STATE of GEORGIA CERTIFICATE of EXEMPTION of LOCAL 2022-2026

Understanding the Georgia Certificate of Exemption of Local Tax

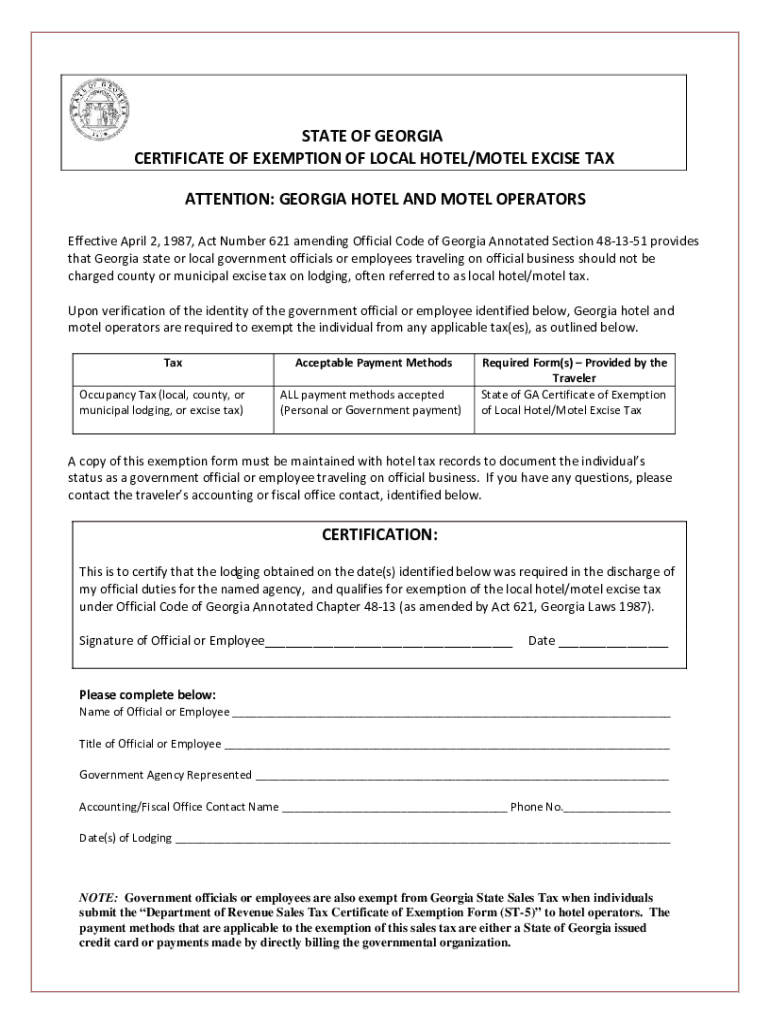

The Georgia Certificate of Exemption of Local Tax is a crucial document that allows eligible entities to claim exemption from local hotel and motel taxes. This certificate is primarily used by organizations that qualify under specific criteria, such as non-profit organizations, government entities, and certain educational institutions. By presenting this certificate, eligible entities can avoid the additional financial burden of local hotel excise taxes when booking accommodations in Georgia.

How to Utilize the Georgia Certificate of Exemption of Local Tax

To effectively use the Georgia Certificate of Exemption of Local Tax, eligible entities must present the certificate to the hotel or motel at the time of check-in or when making a reservation. It is essential to ensure that the certificate is filled out correctly, including the name of the organization, the purpose of the stay, and the signature of an authorized representative. This process helps in confirming the entity's eligibility for tax exemption and ensures compliance with local tax regulations.

Obtaining the Georgia Certificate of Exemption of Local Tax

To obtain the Georgia Certificate of Exemption of Local Tax, eligible organizations must complete the necessary application process. This typically involves filling out the appropriate forms provided by the Georgia Department of Revenue or local tax authorities. Organizations may need to provide documentation that verifies their tax-exempt status, such as IRS determination letters or other relevant certificates. Once the application is approved, the organization will receive the certificate, which can be used for future transactions.

Steps to Complete the Georgia Certificate of Exemption of Local Tax

Completing the Georgia Certificate of Exemption of Local Tax involves several straightforward steps:

- Gather necessary documentation that proves the organization’s tax-exempt status.

- Fill out the certificate form, ensuring all required fields are completed accurately.

- Include the name of the organization, the purpose of the stay, and the signature of an authorized representative.

- Review the completed certificate for accuracy before submission.

- Present the certificate to the hotel or motel when checking in or making a reservation.

Key Elements of the Georgia Certificate of Exemption of Local Tax

The Georgia Certificate of Exemption of Local Tax includes several key elements that are essential for its validity:

- Name of the Organization: The legal name of the entity claiming the exemption.

- Purpose of Stay: A brief description of the reason for the stay, which must align with the exemption criteria.

- Authorized Signature: The signature of an individual authorized to act on behalf of the organization.

- Date of Issue: The date on which the certificate is issued, which may be required for validation.

Eligibility Criteria for the Georgia Certificate of Exemption of Local Tax

Eligibility for the Georgia Certificate of Exemption of Local Tax typically includes the following criteria:

- The organization must be a recognized non-profit entity, government agency, or educational institution.

- The stay must be for official business or activities related to the organization’s exempt purpose.

- Documentation proving the organization's tax-exempt status must be provided upon request.

Penalties for Non-Compliance with the Georgia Certificate of Exemption of Local Tax

Failure to comply with the regulations surrounding the Georgia Certificate of Exemption of Local Tax can result in several penalties. Hotels and motels may be required to collect the tax retroactively if it is determined that the exemption was improperly claimed. Additionally, organizations that misuse the certificate may face fines or other legal consequences. It is crucial for entities to ensure they meet all eligibility criteria and adhere to proper procedures to avoid these penalties.

Quick guide on how to complete state of georgia certificate of exemption of local

Complete STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and electronically sign STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL effortlessly

- Locate STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of georgia certificate of exemption of local

Create this form in 5 minutes!

People also ask

-

What is the Georgia hotel motel tax?

The Georgia hotel motel tax is a tax imposed on the rental of hotel rooms, motels, and similar lodging accommodations within the state of Georgia. This tax is essential for funding local tourism and infrastructure projects. As a business owner in Georgia, it's crucial to understand this tax and how it affects your operations.

-

How is the Georgia hotel motel tax calculated?

The Georgia hotel motel tax is typically calculated as a percentage of the room rate charged to guests. Each county or city may have different rates, so it is vital to verify the specific tax schedule for your location. Accurate tax calculations ensure compliance and prevent unnecessary penalties.

-

How can airSlate SignNow help with Georgia hotel motel tax compliance?

airSlate SignNow streamlines the process of document preparation and eSignature for tax-related forms, including those associated with the Georgia hotel motel tax. By using our platform, businesses can easily manage and track documents, helping ensure compliance with state tax regulations. This efficiency can save time and avoid costly mistakes.

-

Are there any specific features for handling taxes with airSlate SignNow?

Yes, airSlate SignNow offers features specifically designed to assist with tax documentation, including customizable templates for the Georgia hotel motel tax. These features allow you to quickly generate, send, and receive signatures on tax-related documents. With easy access to these tools, businesses can maintain accurate records for tax filing.

-

What benefits does airSlate SignNow provide for tax document management?

Using airSlate SignNow for tax document management offers several benefits, including improved efficiency and reduced processing time. By digitizing the process, businesses can easily organize records related to Georgia hotel motel tax, streamline signature collection, and enhance overall compliance effectiveness. This translates into better resource allocation and reduced administrative burdens.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage and track the Georgia hotel motel tax and other financial documents. These integrations help maintain accurate financial records and ensure that all tax obligations are met without manual data entry errors. This interconnectedness enhances the overall efficiency of your financial management.

-

What is the pricing model for airSlate SignNow?

airSlate SignNow offers a flexible pricing model that accommodates businesses of all sizes, ensuring that you can find a package that aligns with your needs related to Georgia hotel motel tax compliance. There are various tiers available, designed to optimize document management and eSigning at a cost-effective rate. This makes it an excellent investment for businesses looking to simplify their tax documentation processes.

Get more for STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497317526 form

- North dakota landlord 497317527 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497317528 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497317529 form

- Trash violation notice template form

- Letter tenant lease template form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497317532 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497317533 form

Find out other STATE OF GEORGIA CERTIFICATE OF EXEMPTION OF LOCAL

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document