Form ST 810 11908 OS 114 Schedule CT Schedule for New York 2008-2026

What is the Form ST8 OS 114 Schedule CT Schedule For New York

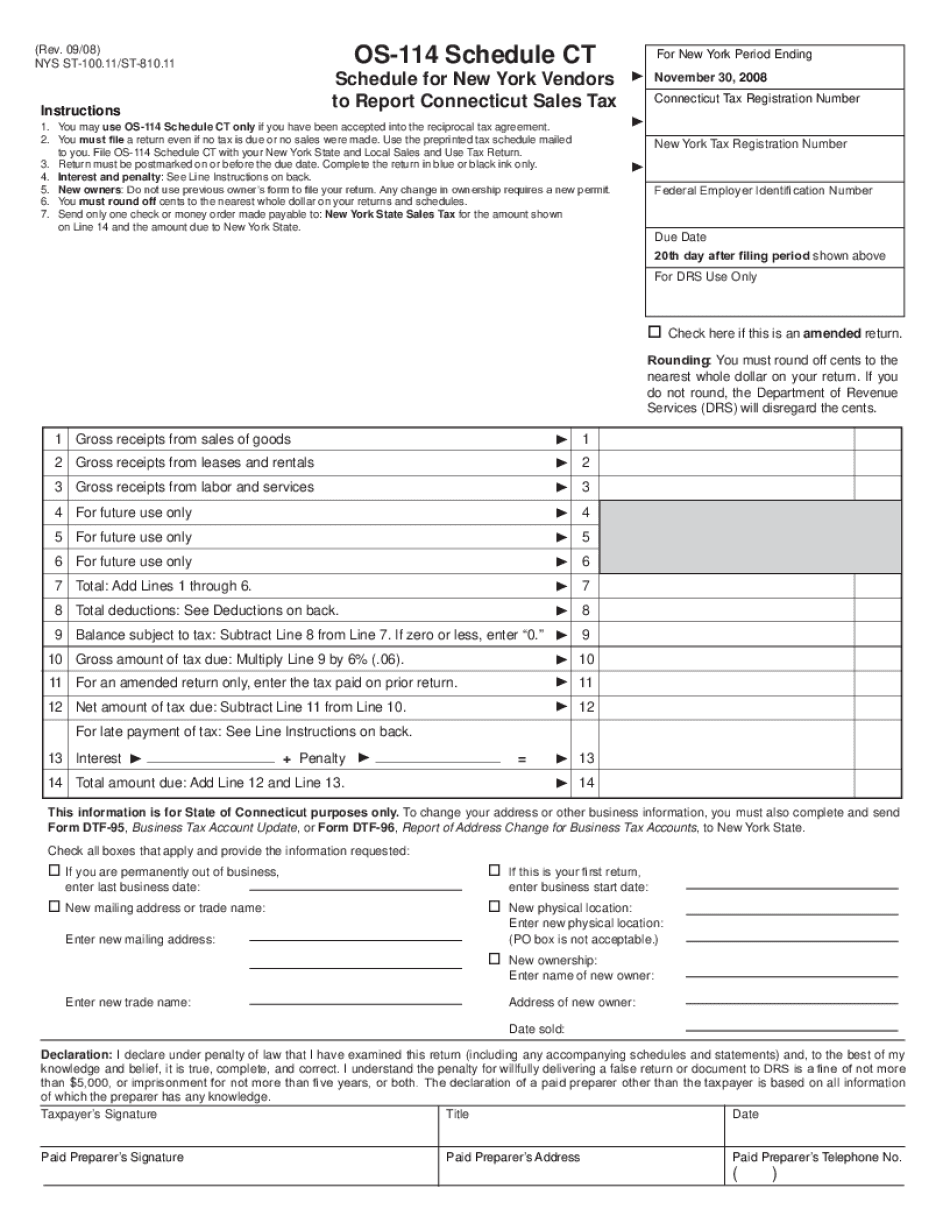

The Form ST8 OS 114 Schedule CT Schedule for New York is a specific tax form used by businesses and individuals to report certain tax-related information to the state. This form is primarily associated with the collection of sales and use taxes, which are essential for state revenue. It is crucial for ensuring compliance with New York tax laws and regulations.

How to use the Form ST8 OS 114 Schedule CT Schedule For New York

To utilize the Form ST8 OS 114 Schedule CT Schedule, individuals or businesses must first gather all necessary information related to their sales and use tax obligations. This includes details about taxable sales, exemptions, and any applicable deductions. Once the information is compiled, the form can be filled out electronically or by hand, ensuring that all sections are completed accurately to avoid delays or penalties.

Steps to complete the Form ST8 OS 114 Schedule CT Schedule For New York

Completing the Form ST8 OS 114 Schedule CT Schedule involves several key steps:

- Gather all relevant financial documents, including sales records and receipts.

- Access the form through the New York State Department of Taxation and Finance website or other authorized sources.

- Fill out the required sections, ensuring that all figures are accurate and reflect your tax obligations.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, which may include online filing, mailing, or in-person delivery.

Legal use of the Form ST8 OS 114 Schedule CT Schedule For New York

The legal use of the Form ST8 OS 114 Schedule CT Schedule is governed by New York state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Additionally, any signatures or electronic submissions must comply with state regulations to ensure that the form is legally binding.

Key elements of the Form ST8 OS 114 Schedule CT Schedule For New York

Key elements of the Form ST8 OS 114 Schedule CT Schedule include:

- Identification of the taxpayer, including name and address.

- Details of taxable sales and any exemptions claimed.

- Calculation of total tax due based on reported figures.

- Signature of the taxpayer or authorized representative to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST8 OS 114 Schedule CT Schedule are typically set by the New York State Department of Taxation and Finance. It is important to be aware of these dates to avoid late fees or penalties. Generally, forms must be submitted quarterly or annually, depending on the taxpayer's specific circumstances.

Quick guide on how to complete form st 81011908 os 114 schedule ct schedule for new york

Complete Form ST 810 11908 OS 114 Schedule CT Schedule For New York effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Form ST 810 11908 OS 114 Schedule CT Schedule For New York on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form ST 810 11908 OS 114 Schedule CT Schedule For New York without hassle

- Locate Form ST 810 11908 OS 114 Schedule CT Schedule For New York and then click Get Form to begin.

- Utilize the tools offered to fill out your form.

- Emphasize important sections of the documents or redact sensitive data with tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information carefully and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Form ST 810 11908 OS 114 Schedule CT Schedule For New York to maintain seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 81011908 os 114 schedule ct schedule for new york

Create this form in 5 minutes!

People also ask

-

What is Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

Form ST 810 11908 OS 114 Schedule CT Schedule For New York is a tax exemption certificate used by businesses to claim exemptions on certain sales and use taxes in New York. This form is essential for ensuring compliance with state tax regulations while maximizing savings on purchases.

-

How can airSlate SignNow help with Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

airSlate SignNow simplifies the process of filling out and signing Form ST 810 11908 OS 114 Schedule CT Schedule For New York by providing an intuitive platform for easy eSigning. Businesses can quickly send the form for signatures and manage their documents electronically, ensuring a smoother process.

-

What are the pricing plans for using airSlate SignNow for Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a suitable plan that provides access to essential features for managing documents like Form ST 810 11908 OS 114 Schedule CT Schedule For New York.

-

Are there features specifically designed for handling Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

Yes, airSlate SignNow includes features such as templates, reminders, and real-time tracking to streamline the management of Form ST 810 11908 OS 114 Schedule CT Schedule For New York. These tools help ensure that your documents are completed correctly and efficiently.

-

What benefits can businesses expect from using airSlate SignNow for tax forms like Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

Using airSlate SignNow for documents such as Form ST 810 11908 OS 114 Schedule CT Schedule For New York can save time and reduce errors. The electronic signing process is faster than traditional methods, and automated workflows ensure that the forms are processed promptly.

-

Can airSlate SignNow integrate with other platforms to manage Form ST 810 11908 OS 114 Schedule CT Schedule For New York?

Yes! airSlate SignNow integrates seamlessly with various business applications, making it easy to incorporate Form ST 810 11908 OS 114 Schedule CT Schedule For New York into your existing workflow. This integration helps facilitate document management across multiple platforms.

-

Is it easy to send Form ST 810 11908 OS 114 Schedule CT Schedule For New York for signature via airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that makes sending Form ST 810 11908 OS 114 Schedule CT Schedule For New York for signature a breeze. You can invite signers via email and track the status of the document in real-time.

Get more for Form ST 810 11908 OS 114 Schedule CT Schedule For New York

- Absolute divorce nc form

- Financial affidavit form

- North carolina option 497317028 form

- North carolina divorce sample form

- Verification north carolina form

- Assignment of lease and rent from borrower to lender north carolina form

- Assignment of lease from lessor with notice of assignment north carolina form

- Letter from landlord to tenant as notice of abandoned personal property north carolina form

Find out other Form ST 810 11908 OS 114 Schedule CT Schedule For New York

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document