Www Michigan Gov Media4580, Michigan Business Tax Unitary Business Group Combined 2021

What is the Michigan 4580 form?

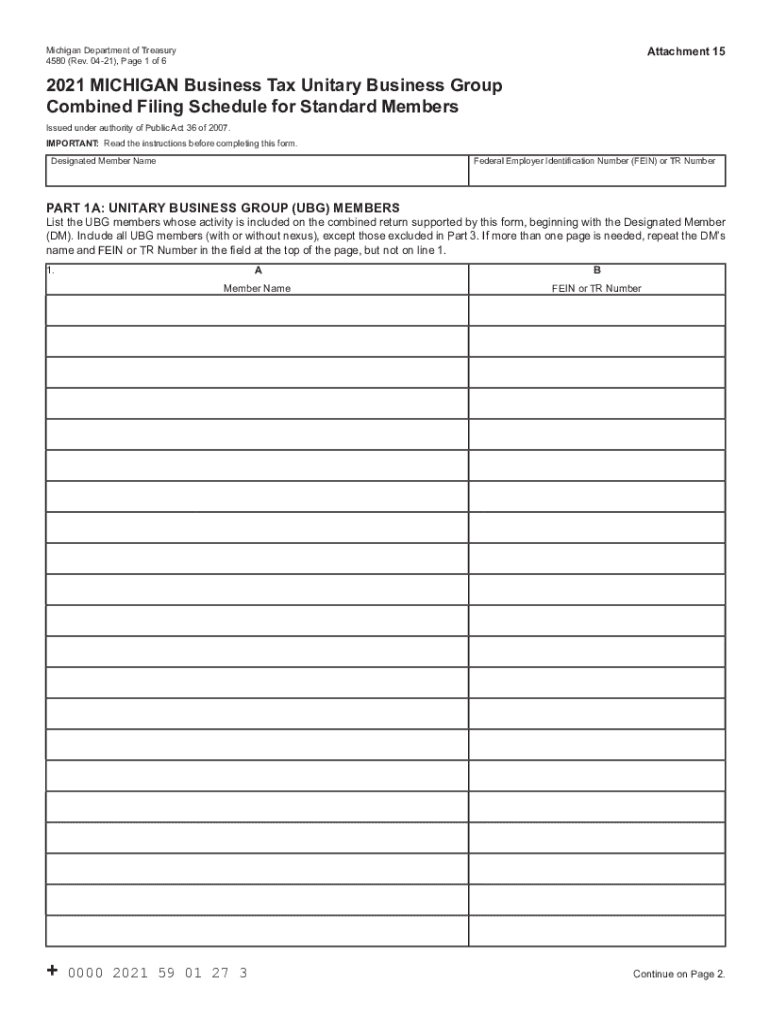

The Michigan 4580 form, also known as the Michigan Business Tax Unitary Business Group Combined form, is a tax document used by businesses operating in Michigan. This form is specifically designed for entities that are part of a unitary business group, allowing them to report their combined business tax liabilities. The Michigan 4580 form consolidates the income and deductions of all members within the group, ensuring a streamlined tax reporting process. It is essential for compliance with state tax regulations and helps in determining the total tax owed by the group as a whole.

Steps to complete the Michigan 4580 form

Completing the Michigan 4580 form involves several key steps to ensure accuracy and compliance with state tax laws. First, gather all necessary financial information from each member of the unitary business group. This includes income statements, expense reports, and any applicable deductions. Next, fill out the form by entering the combined income and deductions for the group. Be sure to follow the specific instructions provided with the form to ensure proper calculations. After completing the form, review it for accuracy before submitting it to the Michigan Department of Treasury.

Key elements of the Michigan 4580 form

The Michigan 4580 form includes several critical components that businesses must accurately complete. These elements typically consist of:

- Entity Information: Details about each member of the unitary business group, including names, addresses, and tax identification numbers.

- Combined Income: The total income generated by all members of the group during the tax year.

- Deductions: Specific deductions that can be claimed by the group, which may include business expenses and credits.

- Tax Calculation: The method used to calculate the total tax owed based on the combined income and allowable deductions.

Filing Deadlines for the Michigan 4580 form

It is crucial for businesses to be aware of the filing deadlines associated with the Michigan 4580 form to avoid penalties. Typically, the form is due on the last day of the month following the end of the tax year. For example, if a business operates on a calendar year, the form must be submitted by January thirty-first of the following year. Businesses should also stay informed about any changes to deadlines that may occur due to state regulations or special circumstances.

Form Submission Methods for the Michigan 4580 form

Businesses can submit the Michigan 4580 form through various methods, providing flexibility in how they choose to file. The available submission methods include:

- Online Submission: Filing electronically through the Michigan Department of Treasury's online portal, which may offer quicker processing times.

- Mail: Sending a completed paper form to the appropriate address provided by the state. Ensure that the form is postmarked by the filing deadline.

- In-Person Submission: Delivering the form directly to a local Michigan Department of Treasury office, which may be beneficial for businesses needing immediate assistance.

Penalties for Non-Compliance with the Michigan 4580 form

Failure to comply with the filing requirements for the Michigan 4580 form can result in significant penalties for businesses. These penalties may include:

- Late Filing Penalties: Businesses may incur fines for submitting the form after the deadline, which can accumulate over time.

- Interest Charges: Any unpaid tax liabilities may accrue interest, increasing the total amount owed to the state.

- Legal Consequences: Continued non-compliance may lead to further legal action by the state, including audits or additional fines.

Quick guide on how to complete wwwmichigangov media4580 michigan business tax unitary business group combined

Complete Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

Steps to edit and electronically sign Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined with ease

- Find Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmichigangov media4580 michigan business tax unitary business group combined

Create this form in 5 minutes!

People also ask

-

What is the 4580 form used for?

The 4580 form is commonly utilized for specific governmental transactions and record-keeping. It serves as an essential document for businesses to ensure compliance with regulations. By effectively managing the 4580 form, organizations can streamline their processes and enhance operational efficiency.

-

How can airSlate SignNow help with the 4580 form?

airSlate SignNow simplifies the process of managing the 4580 form by allowing users to eSign and send documents easily. With airSlate SignNow, businesses can quickly create, share, and track the status of the 4580 form, ensuring a seamless workflow. This digital solution reduces the time and effort traditionally needed for paper-based forms.

-

Is airSlate SignNow cost-effective for handling the 4580 form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using airSlate SignNow to handle the 4580 form, companies can save on costs associated with printing, mailing, and manual processing. The subscription model allows for budgeting and cost control while providing robust features.

-

What features does airSlate SignNow provide for the 4580 form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure e-signatures for the 4580 form. It also offers real-time tracking and notifications, making it easy to manage document statuses. These features help enhance the user experience and streamline the entire signing process.

-

Can I integrate airSlate SignNow with other apps for the 4580 form?

Absolutely! airSlate SignNow supports integration with various applications, allowing users to connect their workflows for the 4580 form seamlessly. These integrations can include CRM systems, cloud storage, and other business tools to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the 4580 form?

Using airSlate SignNow for the 4580 form provides numerous benefits, including increased efficiency, reduced processing time, and enhanced document security. With cloud access and flexible e-signing options, organizations can manage their 4580 forms anytime, anywhere. This adaptability leads to improved collaboration and faster turnaround times.

-

Is airSlate SignNow easy to use for the 4580 form?

Yes, airSlate SignNow is designed to be user-friendly, making it straightforward to manage the 4580 form. Its intuitive interface allows users, regardless of technical expertise, to navigate through the signing and document management process effortlessly. Training resources and customer support further enhance the ease of use.

Get more for Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined

- Buyers home inspection checklist north dakota form

- Sellers information for appraiser provided to buyer north dakota

- Subcontractors agreement north dakota form

- Option to purchase addendum to residential lease lease or rent to own north dakota form

- Prenuptial premarital agreement 497317397 form

- North dakota prenuptial premarital agreement without financial statements north dakota form

- Amendment to prenuptial or premarital agreement north dakota form

- Application form for postgraduate trainees

Find out other Www michigan gov media4580, Michigan Business Tax Unitary Business Group Combined

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure