Instructions for Form RP 458 a Application for Alternative Veterans Exemption from Real Property Taxation Revised 824 2024-2026

Understanding the Instructions for Form RP-458-a

The Instructions for Form RP-458-a, which pertains to the Application for Alternative Veterans Exemption from Real Property Taxation, provide essential guidance for veterans seeking tax exemptions on their property. This form is specifically designed to help eligible veterans navigate the process of applying for property tax relief. The exemption aims to acknowledge the sacrifices made by veterans and to alleviate some financial burdens associated with property ownership.

Steps to Complete the Form RP-458-a

Completing the Form RP-458-a involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that verifies your veteran status and any relevant military service records. Next, fill out the form carefully, providing all requested information, including personal details and property information. It is crucial to double-check for any errors before submission. Once completed, you can submit the form to your local tax assessor's office, either by mail or in person, depending on local regulations.

Eligibility Criteria for the Exemption

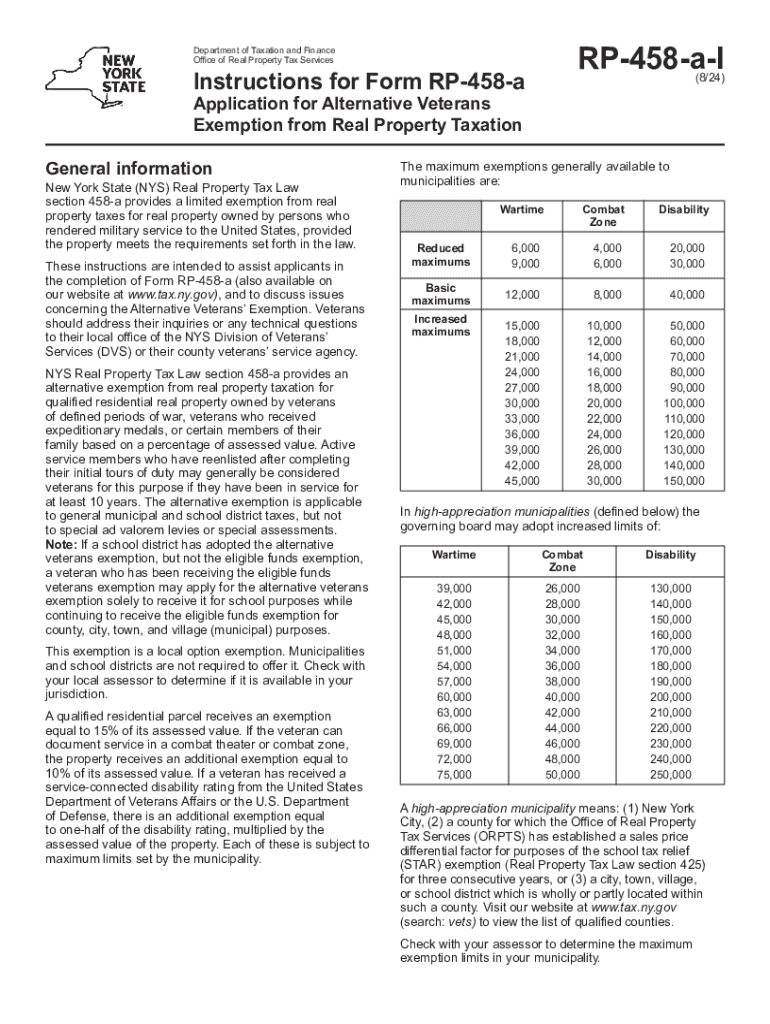

To qualify for the Alternative Veterans Exemption, applicants must meet specific eligibility criteria. Generally, this includes being a veteran who served during a designated period of conflict or having a service-connected disability. Additionally, the property must be the primary residence of the veteran, and the exemption is typically limited to a certain assessed value of the property. It is important to review the specific requirements in your state, as they may vary.

Required Documents for Submission

When applying for the Alternative Veterans Exemption, certain documents are required to support your application. These typically include a copy of your military discharge papers (DD-214), proof of residency, and any documentation that verifies your eligibility for the exemption. Having these documents ready can streamline the application process and reduce the likelihood of delays in approval.

Form Submission Methods

The Form RP-458-a can be submitted through various methods, depending on local regulations. Most commonly, applicants can mail the completed form to their local tax assessor's office. Alternatively, some jurisdictions may allow in-person submissions. It is advisable to check with your local office for specific submission guidelines, including any potential online submission options that may be available.

State-Specific Rules and Variants

Each state may have its own rules and regulations regarding the Alternative Veterans Exemption. It is essential to familiarize yourself with these state-specific guidelines, as they can affect eligibility, application procedures, and deadlines. Additionally, be aware that there may be variants of the RP-458-a form that apply to different circumstances or updates in legislation, so ensure you are using the correct version for your application.

Application Process and Approval Time

The application process for the Alternative Veterans Exemption typically involves submitting the completed Form RP-458-a along with the required documentation to the local tax assessor's office. After submission, the approval time can vary based on the office's workload and the completeness of your application. Generally, applicants can expect to receive a decision within a few weeks, but it is advisable to follow up with the office if there are any delays.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised 824

Create this form in 5 minutes!

How to create an eSignature for the instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised 824

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

The Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824 provide guidance for veterans seeking tax exemptions on their property. This form outlines eligibility criteria, required documentation, and the application process to ensure veterans can benefit from available tax relief.

-

How can airSlate SignNow assist with the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

airSlate SignNow simplifies the process of completing and submitting the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824. Our platform allows users to eSign documents securely and efficiently, ensuring that all necessary forms are submitted correctly and on time.

-

Are there any costs associated with using airSlate SignNow for the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While there may be a fee for premium features, the platform provides a cost-effective solution for managing the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824, making it accessible for all users.

-

What features does airSlate SignNow offer for managing the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking for the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824. These tools streamline the application process, making it easier for veterans to complete their forms accurately.

-

Can I integrate airSlate SignNow with other applications for the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow for the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824. This allows users to connect with CRM systems, cloud storage, and other tools to manage their documents seamlessly.

-

What benefits does airSlate SignNow provide for veterans using the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

Veterans using airSlate SignNow for the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824 can enjoy a user-friendly interface, quick turnaround times, and enhanced security for their documents. This ensures that their applications are processed efficiently and securely.

-

Is there customer support available for questions about the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions regarding the Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824. Our support team is available to help ensure that your experience is smooth and successful.

Get more for Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824

Find out other Instructions For Form RP 458 a Application For Alternative Veterans Exemption From Real Property Taxation Revised 824

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form