Instructions for Form MT 903 Highway Use Tax Return Revised 122 2022-2026

Understanding the Highway Use Tax Return (Form MT 903)

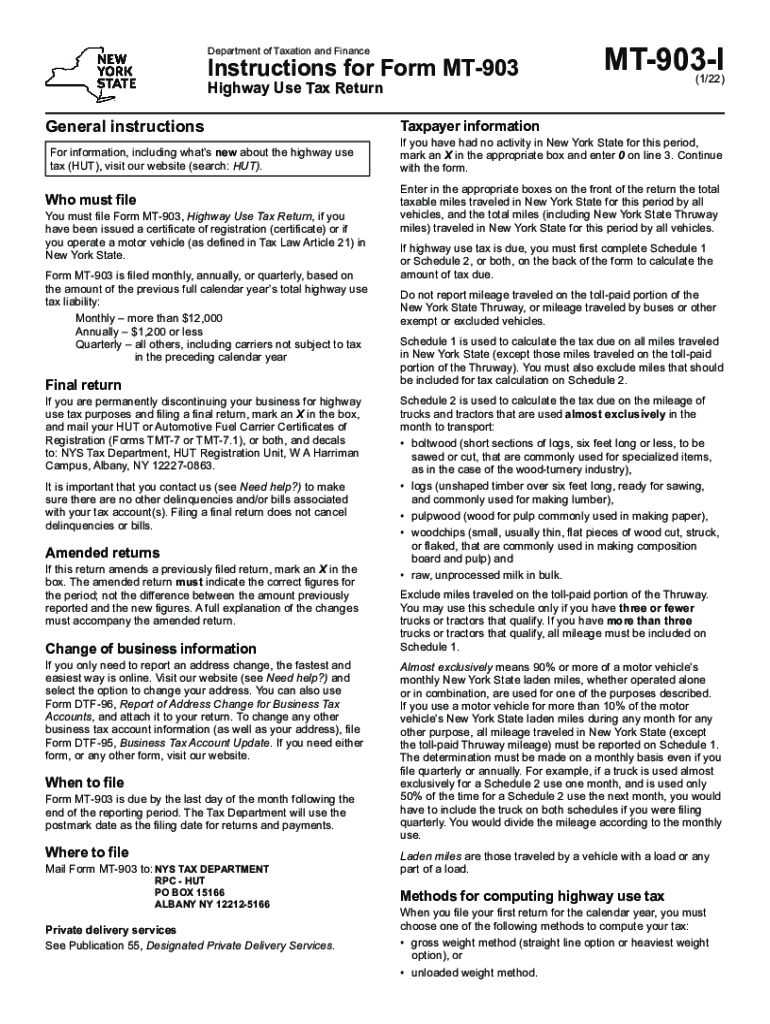

The Highway Use Tax Return, officially known as Form MT 903, is a crucial document for businesses operating heavy vehicles on public highways in the United States. This form is used to report and pay the highway use tax, which is imposed on vehicles that exceed a certain weight threshold. Understanding the purpose and requirements of this form is essential for compliance with federal and state regulations. The tax collected helps maintain and improve highway infrastructure, making it vital for the transportation industry.

Steps to Complete the Highway Use Tax Return (Form MT 903)

Completing the Highway Use Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your vehicle, including its weight and the number of miles driven on public highways. Next, fill out the form by providing details such as your business name, address, and the vehicle's identification number. Calculate the tax owed based on the weight of the vehicle and the miles driven. Finally, review the completed form for any errors before submitting it to the appropriate state agency.

Required Documents for Form MT 903

When preparing to file the Highway Use Tax Return, certain documents are essential. These include proof of vehicle registration, weight certificates, and mileage logs. Additionally, any previous tax returns related to the highway use tax may be required for reference. Keeping these documents organized and accessible can streamline the filing process and help ensure compliance with tax regulations.

Filing Methods for Form MT 903

Form MT 903 can be submitted through various methods, including online, by mail, or in person. Many states offer an online portal for electronic filing, which can expedite the process and reduce paperwork. If filing by mail, ensure that you send the form to the correct address as specified by your state’s tax authority. In-person submissions may also be available at designated state offices, providing an opportunity for immediate assistance if needed.

Penalties for Non-Compliance with Highway Use Tax Regulations

Failure to comply with highway use tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to stay informed about filing deadlines and ensure that all required forms are submitted accurately and on time. Understanding the consequences of non-compliance can motivate timely and correct filings.

State-Specific Rules for Form MT 903

Each state may have specific regulations and requirements regarding the Highway Use Tax Return. It is important to familiarize yourself with your state’s guidelines, as they can vary significantly. This includes understanding the tax rates, filing deadlines, and any additional documentation that may be required. Staying informed about state-specific rules can help avoid issues and ensure compliance with local laws.

Quick guide on how to complete instructions for form mt 903 highway use tax return revised 122

Finalize Instructions For Form MT 903 Highway Use Tax Return Revised 122 effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without hindrance. Manage Instructions For Form MT 903 Highway Use Tax Return Revised 122 on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Steps to modify and electronically sign Instructions For Form MT 903 Highway Use Tax Return Revised 122 with ease

- Find Instructions For Form MT 903 Highway Use Tax Return Revised 122 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Instructions For Form MT 903 Highway Use Tax Return Revised 122 and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form mt 903 highway use tax return revised 122

Create this form in 5 minutes!

People also ask

-

What is the nys dtf hut and how does it work?

The nys dtf hut refers to the New York State Department of Taxation and Finance's Digital Tax Filing Hub. It provides a streamlined process for businesses to submit tax documents electronically. By using the nys dtf hut, companies can ensure they meet state compliance while saving time and resources.

-

Are there any costs associated with using the nys dtf hut?

Using the nys dtf hut is generally free for tax filings, but businesses should consult their specific tax obligations. While the platform itself doesn't charge fees, additional tools like airSlate SignNow may have associated costs for document e-signing. Utilizing these tools can enhance efficiency and compliance during the filing process.

-

What features does airSlate SignNow offer for the nys dtf hut?

airSlate SignNow provides a robust suite of features that can simplify document management for the nys dtf hut. Features include secure e-signatures, document templates, and automated workflows. This helps businesses expedite their tax filing processes while ensuring all necessary documents are properly signed and submitted.

-

How can airSlate SignNow improve my experience with the nys dtf hut?

Integrating airSlate SignNow with the nys dtf hut enhances efficiency by allowing users to eSign documents directly within the platform. This means you can handle all the necessary paperwork swiftly and securely, avoiding delays associated with physical signatures. With airSlate SignNow, you’ll find tracking and managing your filings easier.

-

Is airSlate SignNow compatible with other software for the nys dtf hut?

Yes, airSlate SignNow is designed to integrate seamlessly with various software applications commonly used alongside the nys dtf hut. This includes accounting software and enterprise resource planning systems. These integrations make it easier for businesses to create, manage, and send their tax documents without disruption.

-

What are the benefits of using electronic signatures for the nys dtf hut?

Using electronic signatures for the nys dtf hut streamlines the document signing process, making it faster and more secure. eSignatures provide legal validity and reduce the need for in-person interactions, which is particularly beneficial during busy tax seasons. Furthermore, they enhance document tracking and provide a clear audit trail.

-

Can airSlate SignNow help with compliance for the nys dtf hut?

Absolutely! airSlate SignNow helps ensure that all documents submitted through the nys dtf hut are compliant with New York state regulations. With features such as secure access and comprehensive record-keeping, businesses can rest assured that they're meeting all necessary legal requirements.

Get more for Instructions For Form MT 903 Highway Use Tax Return Revised 122

- Sale of a business package north dakota form

- Legal documents for the guardian of a minor package north dakota form

- New state resident package north dakota form

- Commercial property sales package north dakota form

- General partnership package north dakota form

- Contract for deed package north dakota form

- Power of attorney forms package north dakota

- North dakota uniform

Find out other Instructions For Form MT 903 Highway Use Tax Return Revised 122

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later