Ct Form Os 114 Online Filing 2004

What is the Ct Form Os 114 Online Filing

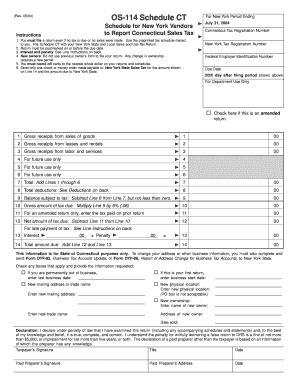

The Ct Form Os 114 is a crucial document used for reporting and filing specific information with the state of Connecticut. This form is primarily utilized by businesses and individuals to comply with state regulations. The online filing option provides a convenient way to complete and submit the form digitally, streamlining the process and reducing the need for physical paperwork. By using the online platform, users can ensure that their submissions are timely and accurately processed.

Steps to Complete the Ct Form Os 114 Online Filing

Completing the Ct Form Os 114 online involves a series of straightforward steps:

- Access the online filing platform designated for the Ct Form Os 114.

- Enter the required personal and business information accurately.

- Provide any necessary financial details or data specific to the filing requirements.

- Review the information entered to ensure accuracy and completeness.

- Submit the form electronically, ensuring that you receive a confirmation of submission.

Following these steps will help ensure that your filing is successful and compliant with state regulations.

Legal Use of the Ct Form Os 114 Online Filing

The legal validity of the Ct Form Os 114 when filed online is supported by compliance with various electronic signature laws. In the United States, eSignatures are recognized as legally binding under the ESIGN Act and UETA, provided that certain conditions are met. This means that when you complete the form online using a compliant platform, it holds the same legal weight as a traditional paper filing. It is essential to ensure that the platform used for filing maintains compliance with these legal frameworks to protect the integrity of your submission.

Key Elements of the Ct Form Os 114 Online Filing

When preparing to complete the Ct Form Os 114, it is important to be aware of the key elements that must be included:

- Personal Information: This includes the name, address, and contact details of the individual or business filing the form.

- Financial Data: Accurate reporting of income, expenses, and other relevant financial information is critical.

- Signature: An electronic signature is required to validate the submission, confirming that the information provided is accurate and complete.

- Submission Date: The date of submission is essential for compliance with filing deadlines.

Ensuring that these elements are accurately filled out will facilitate a smooth filing process.

Form Submission Methods for the Ct Form Os 114

The Ct Form Os 114 can be submitted through various methods, providing flexibility for users:

- Online Filing: The most efficient method, allowing for immediate processing and confirmation.

- Mail: Users can print the completed form and send it via postal service, though this may result in longer processing times.

- In-Person Submission: Some individuals may choose to deliver the form directly to the appropriate state office.

Choosing the right submission method depends on personal preference and urgency.

Filing Deadlines for the Ct Form Os 114

Timely filing of the Ct Form Os 114 is essential to avoid penalties and ensure compliance with state regulations. The specific deadlines can vary based on the type of filing and the fiscal year. Generally, it is advisable to submit the form well in advance of the due date to allow for any potential issues. Checking the official state guidelines for the most current deadlines is recommended to ensure compliance.

Required Documents for the Ct Form Os 114

To successfully complete the Ct Form Os 114, certain documents may be required. These typically include:

- Identification: A valid form of identification for the individual or business filing.

- Financial Records: Documentation supporting the financial information reported on the form.

- Previous Filings: If applicable, copies of previous forms filed may be necessary for reference.

Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is provided.

Quick guide on how to complete ct form os 114 online filing

Complete Ct Form Os 114 Online Filing effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to discover the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ct Form Os 114 Online Filing on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Ct Form Os 114 Online Filing with ease

- Locate Ct Form Os 114 Online Filing and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then hit the Done button to save your alterations.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ct Form Os 114 Online Filing and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct form os 114 online filing

Create this form in 5 minutes!

People also ask

-

What is the CT Form OS 114 online filing process?

The CT Form OS 114 online filing process allows businesses to electronically submit their project filings with the Connecticut Department of Consumer Protection. With airSlate SignNow, this process is streamlined and efficient, enabling you to complete and eSign documents in a matter of minutes. This method not only saves time but also ensures compliance with state regulations.

-

How much does it cost to file the CT Form OS 114 online?

Using airSlate SignNow for CT Form OS 114 online filing is a cost-effective solution for businesses. Our pricing plans are designed to fit various budget needs, with options for individual users and teams. By choosing our platform, you invest in a service that simplifies document management while keeping costs manageable.

-

What features does airSlate SignNow offer for CT Form OS 114 online filing?

airSlate SignNow provides a range of features designed specifically for CT Form OS 114 online filing, including customizable templates, easy eSigning, and secure document storage. You can track the status of your filings and receive real-time notifications, making the process transparent and straightforward. These features help ensure that your documents are filed promptly and accurately.

-

What are the benefits of using airSlate SignNow for CT Form OS 114 online filing?

Using airSlate SignNow for CT Form OS 114 online filing streamlines the entire process, reducing time and paperwork. Our platform enhances collaboration by allowing multiple users to review and sign documents simultaneously. Additionally, the security features ensure that your sensitive information remains protected throughout the filing process.

-

Is airSlate SignNow compliant with state regulations for CT Form OS 114 filing?

Yes, airSlate SignNow is fully compliant with all state regulations regarding CT Form OS 114 online filing. Our platform is regularly updated to meet legal standards, ensuring that your filings are submitted correctly. This compliance gives you peace of mind knowing that you are using a trusted solution.

-

Can I integrate airSlate SignNow with other tools for CT Form OS 114 online filing?

Absolutely! airSlate SignNow offers various integrations with popular tools and platforms, enhancing your workflow for CT Form OS 114 online filing. Whether you're using productivity software or financial systems, our integrations enable seamless data exchange, making your document management processes more efficient.

-

How does airSlate SignNow support collaboration during the CT Form OS 114 online filing?

airSlate SignNow facilitates collaboration during the CT Form OS 114 online filing process by allowing multiple users to access, review, and sign documents in real-time. You can assign roles and permissions to ensure that everyone involved can contribute as needed without compromising security. This collaborative approach enhances efficiency and accuracy.

Get more for Ct Form Os 114 Online Filing

Find out other Ct Form Os 114 Online Filing

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application