Georgia Hotel Tax Exempt Form 2013

What is the Georgia Hotel Tax Exempt Form

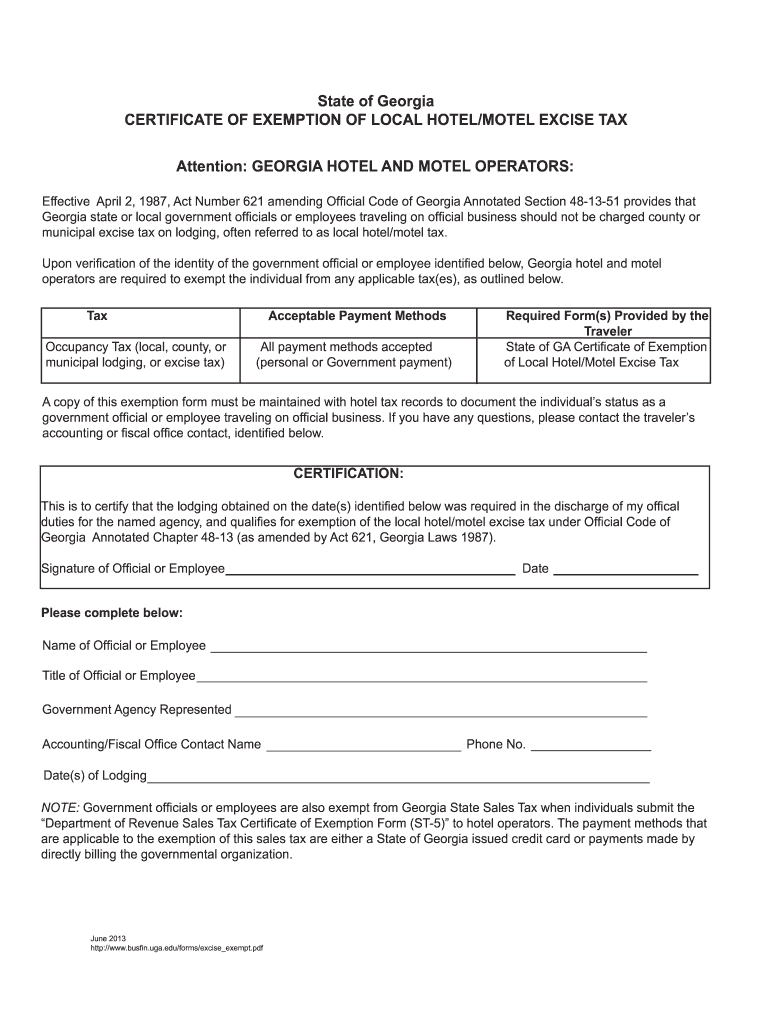

The Georgia Hotel Tax Exempt Form is a document that allows eligible individuals and organizations to claim exemption from local hotel taxes when staying at hotels or motels in Georgia. This form is essential for entities such as government agencies, non-profit organizations, and certain educational institutions that qualify under Georgia tax laws. By submitting this form, travelers can avoid additional lodging costs associated with hotel taxes, which can significantly impact their overall travel expenses.

How to use the Georgia Hotel Tax Exempt Form

To use the Georgia Hotel Tax Exempt Form, individuals must first determine their eligibility based on the criteria set by the state. Once eligibility is confirmed, the form should be completed accurately with the necessary details, including the name of the exempt organization, the purpose of the stay, and the duration of the visit. After filling out the form, it should be presented to the hotel at the time of check-in to ensure that the tax exemption is applied correctly. It is important to keep a copy of the completed form for personal records.

Steps to complete the Georgia Hotel Tax Exempt Form

Completing the Georgia Hotel Tax Exempt Form involves several key steps:

- Obtain the form from a reliable source, such as the Georgia Department of Revenue website or the hotel.

- Fill in the required information, including the name of the exempt organization and the purpose of the stay.

- Specify the dates of the hotel stay and any other relevant details.

- Sign and date the form to certify its accuracy.

- Submit the form to the hotel during check-in to receive the tax exemption.

Legal use of the Georgia Hotel Tax Exempt Form

The legal use of the Georgia Hotel Tax Exempt Form is governed by state tax laws, which outline who qualifies for tax exemption and the proper procedures for claiming it. The form must be filled out truthfully and accurately, as providing false information can lead to penalties. Hotels are required to retain a copy of the form for their records, ensuring compliance with state regulations. Understanding these legalities is crucial for both guests and hotel operators to avoid any issues related to tax compliance.

Eligibility Criteria

Eligibility for using the Georgia Hotel Tax Exempt Form typically includes the following criteria:

- Government agencies, including federal, state, and local entities.

- Non-profit organizations that have been granted tax-exempt status under IRS regulations.

- Educational institutions that are recognized as tax-exempt entities.

- Other specific organizations that meet the criteria set by Georgia tax laws.

It is important for individuals to verify their eligibility before attempting to use the form to ensure compliance with state regulations.

Form Submission Methods

The Georgia Hotel Tax Exempt Form can be submitted in various ways, depending on the hotel’s policies:

- In-person at the hotel during check-in.

- Some hotels may allow submission via email or fax prior to arrival.

It is advisable to check with the hotel in advance to understand their preferred submission method and any specific requirements they may have.

Quick guide on how to complete georgia hotel tax exempt form

Effortlessly Prepare Georgia Hotel Tax Exempt Form on Any Device

Digital document management has gained signNow traction among both businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Georgia Hotel Tax Exempt Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and eSign Georgia Hotel Tax Exempt Form with Ease

- Obtain Georgia Hotel Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only moments and carries the same legal authority as a conventional wet ink signature.

- Review all information and press the Done button to save your modifications.

- Select your preferred method of sharing your form, whether through email, text message (SMS), or an invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Georgia Hotel Tax Exempt Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia hotel tax exempt form

Create this form in 5 minutes!

How to create an eSignature for the georgia hotel tax exempt form

How to make an electronic signature for your Georgia Hotel Tax Exempt Form in the online mode

How to create an eSignature for your Georgia Hotel Tax Exempt Form in Chrome

How to create an eSignature for putting it on the Georgia Hotel Tax Exempt Form in Gmail

How to create an electronic signature for the Georgia Hotel Tax Exempt Form right from your mobile device

How to create an electronic signature for the Georgia Hotel Tax Exempt Form on iOS

How to create an electronic signature for the Georgia Hotel Tax Exempt Form on Android OS

People also ask

-

What is the Georgia tax exempt form for hotels?

The Georgia tax exempt form for hotels is a document that allows qualifying organizations to avoid paying hotel taxes when traveling for business or official purposes. Organizations like government agencies, nonprofit entities, and educational institutions typically utilize this form to claim tax exemptions during their stays.

-

How do I obtain the Georgia tax exempt form for hotels?

You can obtain the Georgia tax exempt form for hotels through the Georgia Department of Revenue's website or directly from the hotel where you are planning to stay. Ensure that the form is filled out correctly to avoid any issues during check-in.

-

Is airSlate SignNow compatible with the Georgia tax exempt form for hotels?

Yes, airSlate SignNow is fully compatible with the Georgia tax exempt form for hotels, allowing you to easily eSign and send the form. Our platform streamlines the process, ensuring your documentation is both secure and compliant.

-

What are the benefits of using airSlate SignNow for the Georgia tax exempt form for hotels?

Using airSlate SignNow for the Georgia tax exempt form for hotels offers several benefits, including faster processing times, reduced paperwork, and enhanced security. Our cloud-based solution allows you to access, sign, and send documents from anywhere, making it ideal for busy professionals.

-

How much does airSlate SignNow cost for managing tax forms like the Georgia tax exempt form for hotels?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, starting with a free trial. For organizations frequently managing documents like the Georgia tax exempt form for hotels, our cost-effective options will help save both time and money.

-

Can I integrate airSlate SignNow with other applications for managing the Georgia tax exempt form for hotels?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRMs and project management tools. This allows you to streamline your workflow when handling important documents like the Georgia tax exempt form for hotels.

-

What features does airSlate SignNow offer for handling the Georgia tax exempt form for hotels?

airSlate SignNow provides features like eSignature, document templates, and audit trails that are essential for handling the Georgia tax exempt form for hotels effectively. Our user-friendly interface makes it easy to manage tax-related documents securely, from anywhere.

Get more for Georgia Hotel Tax Exempt Form

- Recertification packet baltimore regional housing partnership form

- Physical demands information form and wsib

- Community hours form grand erie district school board

- Builder eligibility form

- Nnei contract form 10 0003l 4

- 2016 little mr amp miss bapplicationb cherry blossom festival form

- Sssfvhn form

- Service request form eit llc

Find out other Georgia Hotel Tax Exempt Form

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form