CR PTE, Property Tax Exemption Application 2021-2026

What is the CR PTE, Property Tax Exemption Application

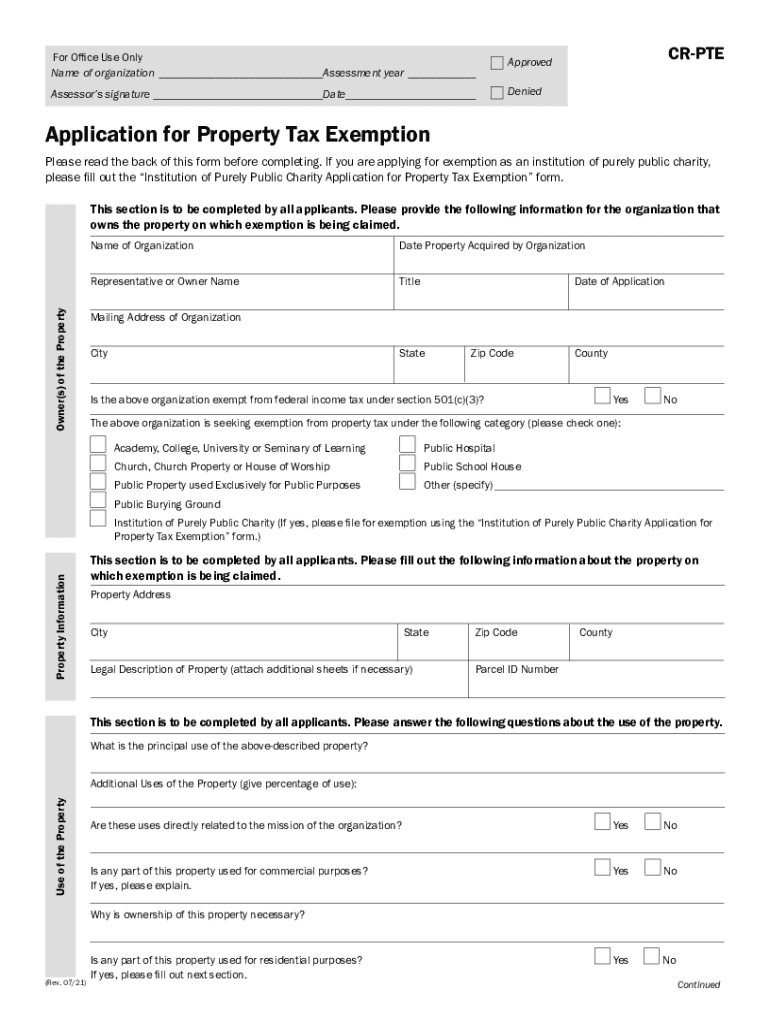

The CR PTE, or Property Tax Exemption Application, is a form designed for property owners in Minnesota seeking a tax exemption on their property. This exemption is particularly beneficial for certain types of properties, such as those used for agricultural purposes or owned by specific nonprofit organizations. By completing this application, property owners can potentially reduce their tax liability, making it a valuable tool for eligible individuals and entities.

Steps to complete the CR PTE, Property Tax Exemption Application

Completing the CR PTE application involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of ownership and any supporting evidence that demonstrates eligibility for the exemption. Next, fill out the application form carefully, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions before submitting it to the appropriate local tax authority. It is crucial to adhere to any specific guidelines provided by your local jurisdiction to avoid delays in processing.

Eligibility Criteria

Eligibility for the CR PTE exemption varies based on several factors, including the type of property and its intended use. Common criteria include ownership by a nonprofit organization, agricultural use, or properties that serve a public purpose. Property owners should review the specific requirements outlined by the Minnesota Department of Revenue to determine if their property qualifies for the exemption. Meeting these criteria is essential for successful application and approval.

Required Documents

When applying for the CR PTE exemption, certain documents are typically required to substantiate the application. These may include:

- Proof of property ownership, such as a deed or tax statement.

- Documentation supporting the claim for exemption, like organizational status for nonprofits or agricultural use verification.

- Any additional forms or schedules specified by the local tax authority.

Having these documents ready will streamline the application process and enhance the likelihood of approval.

Form Submission Methods

The CR PTE application can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form and required documents to the appropriate office.

- In-person submission at designated local government offices.

It is advisable to confirm the preferred submission method with your local tax authority to ensure compliance with their procedures.

Legal use of the CR PTE, Property Tax Exemption Application

The CR PTE application is legally recognized as a formal request for property tax exemption under Minnesota law. To be considered valid, the application must be completed accurately and submitted within the designated timeframe. Compliance with all legal requirements is essential, as improper submissions can result in denial of the exemption or potential penalties. Understanding the legal framework surrounding the CR PTE application helps ensure that property owners can effectively navigate the process.

Quick guide on how to complete cr pte property tax exemption application

Complete CR PTE, Property Tax Exemption Application effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without holdups. Manage CR PTE, Property Tax Exemption Application on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and eSign CR PTE, Property Tax Exemption Application with ease

- Locate CR PTE, Property Tax Exemption Application and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign CR PTE, Property Tax Exemption Application and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr pte property tax exemption application

Create this form in 5 minutes!

People also ask

-

What is the Minnesota CR PTE printable form?

The Minnesota CR PTE printable form is a crucial document for businesses operating in Minnesota, allowing them to report and pay their pass-through entity tax efficiently. With airSlate SignNow, you can easily fill out and eSign the Minnesota CR PTE printable form, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the Minnesota CR PTE printable process?

airSlate SignNow offers a streamlined platform for completing and managing the Minnesota CR PTE printable form electronically. Our solution not only enhances productivity but also reduces the time spent on paperwork by allowing users to eSign documents securely from anywhere.

-

Is there a cost associated with using airSlate SignNow for the Minnesota CR PTE printable form?

Yes, there is a cost associated with using airSlate SignNow, which offers various pricing plans tailored to meet the needs of different businesses. By choosing the right plan, you can benefit from tools that simplify the Minnesota CR PTE printable form process and ensure efficient document management.

-

Can I customize the Minnesota CR PTE printable form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Minnesota CR PTE printable form according to their specific business needs. This feature ensures that your form meets all requirements while providing a professional appearance for your documents.

-

What are the benefits of using airSlate SignNow for the Minnesota CR PTE printable form?

Using airSlate SignNow for your Minnesota CR PTE printable form offers numerous benefits, including increased efficiency, reduced paper waste, and secure digital storage. Additionally, our platform supports real-time collaboration, making it easier for teams to stay aligned during the document signing process.

-

Does airSlate SignNow integrate with other tools for managing the Minnesota CR PTE printable form?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage the Minnesota CR PTE printable form alongside your existing workflows. These integrations ensure that data flows smoothly between platforms without any hassle.

-

Is the Minnesota CR PTE printable form legally binding when submitted via airSlate SignNow?

Yes, the Minnesota CR PTE printable form submitted via airSlate SignNow is legally binding, as our eSignature technology complies with all state and federal regulations. By using our platform, you can confidently submit your form knowing it meets legal standards.

Get more for CR PTE, Property Tax Exemption Application

- Ga 2 court form

- Georgia succession form

- Quitclaim deed by two individuals to husband and wife georgia form

- Warranty deed from two individuals to husband and wife georgia form

- Quitclaim deed individual to a trust georgia form

- Special warranty deed from individual and trust to individual georgia form

- Quitclaim deed from a trust to an individual georgia form

- Quitclaim deed form georgia

Find out other CR PTE, Property Tax Exemption Application

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage