T1036 2021

What is the T1036?

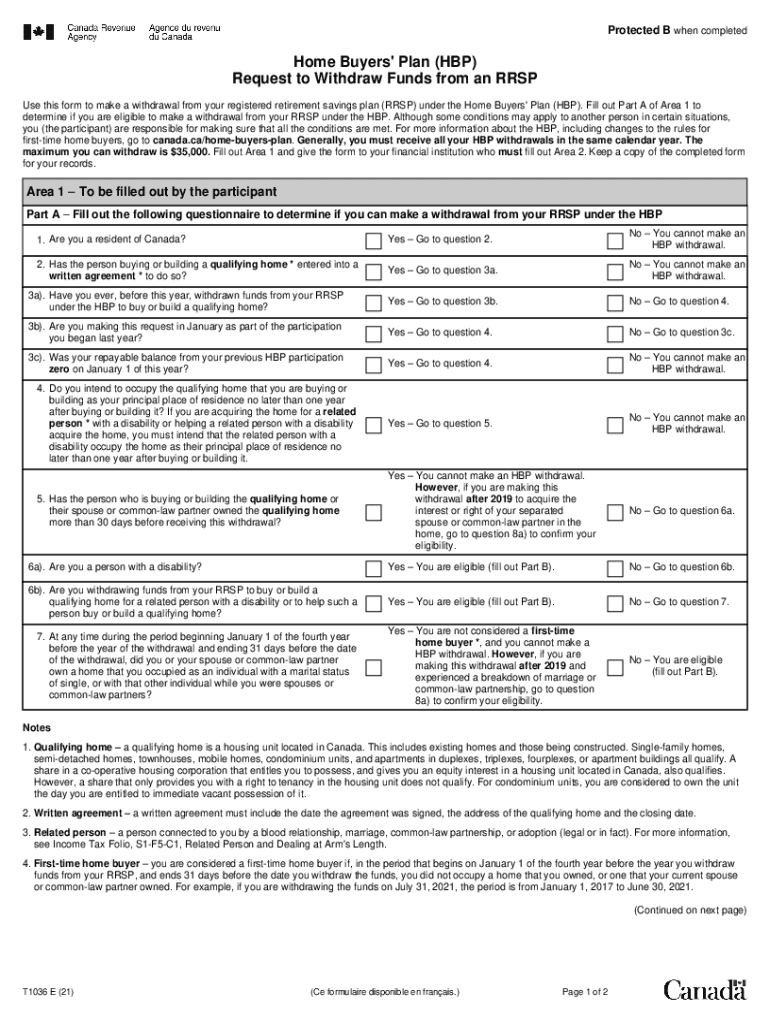

The T1036 form, also known as the T1036 RRSP form, is a document used in Canada for the Home Buyers' Plan (HBP). This plan allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to purchase or build a qualifying home. The T1036 form is essential for those looking to take advantage of this program, as it outlines the necessary information and conditions for the withdrawal.

How to use the T1036

To utilize the T1036 form, applicants must complete the document accurately, ensuring that all required information is provided. The form requires personal details, including the applicant's name, address, and RRSP account information. Once filled out, the form must be submitted to the RRSP issuer to initiate the withdrawal process. It is important to keep a copy of the completed form for personal records and future reference.

Steps to complete the T1036

Completing the T1036 form involves several key steps:

- Gather necessary information, including your RRSP account details and personal identification.

- Fill out the T1036 form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your RRSP issuer, either online or via mail.

Legal use of the T1036

The T1036 form is legally recognized as a valid method for withdrawing funds from an RRSP under the Home Buyers' Plan. To ensure compliance with Canadian tax laws, it is crucial to complete the form correctly and adhere to the guidelines set forth by the Canada Revenue Agency (CRA). This includes understanding repayment obligations and timelines associated with the withdrawal.

Eligibility Criteria

To qualify for the Home Buyers' Plan using the T1036 form, applicants must meet specific eligibility criteria. These include:

- Being a first-time home buyer or having not owned a home in the past five years.

- Intending to use the withdrawn funds to purchase or build a qualifying home.

- Having a valid RRSP account from which to withdraw funds.

Required Documents

When completing the T1036 form, applicants may need to provide supporting documentation. This can include:

- Proof of RRSP account ownership and balance.

- Identification documents, such as a driver's license or social security number.

- Any additional paperwork that verifies the purchase or construction of the home.

Quick guide on how to complete t1036

Complete T1036 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any holdups. Manage T1036 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign T1036 with ease

- Obtain T1036 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign T1036 and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1036

Create this form in 5 minutes!

How to create an eSignature for the t1036

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1036 form?

The t1036 form is a tax document used in Canada for the purpose of applying for the Canada Employment Credit. It is essential for employees to file this form accurately to ensure that they receive the appropriate tax benefits. By utilizing airSlate SignNow, you can easily prepare and eSign your t1036 form, ensuring a smooth filing process.

-

How can airSlate SignNow help with the t1036 form?

With airSlate SignNow, you can streamline the process of completing the t1036 form. Our platform allows you to fill out the form digitally, eSign it, and send it directly to the appropriate tax authority. This simplifies the task and reduces the risk of errors in your submission.

-

Is there a cost associated with using airSlate SignNow for the t1036 form?

Yes, there is a subscription cost for using airSlate SignNow, but we offer various pricing plans to fit different business needs. Given the efficiency and time savings gained by using our service for the t1036 form, many users find that it is a cost-effective solution for managing their documents.

-

What are the key features of airSlate SignNow for handling the t1036 form?

airSlate SignNow includes features such as easy document editing, templates for the t1036 form, and secure eSigning capabilities. Our user-friendly interface allows you to navigate through the form seamlessly, while robust security measures protect your sensitive information during the signing process.

-

Can I integrate airSlate SignNow with other applications for the t1036 form?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Microsoft Office, and CRM systems. This enables you to manage your t1036 form and other documents within the ecosystem of tools you are already using, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the t1036 form?

Using airSlate SignNow for the t1036 form offers several benefits, including time savings, reduced paperwork, and increased accuracy. The ability to eSign allows for quicker transactions and eliminates the need for physical documents, supporting a more efficient workflow.

-

Is airSlate SignNow compliant with legal requirements for the t1036 form?

Absolutely, airSlate SignNow is compliant with all legal requirements pertaining to electronic signatures and document handling, including those for the t1036 form. Our platform adheres to industry standards to ensure that your documents are legally binding and secure.

Get more for T1036

- Excavator contract for contractor indiana form

- Renovation contract for contractor indiana form

- Concrete mason contract for contractor indiana form

- Demolition contract for contractor indiana form

- Framing contract for contractor indiana form

- Security contract for contractor indiana form

- Insulation contract for contractor indiana form

- Paving contract for contractor indiana form

Find out other T1036

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online