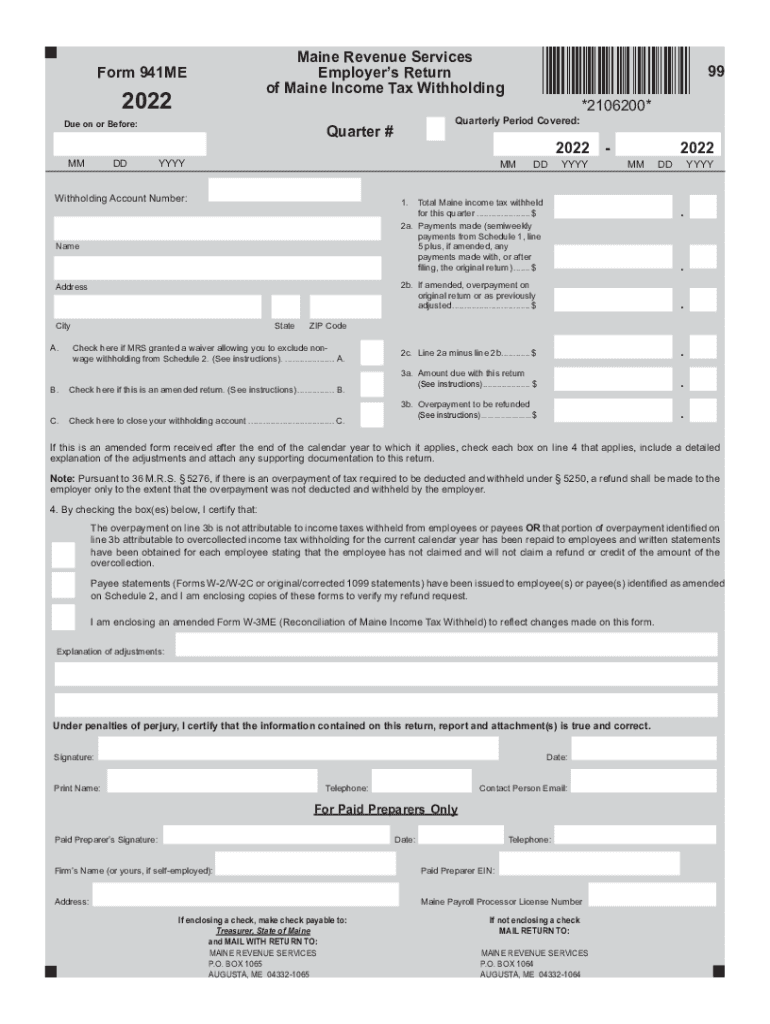

Get the FORM 941ME Loose MAINE REVENUE SERVICES 2022

Understanding the 2023 Maine Income Tax Form

The 2023 Maine income tax form is essential for residents and businesses to report their income and calculate their tax liability. This form is used to declare all sources of income, including wages, self-employment earnings, and other income types. Understanding the components of this form is crucial for accurate reporting and compliance with state tax regulations.

Steps to Complete the 2023 Maine Income Tax Form

Filling out the 2023 Maine income tax form involves several key steps:

- Gather necessary documentation, such as W-2s, 1099s, and records of other income.

- Review the instructions provided with the form to understand specific requirements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include all relevant forms and schedules.

- Calculate your total income and determine your tax liability using the provided tax tables.

- Claim any applicable deductions or credits to reduce your taxable income.

- Sign and date the form before submission.

Filing Deadlines and Important Dates

Timely submission of the 2023 Maine income tax form is crucial to avoid penalties. The typical filing deadline is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It's important to stay informed about any changes to deadlines that may arise due to state regulations or special circumstances.

Required Documents for the 2023 Maine Income Tax Form

To complete the 2023 Maine income tax form accurately, you will need several documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Documentation of any other income sources

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Previous year’s tax return for reference

Form Submission Methods

The 2023 Maine income tax form can be submitted through various methods, ensuring convenience for taxpayers:

- Online submission through the Maine Revenue Services website.

- Mailing a completed paper form to the designated tax office.

- In-person submission at local tax offices, if available.

Key Elements of the 2023 Maine Income Tax Form

Understanding the key elements of the 2023 Maine income tax form is vital for accurate completion. These elements include:

- Personal identification information

- Income reporting sections

- Deductions and credits available

- Signature lines for both the taxpayer and spouse, if applicable

Legal Use of the 2023 Maine Income Tax Form

The legal use of the 2023 Maine income tax form requires compliance with state laws and regulations. This includes ensuring that all information provided is truthful and complete. Filing the form electronically or via mail establishes a legal record of your income and tax obligations, which is crucial in the event of an audit or inquiry by tax authorities.

Quick guide on how to complete get the free form 941me loose 2005 maine revenue services

Complete Get The FORM 941ME Loose MAINE REVENUE SERVICES effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the desired form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Get The FORM 941ME Loose MAINE REVENUE SERVICES on any device using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to modify and electronically sign Get The FORM 941ME Loose MAINE REVENUE SERVICES with ease

- Locate Get The FORM 941ME Loose MAINE REVENUE SERVICES and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Get The FORM 941ME Loose MAINE REVENUE SERVICES, ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free form 941me loose 2005 maine revenue services

Create this form in 5 minutes!

People also ask

-

What is the 2023 Maine income tax form and who needs it?

The 2023 Maine income tax form is a document that residents of Maine must complete to report their income and calculate their tax obligations for the year. This form is necessary for individuals earning income, including wages and self-employment earnings, and is required for anyone who is a resident or part-year resident of Maine.

-

Where can I obtain the 2023 Maine income tax form?

You can obtain the 2023 Maine income tax form from the Maine Revenue Services website or through local taxation offices. In addition, airSlate SignNow provides a convenient solution for electronically signing and submitting these forms, making the process even easier.

-

How can airSlate SignNow help with the 2023 Maine income tax form?

airSlate SignNow allows users to easily send and electronically sign the 2023 Maine income tax form, streamlining your filing process. With our cost-effective solution, you can avoid delays and ensure your forms are submitted accurately and on time.

-

What features does airSlate SignNow offer for managing the 2023 Maine income tax form?

airSlate SignNow offers features such as document templates, real-time tracking, and secure storage to assist with the 2023 Maine income tax form. These tools enhance your efficiency and make document management seamless for your tax preparations.

-

Is there a cost associated with using airSlate SignNow for the 2023 Maine income tax form?

Yes, airSlate SignNow operates on a subscription-based model that offers various pricing tiers to suit different needs. Our pricing provides a cost-effective solution when completing and eSigning the 2023 Maine income tax form, making it accessible for individuals and businesses alike.

-

Can I integrate airSlate SignNow with accounting software for the 2023 Maine income tax form?

Absolutely! airSlate SignNow integrates with various accounting software platforms, allowing you to import necessary data easily for your 2023 Maine income tax form. This integration saves time and minimizes errors during the tax preparation process.

-

What are the benefits of using airSlate SignNow for the 2023 Maine income tax form?

Using airSlate SignNow for the 2023 Maine income tax form offers numerous benefits, including improved efficiency, enhanced security, and the ability to manage documents remotely. This flexibility allows you to complete your tax obligations conveniently and confidently.

Get more for Get The FORM 941ME Loose MAINE REVENUE SERVICES

- Child support joint nc form

- Child support custody form

- Bankruptcy 7 13 497317087 form

- North carolina bankruptcy form

- Nc chapter 7 form

- Bill of sale with warranty by individual seller north carolina form

- Nc warranty 497317091 form

- Bill of sale without warranty by individual seller north carolina form

Find out other Get The FORM 941ME Loose MAINE REVENUE SERVICES

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors