Dor Sc Govforms SiteFormsDEPARTMENT of REVENUE SC4506 REQUEST for COPY of TAX RETURN 2022-2026

What is the SC4506 request for copy of tax return?

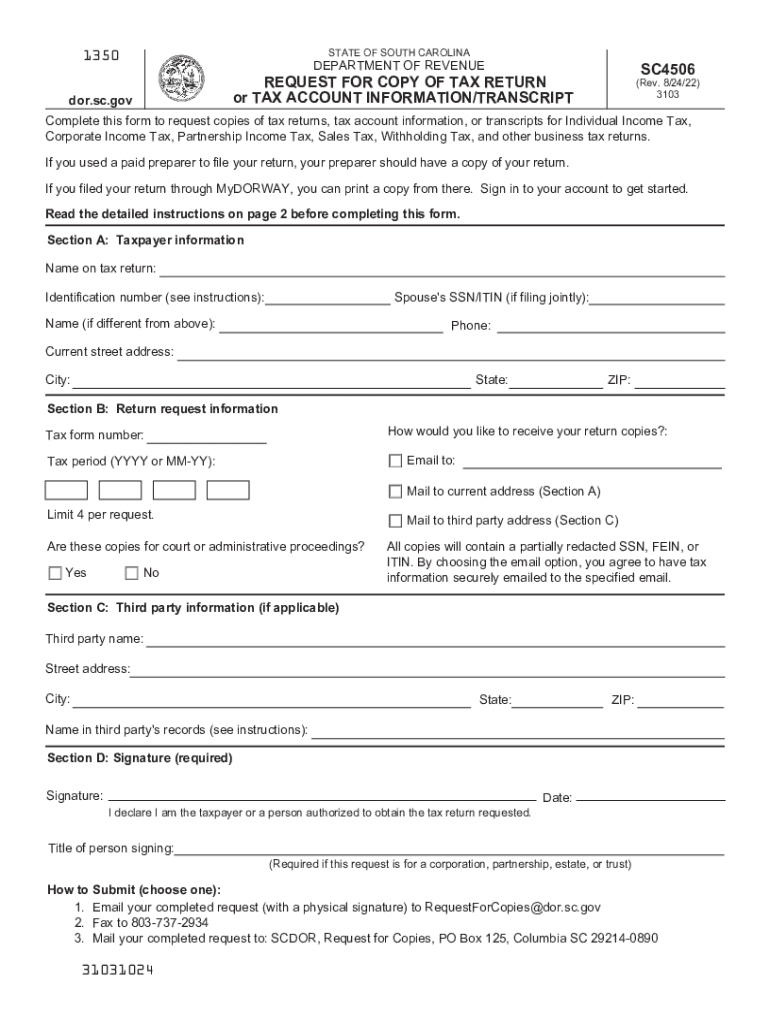

The SC4506 form is a request for a copy of your tax return from the South Carolina Department of Revenue. This form is essential for individuals who need to obtain past tax documents for various reasons, such as applying for loans, verifying income, or resolving tax issues. By submitting the SC4506 request, taxpayers can access copies of their filed tax returns, which may include important information such as income, deductions, and credits claimed in previous years.

Steps to complete the SC4506 request for copy of tax return

Completing the SC4506 request involves several straightforward steps:

- Download the SC4506 form from the South Carolina Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax years for which you are requesting copies of your returns.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form via mail or in person to the appropriate address listed on the form.

Legal use of the SC4506 request for copy of tax return

The SC4506 form is legally recognized as a valid request for tax documents. When properly completed and submitted, it allows taxpayers to obtain copies of their tax returns in compliance with state regulations. It is important to ensure that the form is filled out accurately to avoid delays or rejections. Additionally, the information obtained through the SC4506 request can be used in legal matters or financial applications, making it a crucial document for many individuals.

Required documents for the SC4506 request

When submitting the SC4506 request, you may need to provide certain documents to verify your identity and support your request. These may include:

- A valid form of identification, such as a driver's license or state ID.

- Proof of address, which can be a utility bill or bank statement.

- Any additional documentation requested by the South Carolina Department of Revenue.

Form submission methods for the SC4506 request

The SC4506 request can be submitted through various methods, ensuring flexibility for taxpayers. You can choose to:

- Mail the completed form to the address specified on the SC4506.

- Deliver the form in person to a local Department of Revenue office.

Submitting the form online is not currently an option, so ensure that you choose a method that suits your needs and timeline.

Eligibility criteria for the SC4506 request

To be eligible to submit the SC4506 request, you must be the taxpayer or an authorized representative. This means you should have filed the tax returns for which you are requesting copies. If you are requesting copies on behalf of someone else, you will need to provide documentation that grants you the authority to do so, such as a power of attorney.

Quick guide on how to complete dorscgovforms siteformsdepartment of revenue sc4506 request for copy of tax return

Effortlessly Prepare Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents promptly without complications. Manage Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN on any device using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to Alter and eSign Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN with Ease

- Obtain Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight key sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorscgovforms siteformsdepartment of revenue sc4506 request for copy of tax return

Create this form in 5 minutes!

People also ask

-

What is you sc4506 and how does it relate to airSlate SignNow?

You sc4506 refers to a feature within airSlate SignNow that supports secure electronic signatures. This functionality ensures that your documents are signed quickly and securely, which enhances your workflow efficiency.

-

How much does the you sc4506 feature cost on airSlate SignNow?

The you sc4506 feature is included in our competitive pricing plans. By choosing airSlate SignNow, you gain access to this feature without hidden fees, making it a cost-effective solution for managing your document signing needs.

-

What are the key benefits of using you sc4506 with airSlate SignNow?

Using you sc4506 with airSlate SignNow streamlines the signing process, saving you time and resources. It also enhances document security, ensures compliance, and allows for easy tracking of signature status.

-

Can you integrate you sc4506 with other software tools?

Yes, you can seamlessly integrate you sc4506 with various popular software solutions such as CRM and project management tools. This integration boosts productivity by allowing you to manage documents across platforms easily.

-

Is the you sc4506 feature user-friendly for non-technical users?

Absolutely! You sc4506 is designed with a user-friendly interface that enables anyone to navigate and use the airSlate SignNow platform, regardless of their technical skills. Training resources and customer support are also readily available.

-

How secure is the you sc4506 feature for document signing?

The you sc4506 feature employs advanced security measures to protect your signed documents, including encryption and secure cloud storage. This ensures your sensitive information remains confidential and secure.

-

What types of documents can I sign using you sc4506?

You sc4506 allows you to sign a wide range of document types, including contracts, agreements, and forms. Whether you're in real estate, legal, or any other business, you can effectively manage your documents with airSlate SignNow.

Get more for Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN

- Correction statement and agreement north dakota form

- Closing statement north dakota form

- Flood zone statement and authorization north dakota form

- Name affidavit of buyer north dakota form

- Name affidavit of seller north dakota form

- Non foreign affidavit under irc 1445 north dakota form

- Owners or sellers affidavit of no liens north dakota form

- North dakota affidavit form

Find out other Dor sc govforms siteFormsDEPARTMENT OF REVENUE SC4506 REQUEST FOR COPY OF TAX RETURN

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP