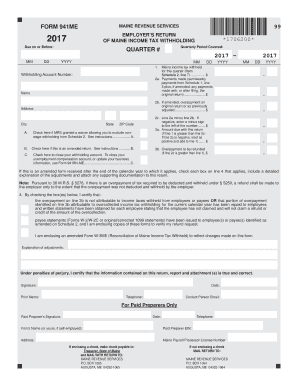

Payments Made Semiweekly Maine 2023

Understanding the Payments Made Semiweekly in Maine

The Payments Made semiweekly in Maine refer to a specific schedule for businesses to remit their income tax withholding. This schedule is typically applicable to employers who have a substantial amount of payroll taxes. Under this system, employers are required to make payments twice a week, which helps ensure that tax obligations are met in a timely manner. Understanding this payment schedule is crucial for maintaining compliance and avoiding penalties.

How to Use the Payments Made Semiweekly in Maine

To effectively use the Payments Made semiweekly in Maine, employers need to identify their payroll periods and calculate the total tax withheld during those periods. Payments are generally due on Wednesdays and Fridays, depending on the payroll schedule. Employers should keep accurate records of all withholdings and ensure that payments are made on time to avoid interest and penalties. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to Complete the Payments Made Semiweekly in Maine

Completing the Payments Made semiweekly involves several steps:

- Determine your payroll schedule and the corresponding payment dates.

- Calculate the total amount of income tax withheld for each payroll period.

- Prepare the payment using the appropriate method, whether online or via mail.

- Submit the payment on the designated due dates to avoid penalties.

Employers should also verify that their payment methods are compliant with Maine’s tax regulations.

Filing Deadlines and Important Dates

It is essential for employers to be aware of the filing deadlines associated with the Payments Made semiweekly in Maine. Payments are due on specific days of the week, typically on Wednesdays and Fridays, depending on the payroll schedule. Missing these deadlines can result in penalties and interest charges. Keeping a calendar of these important dates can help ensure timely compliance.

Required Documents for Payments Made Semiweekly in Maine

When making Payments Made semiweekly in Maine, employers should have the following documents prepared:

- Payroll records detailing the amount of income tax withheld.

- Any previous payment receipts to ensure accurate record-keeping.

- Documentation of the payment method used, whether online or via mail.

Having these documents organized can facilitate a smoother payment process and help in case of audits.

Penalties for Non-Compliance with Payments Made Semiweekly in Maine

Failure to comply with the Payments Made semiweekly requirements in Maine can lead to significant penalties. Employers may incur interest charges on late payments and may be subject to additional fines for repeated non-compliance. It is crucial to adhere to the payment schedule and maintain accurate records to avoid these consequences.

Quick guide on how to complete payments made semiweekly maine

Complete Payments Made semiweekly Maine effortlessly on any gadget

Online document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documentation, as you can access the correct template and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Payments Made semiweekly Maine on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign Payments Made semiweekly Maine without hassle

- Locate Payments Made semiweekly Maine and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing out new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device you select. Modify and eSign Payments Made semiweekly Maine and guarantee excellent communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payments made semiweekly maine

Create this form in 5 minutes!

How to create an eSignature for the payments made semiweekly maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of understanding Maine income tax for businesses?

Understanding Maine income tax is crucial for businesses operating in the state, as it affects financial planning and compliance. Proper knowledge helps in accurately calculating tax liabilities and avoiding penalties. airSlate SignNow can assist in managing documents related to tax filings efficiently.

-

How can airSlate SignNow help with Maine income tax documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to Maine income tax. With our eSignature solution, you can easily send tax forms for signatures, ensuring timely submissions. This reduces the risk of errors and enhances compliance with state regulations.

-

What features does airSlate SignNow offer for managing Maine income tax forms?

Our platform offers features like customizable templates, secure eSigning, and document tracking specifically for Maine income tax forms. These tools simplify the process of preparing and managing tax documents. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for handling Maine income tax needs?

Yes, airSlate SignNow provides a cost-effective solution for managing Maine income tax documentation. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can airSlate SignNow integrate with accounting software for Maine income tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage Maine income tax documents. This integration allows for automatic data transfer, reducing manual entry errors and ensuring that your tax information is always up-to-date.

-

What are the benefits of using airSlate SignNow for Maine income tax compliance?

Using airSlate SignNow for Maine income tax compliance offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform ensures that all documents are securely stored and easily accessible. This helps businesses maintain compliance with state tax regulations efficiently.

-

How does airSlate SignNow ensure the security of Maine income tax documents?

airSlate SignNow prioritizes the security of your Maine income tax documents with advanced encryption and secure cloud storage. We comply with industry standards to protect sensitive information. This ensures that your tax documents are safe from unauthorized access and data bsignNowes.

Get more for Payments Made semiweekly Maine

- Vollmacht fr klausureinsicht financefbvkitedu form

- New group registrati on form narcotics anonymous na

- Attach copy of i form

- Toxic substance control form

- 2016 travel baseball registration form tournament teams nbsaonline

- Api svmh form

- Print form limited power of attorney for study abroad frequently asked questions 1

- Blank sar form 111

Find out other Payments Made semiweekly Maine

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile