Instructions for Form RP 458 a Application for Alternative Veterans Exemption from Real Property Taxation Revised 1120aInstructi 2022

Understanding Form RP 458 A for Alternative Veterans Exemption

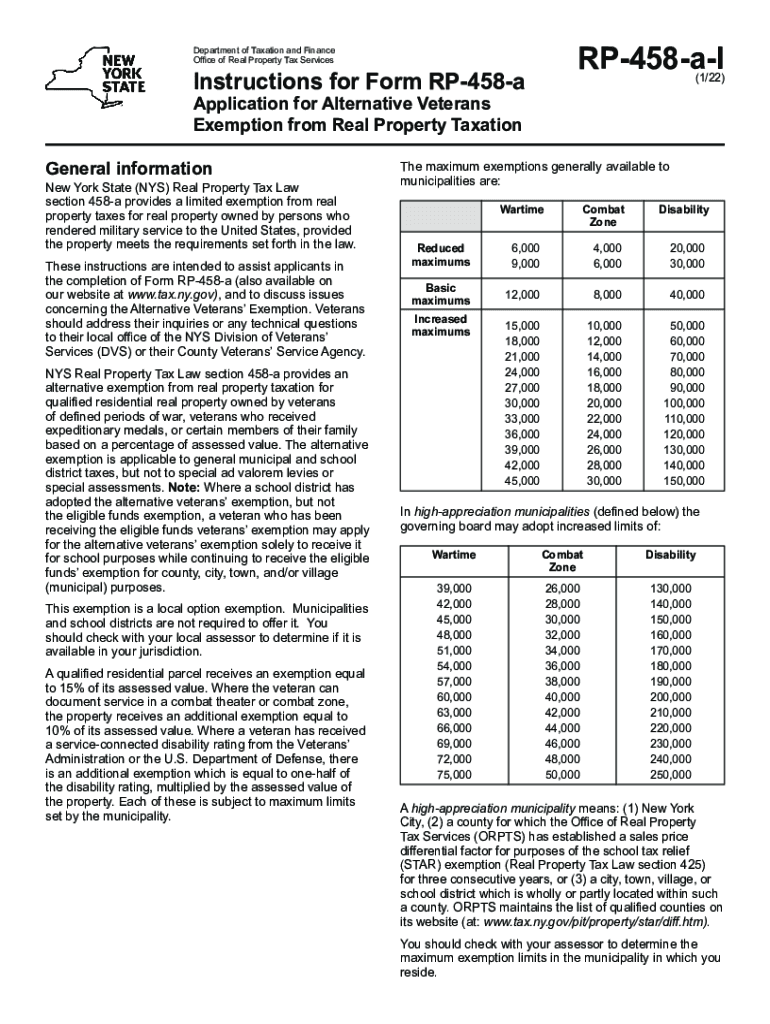

The Instructions for Form RP 458 A provide essential guidance for veterans seeking an exemption from real property taxation in New York. This form is specifically designed for those who qualify under the alternative veterans exemption criteria, allowing eligible individuals to reduce their property tax burden. Understanding the nuances of this form is crucial for proper completion and submission.

Steps to Complete Form RP 458 A

Completing the RP 458 A requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of military service and any relevant discharge papers.

- Fill out the form accurately, ensuring all personal information is correct.

- Provide details regarding your property, including the address and any applicable tax identification numbers.

- Sign and date the form to validate your application.

- Submit the completed form to your local tax assessor's office.

Eligibility Criteria for Form RP 458 A

To qualify for the RP 458 A exemption, applicants must meet specific eligibility requirements. Generally, this includes:

- Being a veteran who served in active duty during a recognized conflict.

- Providing documentation that verifies your military service.

- Owning the property for which the exemption is being requested.

It is essential to review the detailed eligibility criteria outlined in the instructions to ensure compliance.

Required Documents for Submission

When submitting the RP 458 A, certain documents must accompany the form to support your application. These typically include:

- Proof of military service, such as a DD-214 form.

- Identification documents that verify your identity and residency.

- Any additional documentation required by your local tax assessor.

Form Submission Methods

The RP 458 A can be submitted through various methods, including:

- Online submission via your local tax assessor's website, if available.

- Mailing the completed form to the appropriate office.

- In-person delivery to your local tax assessor's office.

Choosing the right submission method can help ensure timely processing of your application.

Legal Use of Form RP 458 A

The legal framework surrounding the RP 458 A is vital for its acceptance. This form must be completed in accordance with state laws governing property tax exemptions for veterans. Understanding these legal requirements ensures that your application is valid and compliant with all necessary regulations.

Quick guide on how to complete instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised

Complete Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a fantastic environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi with ease

- Find Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors requiring you to print new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised

Create this form in 5 minutes!

People also ask

-

What is the rp 458 a and how does it work?

The rp 458 a is a powerful tool offered by airSlate SignNow that allows businesses to easily send and eSign documents. It streamlines the entire signing process, making it not only efficient but also user-friendly. By utilizing the rp 458 a, you can ensure that your documents are signed quickly and securely.

-

What are the key features of the rp 458 a?

The rp 458 a comes with a variety of features designed to meet the needs of any business. Key features include customizable workflows, template creation, and real-time tracking of document status. These functionalities help enhance productivity and simplify the eSigning process.

-

How does pricing for the rp 458 a work?

Pricing for the rp 458 a is structured to be cost-effective, accommodating businesses of all sizes. You can choose from different subscription plans based on your organization's needs and volume of documents processed. This flexibility makes the rp 458 a an appealing choice for budget-conscious companies.

-

What benefits does the rp 458 a offer to businesses?

The rp 458 a provides numerous benefits, including enhanced efficiency, reduced turnaround times for document signing, and improved compliance with regulatory standards. By adopting the rp 458 a, businesses can streamline their workflows and increase overall productivity.

-

Can the rp 458 a integrate with other software tools?

Yes, the rp 458 a is designed to seamlessly integrate with various software tools, including CRMs, management platforms, and cloud storage services. This integration capability allows you to enhance your existing processes and ensure a cohesive workflow across your business applications.

-

Is the rp 458 a secure for sensitive documents?

Absolutely, the rp 458 a prioritizes security and ensures that sensitive documents are protected throughout the signing process. With features like encryption and secure access controls, businesses can confidently use the rp 458 a knowing their information is safe.

-

How user-friendly is the rp 458 a for new users?

The rp 458 a is designed to be intuitive and user-friendly, making it accessible for users of all technical skill levels. The easy navigation and straightforward interfaces allow new users to quickly familiarize themselves with its functionalities, ensuring a smooth adoption.

Get more for Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi

- Freedom school tax matters page form

- North dakota lien 497317483 form

- Quitclaim deed from individual to corporation north dakota form

- Warranty deed from individual to corporation north dakota form

- Nd corporation 497317486 form

- Nd assignment form

- Quitclaim deed from individual to llc north dakota form

- Nd llc 497317490 form

Find out other Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 1120aInstructi

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online