Property Tax Exemption Appl Institution of Purely Public Charity Co Todd Mn 2013

What is the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn

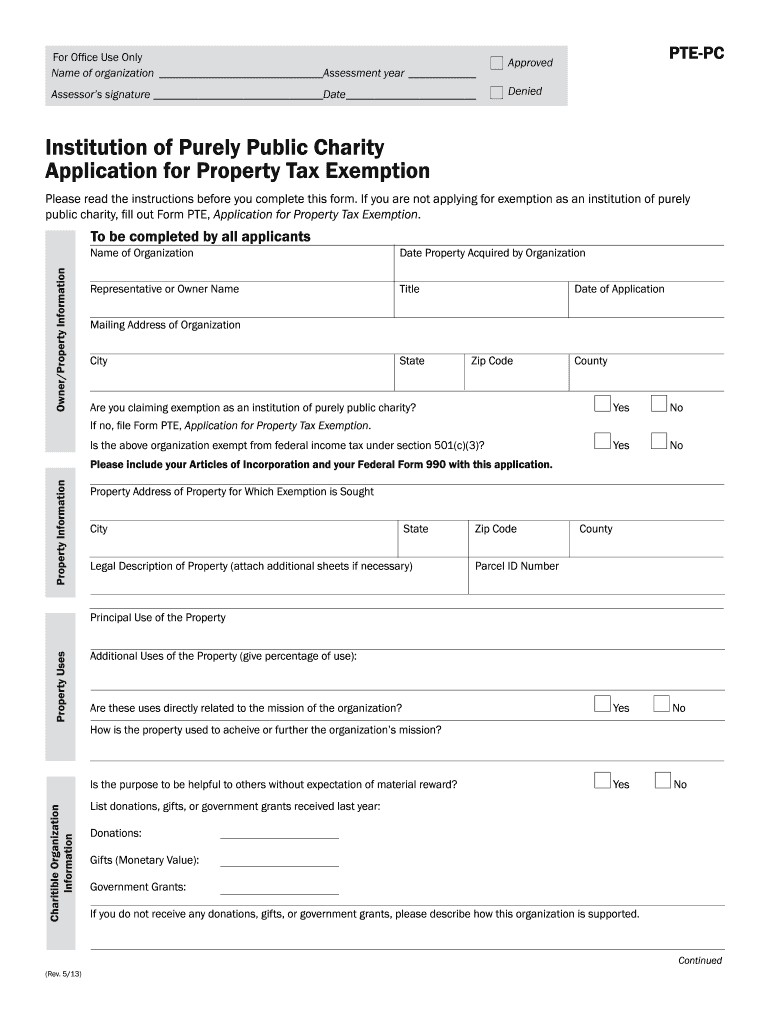

The Property Tax Exemption Application for Institutions of Purely Public Charity in Todd County, Minnesota, is a specific form designed for organizations seeking tax-exempt status based on their charitable activities. This application allows qualifying entities to avoid property taxes, provided they meet certain criteria established by state law. The exemption is intended to support organizations that provide significant public benefits, such as health services, education, and social welfare programs. Understanding the requirements and implications of this exemption is crucial for organizations operating within the county.

Eligibility Criteria

To qualify for the Property Tax Exemption in Todd County, organizations must demonstrate that they operate exclusively for charitable purposes. Key eligibility criteria include:

- The organization must be a nonprofit entity.

- Activities must primarily benefit the public rather than private interests.

- The property for which the exemption is sought must be used for charitable purposes.

- Compliance with state and local regulations is necessary.

Organizations must provide documentation that supports their eligibility, including financial statements and descriptions of their services.

Steps to Complete the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn

Completing the Property Tax Exemption Application involves several steps to ensure that all required information is accurately submitted. Here are the essential steps:

- Gather necessary documentation, including proof of nonprofit status and detailed descriptions of charitable activities.

- Complete the application form, ensuring all sections are filled out thoroughly.

- Attach supporting documents, such as financial records and organizational bylaws.

- Review the application for accuracy and completeness before submission.

- Submit the application to the appropriate county office, either online or by mail.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Required Documents

When applying for the Property Tax Exemption in Todd County, specific documents are required to substantiate the application. These typically include:

- Proof of nonprofit status, such as IRS determination letters.

- Financial statements that outline the organization’s income and expenses.

- A detailed description of the services provided and their impact on the community.

- Bylaws or articles of incorporation that define the organization’s mission and structure.

Having these documents ready can facilitate a smoother application process and help demonstrate the organization’s commitment to public charity.

Form Submission Methods

The Property Tax Exemption Application can be submitted through various methods, depending on the preferences of the organization and the resources available. Common submission methods include:

- Online submission through the county’s official website, if available.

- Mailing the completed application to the designated county office.

- In-person submission at the county office during business hours.

Choosing the right submission method can help ensure that the application is received and processed in a timely manner.

Legal Use of the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn

The legal use of the Property Tax Exemption Application is governed by state laws and regulations that define the parameters of tax-exempt status for charitable organizations. To maintain compliance, organizations must:

- Ensure that the property is used exclusively for charitable purposes.

- File the application annually or as required by local regulations.

- Keep accurate records of activities and finances to support continued eligibility.

Understanding these legal requirements is essential for organizations to avoid penalties and ensure they can continue to benefit from tax-exempt status.

Quick guide on how to complete property tax exemption appl institution of purely public charity co todd mn

Complete Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn on any platform with airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

How to modify and electronically sign Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn effortlessly

- Locate Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax exemption appl institution of purely public charity co todd mn

Create this form in 5 minutes!

How to create an eSignature for the property tax exemption appl institution of purely public charity co todd mn

How to make an eSignature for your Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn in the online mode

How to make an electronic signature for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn in Chrome

How to make an electronic signature for signing the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn in Gmail

How to make an electronic signature for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn straight from your smart phone

How to generate an eSignature for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn on iOS

How to create an eSignature for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn on Android

People also ask

-

What is the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

The Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn is a document that allows qualifying institutions to apply for property tax exemptions. This process is essential for organizations that meet the criteria of purely public charities, enabling them to save on property taxes and allocate funds towards their charitable missions.

-

How can airSlate SignNow help with the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

airSlate SignNow streamlines the process of completing and submitting the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn. With our eSignature capabilities, you can efficiently sign and send documents securely, ensuring compliance and saving valuable time for your organization.

-

What pricing options are available for using airSlate SignNow for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of different organizations. Whether you are a small nonprofit or a larger institution, you can choose a plan that fits your budget while leveraging the essential tools to manage your Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn effectively.

-

What features does airSlate SignNow provide that are beneficial for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn process?

Our platform offers a range of features that enhance the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn process, including customizable templates, automated workflows, and secure eSigning. These tools not only improve efficiency but also help ensure all necessary documentation is completed correctly.

-

Is it safe to use airSlate SignNow for submitting the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

Absolutely! airSlate SignNow prioritizes security by employing advanced encryption and compliance standards for handling sensitive information. You can confidently use our platform to process the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn without worrying about data bsignNowes or security issues.

-

Can airSlate SignNow integrate with other software for managing the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

Yes, airSlate SignNow offers integrations with many popular software applications. These integrations can facilitate data sharing and streamline the management of the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn, helping you automate repetitive tasks and improve overall productivity.

-

How can I get started with airSlate SignNow for the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features and see how they can assist you with the Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn process. Once you're ready, choose a plan that best fits your organization's needs.

Get more for Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn

- Pa 586 report of physicalmental examination form

- Consent template combined hipaa the childrenamp39s hospital of research chop form

- Sentara advance directive form

- Printing out a form for a tetanus shot

- Los colinas medical center authorization form

- Hospital bed pm shedule form

- Medcom 756 form

- Acpe application fillable form

Find out other Property Tax Exemption Appl Institution Of Purely Public Charity Co Todd Mn

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form