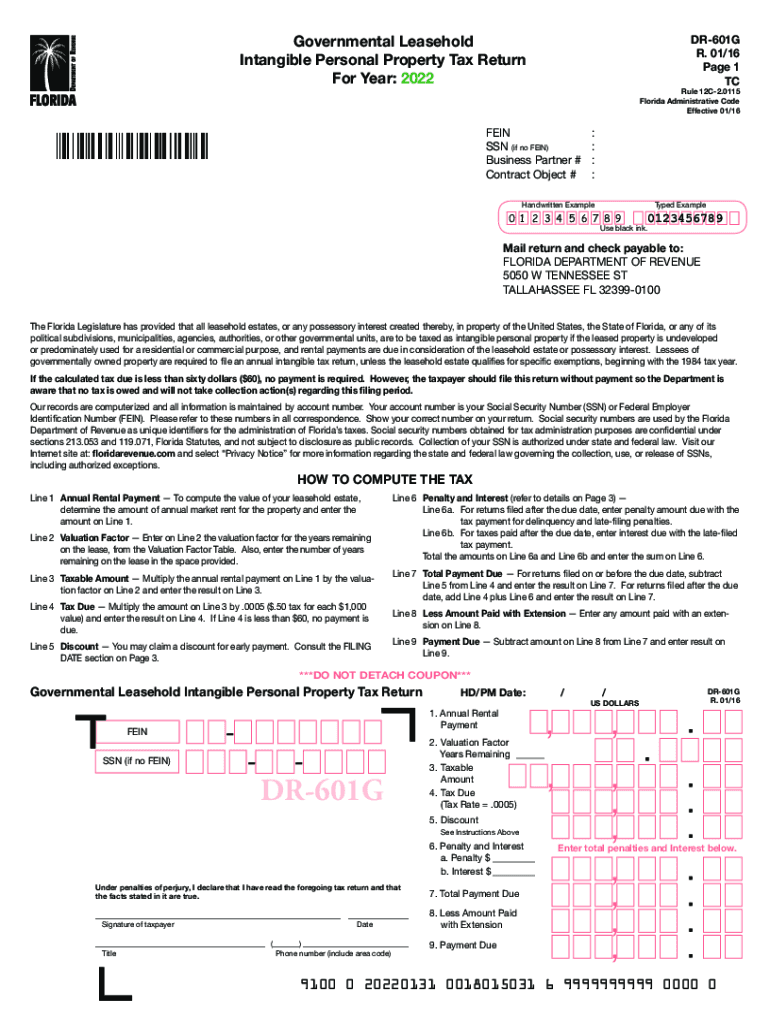

The Form DR 601G is used for reporting the Governmental Leasehold Intangible Personal Property Tax in Florida. This form is essential for entities that hold leasehold interests in government property. It helps in assessing the intangible personal property tax applicable to these leaseholds, ensuring compliance with state tax regulations. Understanding the purpose of this form is crucial for businesses and individuals involved in governmental leasehold arrangements.

Steps to Complete the Form DR 601G

Completing the Form DR 601G involves several important steps to ensure accurate reporting. First, gather all necessary information regarding the leasehold property, including the lease terms and the property’s assessed value. Next, fill out the form with precise details, including the property address and the name of the entity holding the lease. Ensure that all calculations regarding the tax owed are accurate. Finally, review the completed form for any errors before submission.

Legal Use of the Form DR 601G

The Form DR 601G must be used in accordance with Florida state laws governing property taxes. It is legally binding when completed correctly and submitted on time. Failure to use this form properly can result in penalties or fines. The form serves as a declaration of the leasehold interest and the associated tax liability, making it essential for compliance with state tax regulations.

Required Documents for Form DR 601G

When filling out the Form DR 601G, certain documents may be required to support the information provided. These documents typically include the lease agreement, any prior tax assessments related to the property, and documentation proving the value of the leasehold interest. Having these documents ready can facilitate a smoother completion process and help ensure compliance with tax obligations.

Filing Deadlines for Form DR 601G

It is important to be aware of the filing deadlines for the Form DR 601G to avoid penalties. The form must be submitted annually, and specific deadlines may vary depending on the local tax authority. Generally, it is advisable to file the form as early as possible within the tax season to ensure that all necessary information is accurately reported and processed in a timely manner.

Examples of Using the Form DR 601G

Examples of using the Form DR 601G include situations where a business leases government-owned land for commercial purposes or when a nonprofit organization holds a lease for community services. In these cases, the form helps determine the intangible personal property tax owed based on the leasehold interest. Proper use of the form ensures that these entities remain compliant with state tax laws and avoid potential legal issues.

Quick guide on how to complete form dr 601g ampquotgovernmental leasehold intangible personal property tax

Complete Form DR 601G "Governmental Leasehold Intangible Personal Property Tax seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Form DR 601G "Governmental Leasehold Intangible Personal Property Tax on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign Form DR 601G "Governmental Leasehold Intangible Personal Property Tax effortlessly

- Obtain Form DR 601G "Governmental Leasehold Intangible Personal Property Tax and click on Get Form to begin.

- Utilize the tools we supply to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tiresome form searches, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form DR 601G "Governmental Leasehold Intangible Personal Property Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dr 601g ampquotgovernmental leasehold intangible personal property tax

Create this form in 5 minutes!

People also ask

-

What is the 601g g latest feature in airSlate SignNow?

The 601g g latest feature in airSlate SignNow provides users with the most updated and streamlined electronic signature capabilities. This ensures that your document signing process is efficient, secure, and compliant with the latest legal standards. With this feature, you can easily send and eSign documents, enhancing your workflow.

-

What are the pricing options for using the 601g g latest version?

Pricing for the 601g g latest version of airSlate SignNow is flexible and designed to accommodate different business needs. You can choose from monthly or annual subscriptions based on your usage requirements. Additionally, there is a free trial available, allowing you to explore the features before making a commitment.

-

How does the 601g g latest version improve document security?

The 601g g latest version of airSlate SignNow includes advanced security features such as encryption, secure storage, and multi-factor authentication. These safeguards ensure that your documents remain confidential and protected from unauthorized access. Using this version gives you peace of mind that your sensitive information is secure.

-

Can I integrate airSlate SignNow with other software using the 601g g latest version?

Yes, the 601g g latest version of airSlate SignNow supports various integrations with popular software platforms like Salesforce, Google Drive, and more. This flexibility allows you to seamlessly incorporate electronic signing into your existing workflows, streamlining your operations. Integrations enhance productivity and collaboration across your team.

-

What are the benefits of upgrading to the 601g g latest version?

Upgrading to the 601g g latest version of airSlate SignNow unlocks enhanced features such as advanced analytics, compliance tracking, and improved user experience. These updates are designed to increase efficiency and provide better insights into your document management processes. Businesses can expect higher productivity and easier management of electronic signatures.

-

Is the 601g g latest solution suitable for businesses of all sizes?

Absolutely! The 601g g latest solution from airSlate SignNow is designed to cater to businesses of all sizes, from small startups to large enterprises. Its versatility makes it suitable for various industries, ensuring that every organization can benefit from efficient document signing and management. This scalability helps businesses grow without the hassle of switching solutions.

-

How does the 601g g latest version enhance user experience?

The 601g g latest version enhances user experience by providing an intuitive interface and easy navigation. Users can quickly learn how to send and eSign documents without long training sessions, improving overall efficiency. Continuous updates also ensure that the platform remains user-friendly, responding to customer feedback and needs.

Get more for Form DR 601G "Governmental Leasehold Intangible Personal Property Tax

- North carolina llc search form

- Quitclaim deed from individual to two individuals in joint tenancy north carolina form

- North carolina satisfaction form

- North carolina husband wife 497316852 form

- General warranty deed from two individuals to husband and wife north carolina form

- Quitclaim deed from three individuals to one individual north carolina form

- North carolina deed 497316855 form

- Eviction order form

Find out other Form DR 601G "Governmental Leasehold Intangible Personal Property Tax

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document