Portal Ct Gov DRS DRS FormsDRS Forms Ct 2022-2026

Understanding the ct form reg 8

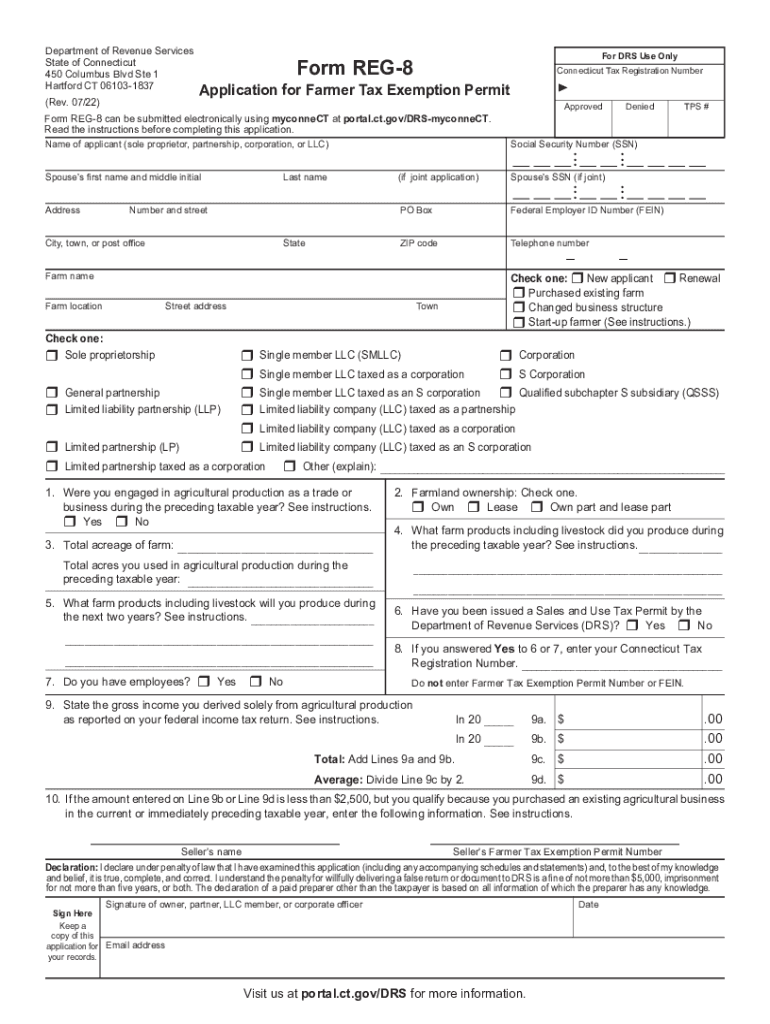

The ct form reg 8 is an essential document used in Connecticut for claiming a tax exemption. This form is specifically designed for farmers and agricultural entities looking to benefit from various tax exemptions available under state law. By completing the reg 8 application, eligible individuals can ensure they are compliant with state regulations while taking advantage of available tax breaks.

Steps to Complete the ct form reg 8

Filling out the ct form reg 8 involves several important steps to ensure accuracy and compliance. Here’s a straightforward approach:

- Gather all necessary information, including your business details and tax identification number.

- Review the eligibility criteria to confirm that you qualify for the reg 8 tax exemption.

- Fill out the form accurately, providing all required details, including the nature of your agricultural activities.

- Sign and date the form, ensuring that all signatures are valid and comply with state requirements.

- Submit the completed form through the appropriate channels, either online or by mail.

Legal Use of the ct form reg 8

The legal validity of the ct form reg 8 is crucial for ensuring that the exemption is recognized by the state. To be considered legally binding, the form must be filled out correctly and submitted in accordance with Connecticut tax laws. This includes adhering to the regulations outlined in the Connecticut General Statutes, which govern tax exemptions for agricultural operations.

Eligibility Criteria for the ct form reg 8

To qualify for the reg 8 tax exemption, applicants must meet specific eligibility criteria. Generally, this includes:

- Being a resident of Connecticut or operating a business within the state.

- Engaging in agricultural activities that meet the state’s definitions and requirements.

- Providing proof of agricultural production, such as receipts or documentation of sales.

Understanding these criteria is essential for a successful application process.

Form Submission Methods

The ct form reg 8 can be submitted through various methods, ensuring flexibility for applicants. Options include:

- Online submission via the Connecticut Department of Revenue Services (DRS) portal, which offers a streamlined process.

- Mailing the completed form to the appropriate DRS office, ensuring it is sent to the correct address.

- In-person submission at designated DRS locations for those who prefer face-to-face interactions.

Key Elements of the ct form reg 8

Understanding the key elements of the ct form reg 8 is vital for successful completion. Important components include:

- Identification of the applicant, including name and address.

- Details of the agricultural operation, such as type of farming and products produced.

- Signature of the applicant, confirming the accuracy of the information provided.

These elements ensure that the form is complete and meets the necessary legal standards.

Quick guide on how to complete portalctgov drs drs formsdrs forms ct

Complete Portal ct gov DRS DRS FormsDRS Forms Ct effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without hindrances. Handle Portal ct gov DRS DRS FormsDRS Forms Ct on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Portal ct gov DRS DRS FormsDRS Forms Ct seamlessly

- Locate Portal ct gov DRS DRS FormsDRS Forms Ct and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Produce your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form—via email, SMS, invitational link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Adjust and eSign Portal ct gov DRS DRS FormsDRS Forms Ct to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov drs drs formsdrs forms ct

Create this form in 5 minutes!

People also ask

-

What is ct form reg 8 and why is it important?

CT Form Reg 8 is a pivotal documentation requirement for businesses in Connecticut for tax compliance. It ensures that all necessary information is correctly reported to the state, minimizing the risk of penalties. Understanding and utilizing ct form reg 8 is crucial for accurate record-keeping and financial reporting.

-

How can airSlate SignNow help with ct form reg 8?

airSlate SignNow facilitates the eSigning and sending of documents like ct form reg 8, making it simpler for businesses to maintain compliance. Our platform allows you to easily upload, sign, and share forms electronically, which enhances efficiency. This streamlines the entire process and helps avoid the hassle of traditional paperwork.

-

What are the pricing options for airSlate SignNow when filling out ct form reg 8?

airSlate SignNow offers flexible pricing plans that cater to different business needs, even for managing ct form reg 8. Our plans are designed to provide value without sacrificing essential features, making it cost-effective for businesses of all sizes. You can choose a plan that best aligns with your budget and requirements.

-

Are there specific features in airSlate SignNow that assist with ct form reg 8?

Yes, airSlate SignNow includes features such as template creation, automated reminders, and secure document storage, all of which are beneficial for managing ct form reg 8. These functionalities ensure that your documents are always accessible and follow up is seamless. Additionally, the platform provides a user-friendly interface to simplify the completion of forms.

-

Can I integrate airSlate SignNow with other software for ct form reg 8?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when dealing with ct form reg 8. Popular integrations include CRM systems and cloud storage services, allowing for a more streamlined document management process. This connectivity maximizes productivity by ensuring all your tools work together smoothly.

-

What are the benefits of using airSlate SignNow for ct form reg 8?

Using airSlate SignNow for ct form reg 8 offers numerous benefits, including time savings and enhanced accuracy. It allows for the seamless sending and signing of documents, reducing the time spent on administrative tasks. Additionally, electronic signatures are legally binding and secure, ensuring that your documents are valid and protected.

-

Is airSlate SignNow secure for handling ct form reg 8?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect sensitive information related to ct form reg 8. Compliance with industry standards ensures that your data is safe from unauthorized access. This reliability means you can confidently use our platform for all your document signing needs.

Get more for Portal ct gov DRS DRS FormsDRS Forms Ct

- Letter from tenant to landlord about sexual harassment florida form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children florida form

- Letter landlord form 497302964

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497302965 form

- Florida landlord rent form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497302967 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497302968 form

- Keep premises clean form

Find out other Portal ct gov DRS DRS FormsDRS Forms Ct

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template