Dr 601g Fill in 2019

What is the Florida Form FR 601G?

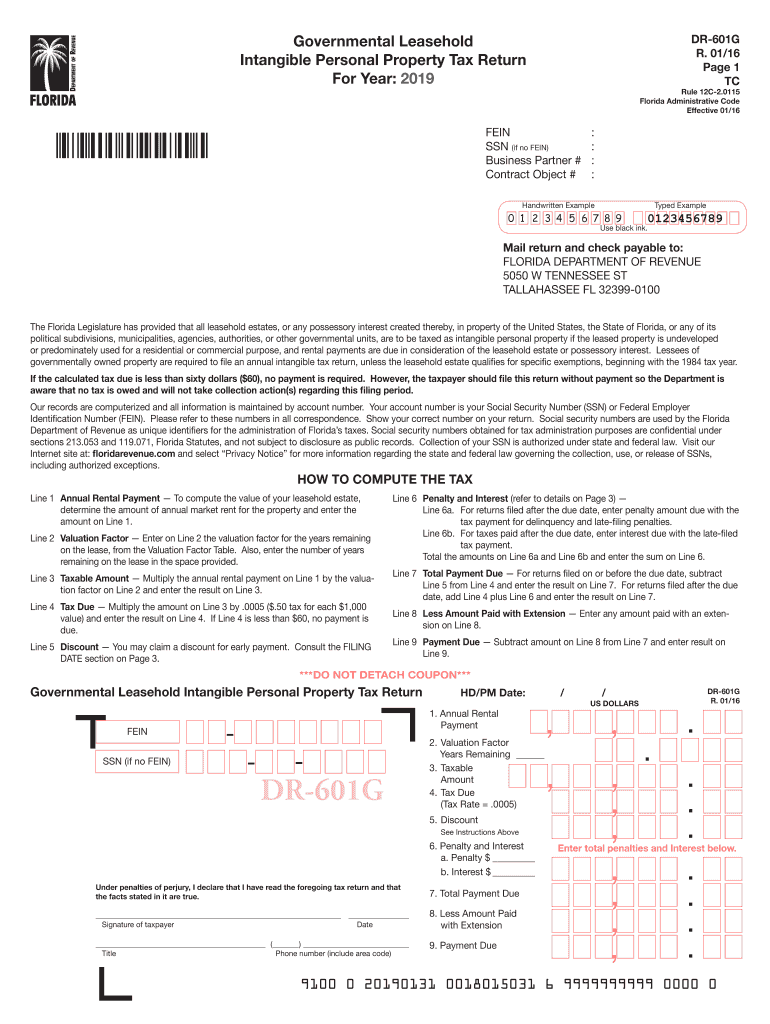

The Florida Form FR 601G, also known as the Governmental Leasehold Intangible Personal Property Tax Return, is a document required for reporting intangible personal property associated with governmental leaseholds in Florida. This form is essential for entities that hold lease agreements with governmental bodies, ensuring compliance with state tax regulations. It provides a structured way to disclose the value of leasehold interests and any associated intangible assets.

Key Elements of the Florida Form FR 601G

The Florida Form FR 601G includes several critical components that must be accurately completed. Key elements consist of:

- Identification Information: This section requires the taxpayer's name, address, and identification number.

- Leasehold Details: Information about the leasehold, including the property description and lease duration.

- Valuation Information: Taxpayers must provide the estimated value of the leasehold and any intangible personal property associated with it.

- Signature and Certification: The form must be signed by an authorized representative, certifying the accuracy of the information provided.

Steps to Complete the Florida Form FR 601G

Completing the Florida Form FR 601G involves several straightforward steps:

- Gather necessary documentation, including lease agreements and valuation records.

- Fill out the identification section with accurate taxpayer information.

- Provide details about the leasehold, including property descriptions and lease terms.

- Estimate the value of the leasehold and any intangible assets, ensuring all calculations are accurate.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal Use of the Florida Form FR 601G

The legal use of the Florida Form FR 601G is crucial for compliance with state tax laws. Filing this form accurately ensures that the taxpayer meets their obligations regarding intangible personal property tax. Failure to submit the form or providing incorrect information can lead to penalties, including fines or additional tax assessments. It is important to understand the legal implications of the information reported on this form.

Form Submission Methods

The Florida Form FR 601G can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online Submission: Many taxpayers prefer to file electronically through the Florida Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate tax authority, ensuring it is sent well before the deadline.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated tax offices.

Filing Deadlines / Important Dates

Awareness of filing deadlines is vital for compliance with the Florida Form FR 601G. Typically, the form must be filed annually, with specific deadlines set by the Florida Department of Revenue. Taxpayers should mark their calendars to ensure timely submission, as late filings can incur penalties. It is advisable to check for any updates or changes to deadlines each tax year.

Quick guide on how to complete fl dor dr 601g 2019

Prepare Dr 601g Fill In effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Dr 601g Fill In on any device with airSlate SignNow’s Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and electronically sign Dr 601g Fill In without any hassle

- Find Dr 601g Fill In and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides especially for that purpose.

- Create your digital signature using the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Alter and electronically sign Dr 601g Fill In and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl dor dr 601g 2019

Create this form in 5 minutes!

How to create an eSignature for the fl dor dr 601g 2019

How to make an electronic signature for the Fl Dor Dr 601g 2019 in the online mode

How to generate an eSignature for the Fl Dor Dr 601g 2019 in Google Chrome

How to create an electronic signature for signing the Fl Dor Dr 601g 2019 in Gmail

How to create an eSignature for the Fl Dor Dr 601g 2019 from your smart phone

How to generate an eSignature for the Fl Dor Dr 601g 2019 on iOS

How to create an electronic signature for the Fl Dor Dr 601g 2019 on Android devices

People also ask

-

What is the Florida Form FR 601G and how does airSlate SignNow help with it?

The Florida Form FR 601G is a critical document used for various business and legal purposes in Florida. airSlate SignNow offers a streamlined platform to complete, sign, and store your Florida Form FR 601G electronically, enhancing efficiency and ensuring compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for Florida Form FR 601G?

Yes, airSlate SignNow offers several pricing plans that cater to businesses of all sizes. These plans provide access to a range of features that assist users in managing their Florida Form FR 601G efficiently, ensuring that you get value for your investment.

-

What features does airSlate SignNow offer for managing Florida Form FR 601G?

airSlate SignNow includes features like document editing, customizable templates, and secure cloud storage, specifically tailored for documents like the Florida Form FR 601G. Additionally, you can track the status of your forms and receive notifications, making the signing process smooth and hassle-free.

-

Can I integrate airSlate SignNow with other software to handle Florida Form FR 601G?

Absolutely! airSlate SignNow seamlessly integrates with various CRM systems, cloud storage services, and business applications. This ensures that you can easily manage your Florida Form FR 601G alongside other essential documents and systems you utilize in your business.

-

What are the benefits of using airSlate SignNow for Florida Form FR 601G?

Using airSlate SignNow for your Florida Form FR 601G benefits you with speed, security, and ease of use. The platform helps reduce turnaround times and minimizes paperwork errors, allowing businesses to focus more on critical operations rather than administrative tasks.

-

Is airSlate SignNow compliant with regulations for Florida Form FR 601G?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management, which includes the Florida Form FR 601G. Our platform ensures that all signed documents are legally binding and adhere to state and federal regulations.

-

How can I ensure the security of my Florida Form FR 601G with airSlate SignNow?

airSlate SignNow prioritizes your document security by employing bank-level encryption and secure data storage. When managing your Florida Form FR 601G, you can rest assured that your sensitive information is protected from unauthorized access and bsignNowes.

Get more for Dr 601g Fill In

Find out other Dr 601g Fill In

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online