Forms Justia ComwashingtonstatewideJustia Wine Shipper to Consumer Summary Tax Report 2022-2026

Understanding the Washington Liquor Tax Form

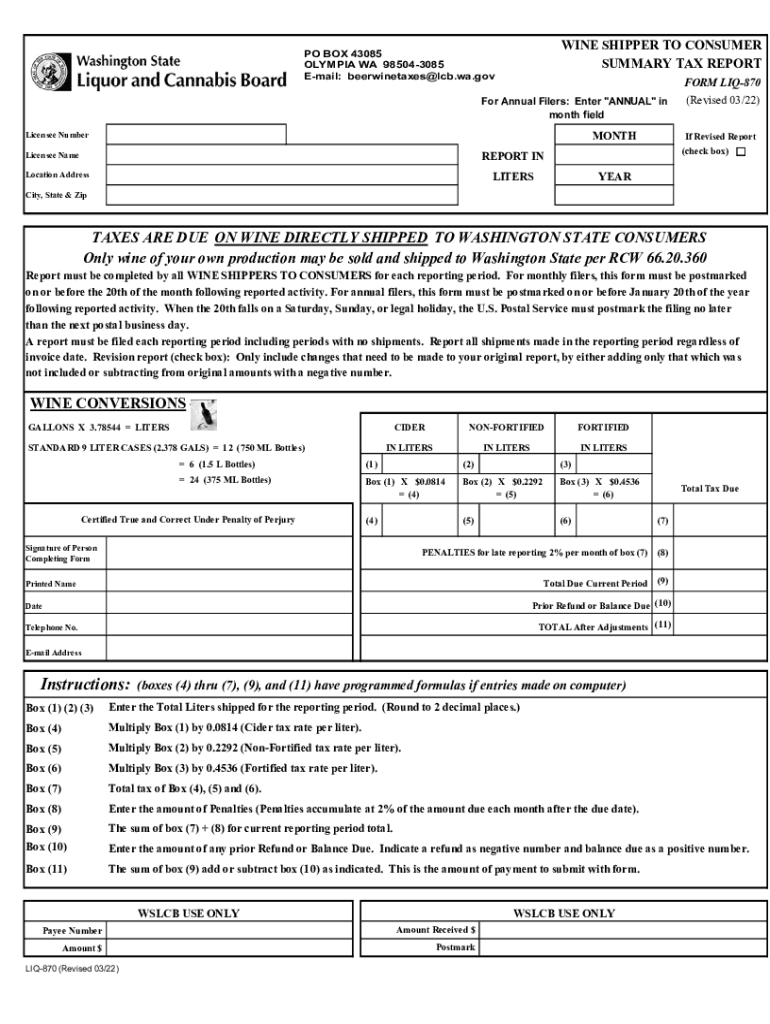

The Washington liquor tax form is essential for businesses involved in the sale or distribution of alcoholic beverages within Washington State. This form is used to report the amount of liquor sold and calculate the taxes owed to the state. The tax is imposed on various types of alcoholic beverages, including beer, wine, and spirits. Understanding the specifics of this form is crucial for compliance and accurate reporting.

Steps to Complete the Washington Liquor Tax Form

Completing the Washington liquor tax form involves several key steps:

- Gather necessary information, including sales data and inventory records.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the sales figures provided.

- Review the form for accuracy before submission.

- Submit the form by the designated deadline, either electronically or by mail.

Filing Deadlines for the Washington Liquor Tax

It is important to be aware of the filing deadlines for the Washington liquor tax form. Typically, businesses must submit their tax reports on a monthly or quarterly basis, depending on their sales volume. Missing deadlines can result in penalties and interest on unpaid taxes, so maintaining a calendar of due dates is recommended.

Legal Use of the Washington Liquor Tax Form

The Washington liquor tax form is legally binding and must be filled out in compliance with state regulations. Accurate reporting is essential to avoid legal repercussions, including fines or audits. Businesses should familiarize themselves with the relevant laws governing liquor sales and taxation in Washington State to ensure compliance.

Required Documents for Filing

When filing the Washington liquor tax form, certain documents may be required to support the information provided. These may include:

- Sales records detailing the quantity and type of alcohol sold.

- Inventory records showing stock levels at the beginning and end of the reporting period.

- Any previous tax filings for reference and accuracy.

Penalties for Non-Compliance

Failure to comply with the Washington liquor tax regulations can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential audits. It is crucial to understand the implications of non-compliance and to take proactive measures to ensure all tax obligations are met in a timely manner.

Quick guide on how to complete formsjustiacomwashingtonstatewidejustia wine shipper to consumer summary tax report

Complete Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report effortlessly on any device

Online document management has become popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and eSign Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report without hassle

- Find Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formsjustiacomwashingtonstatewidejustia wine shipper to consumer summary tax report

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to WA tax?

airSlate SignNow is a robust eSignature solution that allows businesses to send and sign documents digitally. It is particularly beneficial for managing WA tax-related documentation efficiently, ensuring compliance with Washington State regulations.

-

How does airSlate SignNow help with WA tax compliance?

With airSlate SignNow, you can easily create, send, and track documents needed for WA tax compliance. The platform provides customizable templates that ensure all necessary information is captured, minimizing the risk of errors in your tax submissions.

-

Is airSlate SignNow affordable for small businesses dealing with WA tax?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate small businesses. By providing a cost-effective solution for handling WA tax documents, businesses can save money while ensuring their tax processes are managed effectively.

-

What features does airSlate SignNow offer for managing WA tax documents?

airSlate SignNow includes features like customizable templates, automated workflows, and secure storage, making it easier to manage WA tax documents. These capabilities enable users to streamline their document management and improve overall efficiency.

-

Can airSlate SignNow integrate with other tools for WA tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your WA tax management experience. This integration ensures that your documents sync automatically, reducing duplicate work and ensuring accuracy.

-

What are the benefits of using airSlate SignNow for WA tax-related documents?

Using airSlate SignNow for WA tax documents simplifies the signing process, saving time and reducing paperwork. It increases collaboration among team members and clients while maintaining compliance with legal standards for electronic signatures.

-

How secure is airSlate SignNow when handling WA tax documents?

airSlate SignNow prioritizes the security of your documents, employing encryption and secure cloud storage. This security ensures that your sensitive WA tax information is protected against unauthorized access while remaining easily accessible to authorized users.

Get more for Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report

- Identity theft recovery package north carolina form

- Statutory power of attorney for health care north carolina form

- Revocation power attorney 497317206 form

- Power attorney mental form

- Aging parent package north carolina form

- North carolina revocation form

- Sale of a business package north carolina form

- Nc legal documents 497317211 form

Find out other Forms justia comwashingtonstatewideJustia Wine Shipper To Consumer Summary Tax Report

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract