4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule for Standard Members 2023-2026

Understanding the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

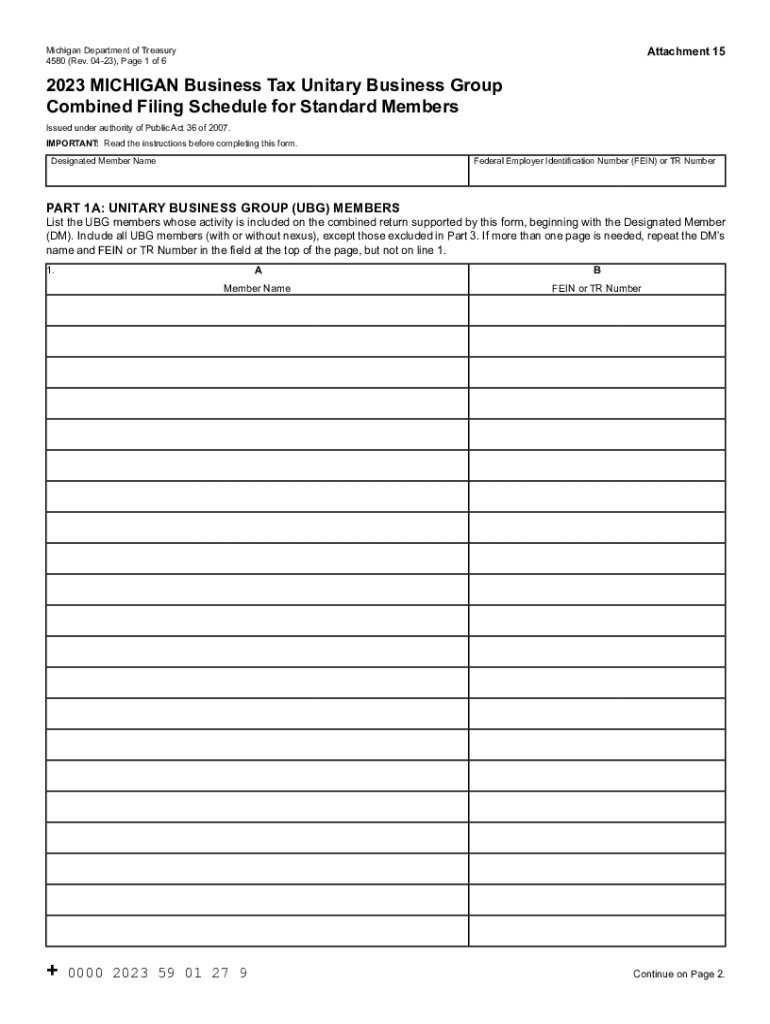

The 4580 form is a critical document used by businesses in Michigan that are part of a unitary business group. This schedule is specifically designed for standard members of such groups to report their business tax obligations. It consolidates the income, deductions, and credits of all members within the unitary business group, allowing for a streamlined filing process. By using this schedule, businesses can ensure compliance with Michigan's tax regulations while potentially optimizing their tax liabilities.

Steps to Complete the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

Completing the 4580 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial data from each member of the unitary business group. This includes income statements, balance sheets, and any relevant deductions or credits. Next, fill out the form by entering the consolidated figures for the group. It is essential to follow the specific instructions provided with the form to avoid errors. Finally, review the completed form for accuracy before submission.

Required Documents for the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

To successfully complete the 4580 form, certain documents are required. These typically include:

- Financial statements for each member of the unitary business group

- Documentation of any deductions or credits being claimed

- Previous tax returns, if applicable

- Any supporting schedules or worksheets that detail the calculations used

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Filing Deadlines for the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

It is crucial for businesses to be aware of the filing deadlines associated with the 4580 form. Typically, the form is due on the last day of the month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the form must be filed by the end of February. Failure to meet these deadlines can result in penalties and interest on any taxes owed.

Legal Use of the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

The 4580 form is legally mandated for businesses that qualify as part of a unitary business group in Michigan. Proper use of this form ensures compliance with state tax laws and regulations. It is important for businesses to understand their legal obligations regarding the filing of this schedule, as incorrect or late submissions can lead to legal repercussions, including fines or audits.

Examples of Using the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

Businesses may encounter various scenarios when using the 4580 form. For example, a manufacturing company with multiple subsidiaries may use the form to report the combined income and expenses of all entities. Another example could involve a retail chain that operates in multiple states but files as a unitary business in Michigan. In both cases, the 4580 form allows for a consolidated view of the business's tax position, simplifying the reporting process and ensuring compliance with state regulations.

Quick guide on how to complete 4580 michigan business tax unitary business group combined filing schedule for standard members 708187354

Effortlessly Prepare 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members with Ease

- Find 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements within a few clicks from any device you prefer. Modify and electronically sign 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4580 michigan business tax unitary business group combined filing schedule for standard members 708187354

Create this form in 5 minutes!

How to create an eSignature for the 4580 michigan business tax unitary business group combined filing schedule for standard members 708187354

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members?

The 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members is a tax form used by businesses in Michigan that are part of a unitary business group. This schedule allows these businesses to file their taxes collectively, simplifying the process and often providing tax benefits for standard members.

-

How can airSlate SignNow assist with filing the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members?

airSlate SignNow offers a user-friendly platform for businesses to eSign and send necessary documents, including the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members. This ensures that you can quickly gather signatures and complete your filing process efficiently.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as customizable templates, audit trails, and cloud storage integrations to help manage your tax documents. These features enhance your ability to handle the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members seamlessly.

-

Is there a pricing plan for using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan comes with access to features that can streamline your preparation and filing of the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members.

-

What are the benefits of using airSlate SignNow for the 4580 form?

Using airSlate SignNow for the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members provides numerous benefits, including increased accuracy in document handling and faster turnaround times for signatures. This can ultimately lead to timely filing and reduced stress during tax season.

-

Can airSlate SignNow integrate with my accounting software?

Absolutely! airSlate SignNow integrates with various accounting software, making it easier to manage tax filings, including the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members. This integration streamlines the process, allowing you to retrieve and send documents directly from your accounting system.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses industry-standard encryption protocols to protect the information shared while preparing the 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members, ensuring that your sensitive tax data remains confidential.

Get more for 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

- Form 202 application for an undergraduate student research nserc crsng gc

- Community involvement work sheet ontario skills passport skills edu gov on form

- Application for renewal of fireworks operator certificate application for renewal of fireworks operator certificate form

- Form 6 changes regarding directors

- Cit 0404 387329421 form

- Urine control log sheets printable form

- Bsf722 agence des services frontaliers du canada cbsa asfc gc form

- Repayment assistance plan application canadaca form

Find out other 4580, Michigan Business Tax Unitary Business Group Combined Filing Schedule For Standard Members

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now