Infohub Nyced Orgdocsdefault Source1095C W 2 Duplicate Request and Information Correction Form 2021

Understanding the W-2 Request Form

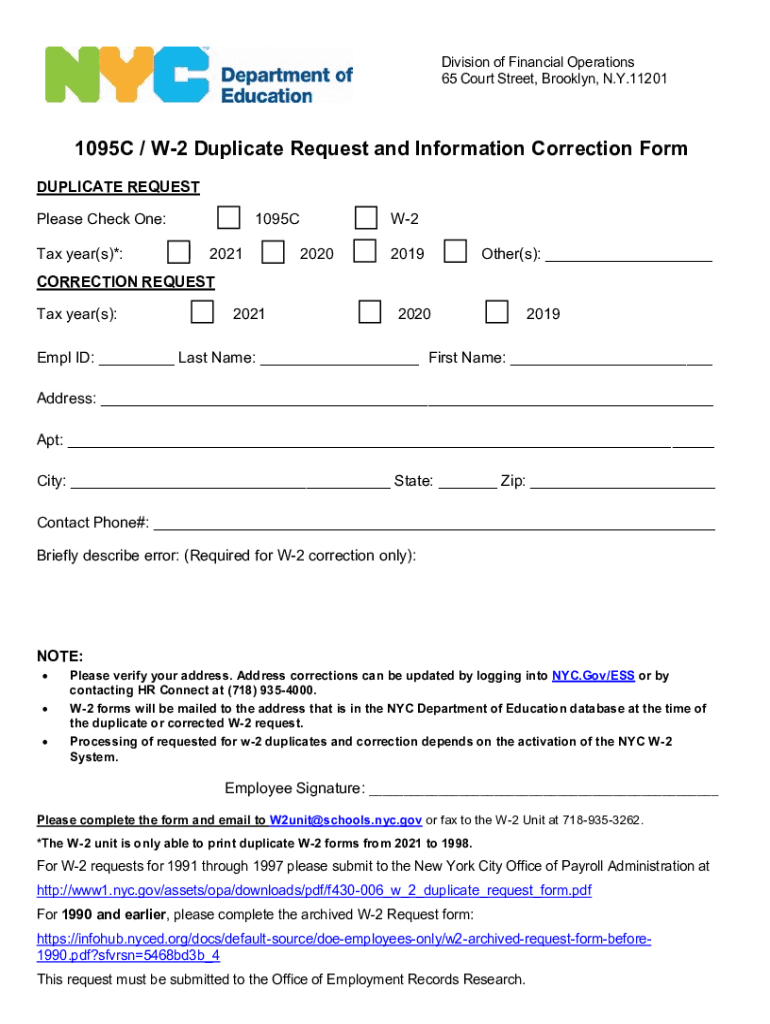

The W-2 request form is a crucial document for employees in the United States who need to obtain a duplicate of their W-2 form, which reports annual wages and taxes withheld. This form is essential for tax filing and ensuring accurate reporting to the IRS. It is particularly useful for individuals who have misplaced their original W-2 or require a corrected version due to errors in the initial document.

Steps to Complete the W-2 Request Form

Filling out the W-2 request form involves several straightforward steps:

- Gather necessary information, including your Social Security number, employer's name, and address.

- Clearly indicate the reason for your request, such as a duplicate or correction.

- Provide your contact information to facilitate communication regarding your request.

- Review the completed form for accuracy before submission.

Completing these steps ensures that your request is processed efficiently, minimizing delays in receiving your W-2 form.

Legal Use of the W-2 Request Form

The W-2 request form is legally recognized for obtaining copies of W-2 forms and is compliant with IRS regulations. It is important to use this form correctly to ensure that your request is valid. Submitting a properly filled-out form protects your rights as a taxpayer and ensures that you receive the correct tax documentation for filing purposes.

Form Submission Methods

You can submit the W-2 request form through various methods, depending on your employer's policies:

- Online: Many employers offer digital submission options through their HR portals.

- Mail: You can print the completed form and send it to your employer's payroll department.

- In-Person: If preferred, you may also deliver the form directly to your HR or payroll office.

Choosing the appropriate submission method can expedite the processing of your request.

Required Documents for the W-2 Request

When submitting a W-2 request form, you may need to provide specific documents to verify your identity and employment:

- Proof of identity, such as a driver's license or state ID.

- Any previous W-2 forms, if available, to assist in correcting errors.

- Additional documentation as requested by your employer.

Having these documents ready can help streamline the request process and ensure that your employer can respond promptly.

IRS Guidelines for W-2 Forms

The IRS has established guidelines for the issuance and correction of W-2 forms. Employers are required to provide W-2 forms to employees by January 31 of each year. If an error is identified on a W-2 form, employers must issue a corrected version, known as a W-2c. Understanding these guidelines helps ensure compliance and proper handling of tax documents.

Quick guide on how to complete infohubnycedorgdocsdefault source1095c w 2 duplicate request and information correction form

Manage Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and electronically sign Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form with ease

- Locate Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to record your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or disorganized files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct infohubnycedorgdocsdefault source1095c w 2 duplicate request and information correction form

Create this form in 5 minutes!

People also ask

-

What is a W2 request form and why do I need it?

A W2 request form is a document used to formally request a copy of your W-2 tax form from your employer. It's essential for individuals who need their W-2 for filing taxes, especially if they did not receive it or have lost it. With airSlate SignNow, you can easily create and send your W2 request form to ensure you get your tax documents on time.

-

How can airSlate SignNow help me with my W2 request form?

airSlate SignNow simplifies the process of creating and sending your W2 request form online. Our platform allows you to customize your request, eSign it, and send it securely to your employer. This not only saves time but also ensures that your request is officially documented.

-

What are the pricing options for using airSlate SignNow for my W2 request form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including individuals and teams needing to handle W2 request forms. You can choose from monthly or annual subscriptions that provide comprehensive features for eSigning and document management. This makes it a cost-effective solution for your W2 request form needs.

-

Are there any special features for managing W2 request forms in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing documents like W2 request forms. You can use templates for quick creation, set reminders for overdue requests, and track the status of your W-2 requests in real time. These features enhance efficiency and ensure you never miss a critical tax document.

-

Can I integrate airSlate SignNow with other systems for my W2 request form?

Absolutely! airSlate SignNow offers integrations with popular software like CRM systems, cloud storage, and HR platforms, which can streamline your W2 request form processes. These integrations allow you to manage your documents seamlessly without switching between multiple platforms, ensuring a cohesive workflow.

-

Is my data secure when I send a W2 request form using airSlate SignNow?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you send a W2 request form via our platform, your sensitive information is protected, ensuring only authorized recipients can access it. This gives you peace of mind when handling your tax documents.

-

How long does it take to send a W2 request form with airSlate SignNow?

Sending a W2 request form using airSlate SignNow is quick and efficient. With our intuitive interface, you can create, eSign, and send your request within minutes. This speed is essential for ensuring that your employers receive the request without unnecessary delays, helping you meet tax deadlines.

Get more for Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form

- Legal last will and testament form for divorced person not remarried with adult children north carolina

- Legal last will and testament form for divorced person not remarried with no children north carolina

- Legal last will and testament form for divorced person not remarried with minor children north carolina

- North carolina will testament form

- Mutual wills package with last wills and testaments for married couple with adult children north carolina form

- Married couple no form

- Mutual wills package with last wills and testaments for married couple with minor children north carolina form

- Legal last will and testament form for married person with adult children north carolina

Find out other Infohub nyced orgdocsdefault source1095C W 2 Duplicate Request And Information Correction Form

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer