Form CU 7, Virginia Consumers Use Tax Return for Individuals

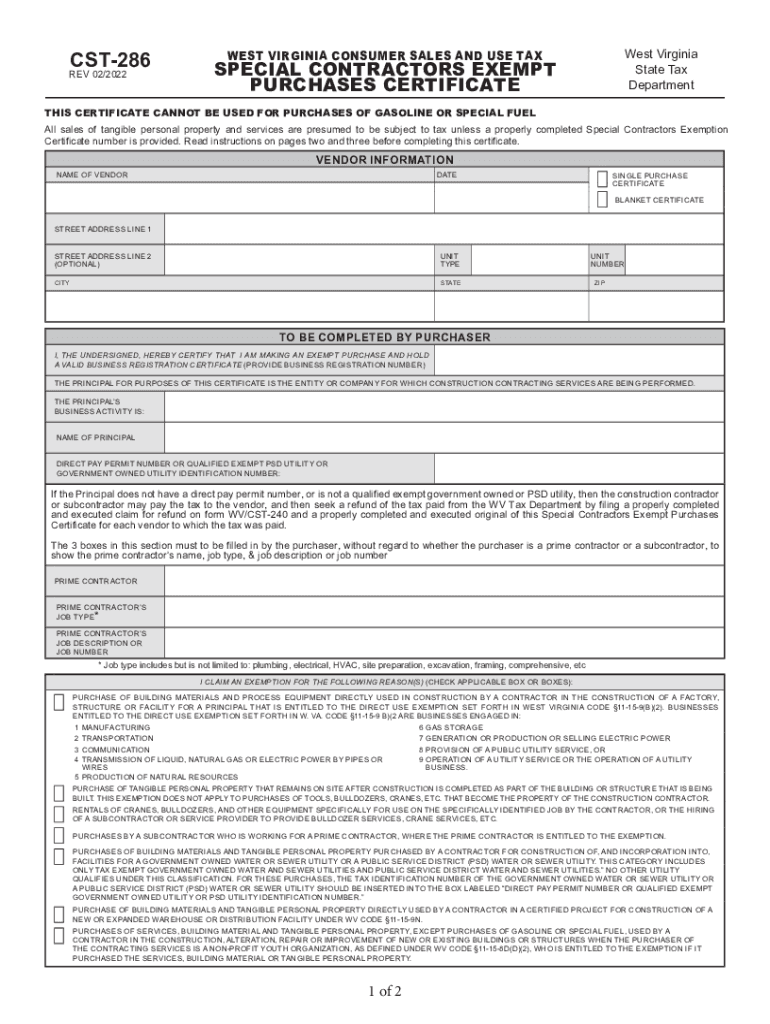

What is the WV Exempt Certificate Form?

The WV exempt certificate form, also known as the CST-286, is a document used in West Virginia to certify that certain purchases are exempt from sales tax. This form is essential for businesses and individuals who qualify for tax-exempt status under specific conditions set by the West Virginia Department of Revenue. The certificate allows eligible purchasers, such as non-profit organizations and government entities, to make purchases without incurring sales tax, thereby reducing overall costs.

How to Use the WV Exempt Certificate Form

To use the WV exempt certificate form, individuals or businesses must first determine their eligibility for tax exemption. Once confirmed, the form should be completed with accurate information, including the purchaser's name, address, and the nature of the exemption. After filling out the form, it must be presented to the seller at the time of purchase. The seller will retain the certificate for their records, ensuring compliance with tax regulations.

Steps to Complete the WV Exempt Certificate Form

Completing the WV exempt certificate form involves several key steps:

- Obtain the CST-286 form from the West Virginia Department of Revenue or authorized sources.

- Fill in the required fields, including the name and address of the purchaser, and specify the reason for the exemption.

- Sign and date the form to certify that the information provided is accurate.

- Present the completed form to the seller during the transaction.

Legal Use of the WV Exempt Certificate Form

The legal use of the WV exempt certificate form is governed by state tax laws. It is crucial for users to ensure that they meet the criteria for tax exemption to avoid potential penalties. Misuse of the form, such as using it for ineligible purchases, can lead to legal repercussions and financial liabilities. Therefore, understanding the legal framework surrounding the use of this certificate is essential for compliance.

Eligibility Criteria for the WV Exempt Certificate Form

Eligibility for the WV exempt certificate form generally includes non-profit organizations, government agencies, and certain educational institutions. Each category has specific guidelines that must be met to qualify for tax exemption. It is important for applicants to review these criteria carefully to ensure they can legitimately claim exemption status when using the CST-286 form.

Form Submission Methods

The WV exempt certificate form can be submitted in various ways, depending on the seller's policies. Typically, the form is presented in person at the time of purchase. Some sellers may also allow electronic submission or faxing of the completed form. It is advisable for purchasers to confirm acceptable submission methods with the seller to ensure compliance and proper processing.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the use of the WV exempt certificate form can result in significant penalties. This may include back taxes owed, interest on unpaid taxes, and potential fines. To mitigate these risks, it is crucial for users to understand their responsibilities and ensure that they only use the form for eligible purchases.

Quick guide on how to complete form cu 7 virginia consumers use tax return for individuals

Set Up Form CU 7, Virginia Consumers Use Tax Return For Individuals effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Form CU 7, Virginia Consumers Use Tax Return For Individuals across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related procedures today.

How to modify and electronically sign Form CU 7, Virginia Consumers Use Tax Return For Individuals without any hassle

- Locate Form CU 7, Virginia Consumers Use Tax Return For Individuals and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign option, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form CU 7, Virginia Consumers Use Tax Return For Individuals and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a WV exempt certificate form?

A WV exempt certificate form is a document used by businesses in West Virginia to claim exemption from sales tax. This form is essential for purchasers who qualify for tax exemptions, allowing them to make tax-free purchases on eligible goods and services. Understanding how to properly fill out a WV exempt certificate form can save you money and ensure compliance with state tax laws.

-

How can airSlate SignNow help with the WV exempt certificate form?

AirSlate SignNow provides an intuitive platform for businesses to complete and eSign the WV exempt certificate form efficiently. With our easy-to-use interface, you can quickly fill out the necessary information and get your form signed by relevant parties. This streamlines the process, reduces paperwork, and enhances your operational efficiency.

-

Is there a cost associated with using the WV exempt certificate form on airSlate SignNow?

While the WV exempt certificate form itself is typically free to download, using airSlate SignNow may involve subscription fees depending on the features you need. Our pricing is designed to be cost-effective, catering to businesses of all sizes. Check out our pricing page for details on plans that suit your needs.

-

What features does airSlate SignNow offer for the WV exempt certificate form?

AirSlate SignNow offers several features to optimize the use of the WV exempt certificate form, including electronic signatures, document tracking, and customizable templates. These tools allow for a seamless experience when preparing and sending your forms. Plus, you can securely store and access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for the WV exempt certificate form?

Yes, airSlate SignNow offers a variety of integrations with popular software applications to enhance your workflow for the WV exempt certificate form. Integrate with platforms like Google Drive, Salesforce, and Dropbox to easily manage and access your documents. These integrations foster a smoother business operation by consolidating your processes.

-

What are the benefits of using airSlate SignNow for the WV exempt certificate form?

Using airSlate SignNow for the WV exempt certificate form delivers signNow benefits such as improved efficiency and enhanced compliance. By automating the signing and submission process, you minimize errors and save time. Additionally, keeping a digital record of your forms ensures that you maintain necessary documentation for taxation purposes.

-

Is it secure to eSign the WV exempt certificate form through airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your data when eSigning the WV exempt certificate form. With features like encryption and secure access, you can trust that your information remains confidential and safe. We take security seriously to support your business's needs.

Get more for Form CU 7, Virginia Consumers Use Tax Return For Individuals

- Residential rental lease application north dakota form

- Salary verification form for potential lease north dakota

- North dakota tenant 497317625 form

- Notice of default on residential lease north dakota form

- Landlord tenant lease co signer agreement north dakota form

- Application for sublease north dakota form

- Inventory and condition of leased premises for pre lease and post lease north dakota form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out north dakota form

Find out other Form CU 7, Virginia Consumers Use Tax Return For Individuals

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later