Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department of StatePublic Charity Exemption 2021-2026

Understanding the Minnesota PTE PC Property Exemption

The Minnesota PTE PC property exemption is designed for purely public charities in the state. This exemption allows qualifying organizations to avoid certain property taxes, promoting charitable activities. To qualify, an organization must meet specific criteria outlined by the Minnesota Department of Revenue. This includes demonstrating that the property is used exclusively for charitable purposes, which can include educational, religious, or other public benefits.

Eligibility Criteria for the PTE PC Exemption

To be eligible for the Minnesota PTE PC property exemption, organizations must fulfill several key requirements:

- The organization must be classified as a purely public charity.

- Property must be utilized solely for charitable purposes.

- The organization must provide evidence of its charitable activities and community benefits.

Meeting these criteria is essential for maintaining the exemption status and avoiding property tax liabilities.

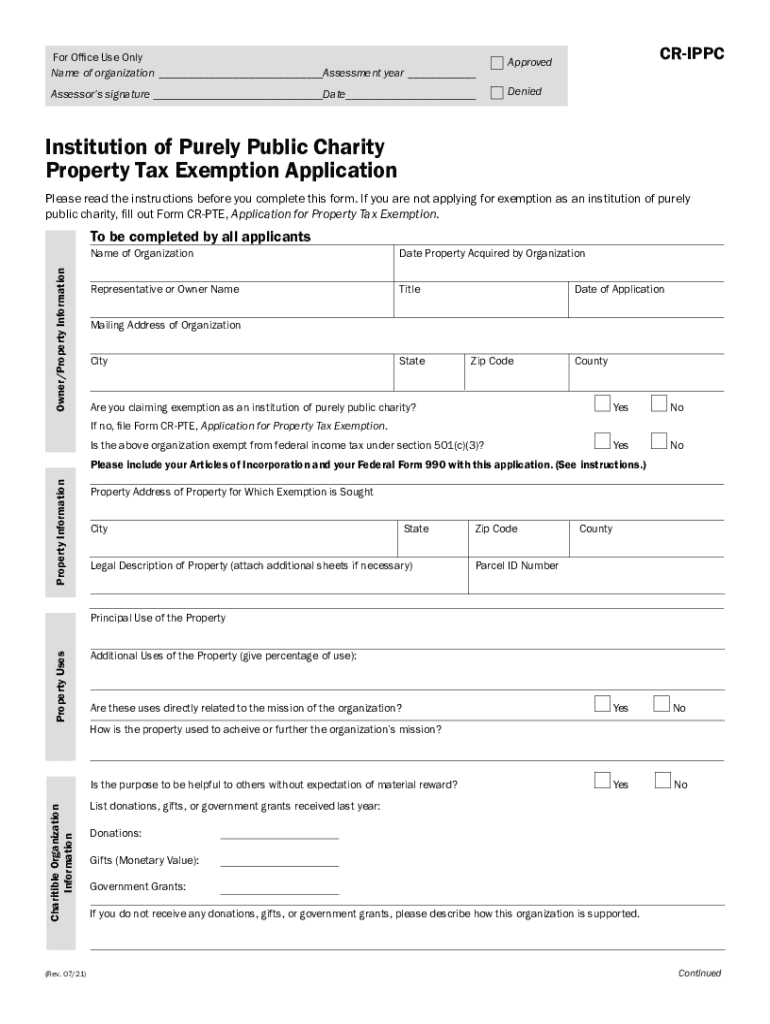

Steps to Complete the Minnesota PTE PC Property Exemption Application

Completing the application for the Minnesota PTE PC property exemption involves several steps:

- Gather necessary documentation, including proof of charitable status and property usage.

- Fill out the exemption application form accurately, providing all required details.

- Submit the application to the appropriate local government office, ensuring compliance with submission guidelines.

- Await confirmation of the application status and be prepared to provide additional information if requested.

Required Documents for the Application

When applying for the Minnesota PTE PC property exemption, organizations must submit specific documents to support their application:

- Proof of the organization's charitable status, such as IRS determination letters.

- Documentation demonstrating property usage for charitable purposes.

- Any additional information requested by the local government office.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Filing Deadlines and Important Dates

Organizations must be aware of critical deadlines when applying for the Minnesota PTE PC property exemption. Typically, applications should be submitted by a specific date each year to ensure consideration for the upcoming tax year. It is advisable to check with the Minnesota Department of Revenue for the most current deadlines and any changes that may occur.

Legal Use of the Minnesota PTE PC Property Exemption

The legal framework governing the Minnesota PTE PC property exemption is grounded in state tax law. Organizations must adhere to all regulations to maintain their exempt status. This includes proper documentation, timely filing of applications, and compliance with any audits or reviews conducted by tax authorities. Understanding these legal obligations is crucial for organizations to avoid penalties and ensure continued eligibility.

Quick guide on how to complete public charity exemption applicationinternal revenuepurely public charities form pa department of statepublic charity exemption

Complete Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption with ease

- Locate Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight key sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your desktop.

Put an end to missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct public charity exemption applicationinternal revenuepurely public charities form pa department of statepublic charity exemption

Create this form in 5 minutes!

People also ask

-

What is Minnesota PTE PC property in relation to airSlate SignNow?

Minnesota PTE PC property refers to the legal and operational aspects of professional corporations in Minnesota. With airSlate SignNow, you can efficiently manage your documents related to Minnesota PTE PC property, ensuring compliance and streamlined communication.

-

How does airSlate SignNow enhance document management for Minnesota PTE PC property?

airSlate SignNow offers a seamless process for creating, sending, and signing documents essential for Minnesota PTE PC property. The platform provides templates and automation features that save time and reduce errors in document handling.

-

What pricing plans does airSlate SignNow offer for Minnesota PTE PC property users?

airSlate SignNow offers various pricing plans tailored to meet the needs of Minnesota PTE PC property users. These plans are designed to be cost-effective, providing essential features without compromising quality or security.

-

What are the key benefits of using airSlate SignNow for Minnesota PTE PC property?

Using airSlate SignNow for your Minnesota PTE PC property ensures quicker document turnaround times and enhanced collaboration. With legally binding e-signatures and a user-friendly interface, managing your professional documents has never been easier.

-

Can airSlate SignNow integrate with other tools for Minnesota PTE PC property management?

Yes, airSlate SignNow effectively integrates with various tools commonly used in managing Minnesota PTE PC property. This includes accounting software and customer relationship management (CRM) systems to streamline your workflows and enhance efficiency.

-

How secure is airSlate SignNow for handling Minnesota PTE PC property documents?

AirSlate SignNow prioritizes security, utilizing advanced encryption and secure data storage practices for all documents, including those related to Minnesota PTE PC property. This ensures that your sensitive information remains protected against unauthorized access.

-

Does airSlate SignNow provide customer support for Minnesota PTE PC property users?

Absolutely! airSlate SignNow offers comprehensive customer support tailored specifically for Minnesota PTE PC property users. Whether you have questions about features or need assistance with integration, our support team is here to help.

Get more for Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption

- Revocation of postnuptial property agreement nebraska nebraska form

- Nebraska property 497317992 form

- Nebraska postnuptial agreement form

- Quitclaim deed from husband and wife to an individual nebraska form

- Warranty deed from husband and wife to an individual nebraska form

- Quitclaim deed two individuals to one individual nebraska form

- Warranty deed limited liability company to limited liability company nebraska form

- Ne defendant form

Find out other Public Charity Exemption ApplicationInternal RevenuePurely Public Charities Form Pa Department Of StatePublic Charity Exemption

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT