SAME DEPARTMENT NEW LOOK FORMS and INSTRUCTIONSFORM 2021

Understanding the Minnesota Renters Rebate

The Minnesota renters rebate is a financial assistance program designed to help eligible renters reduce their property tax burden. This rebate is part of the Minnesota property tax refund program, which aims to provide relief to those who may struggle with housing costs. The program is available to renters who meet specific income and residency requirements. To qualify, applicants must have rented a dwelling in Minnesota and paid property taxes indirectly through their rent.

Eligibility Criteria for the Renters Rebate

To qualify for the Minnesota renters rebate, individuals must meet certain criteria, including:

- Residency in Minnesota for at least half of the year.

- Income limits that vary based on household size and filing status.

- Proof of rent paid during the year, which may include lease agreements or rent receipts.

It is essential to review these criteria carefully to ensure eligibility before applying for the rebate.

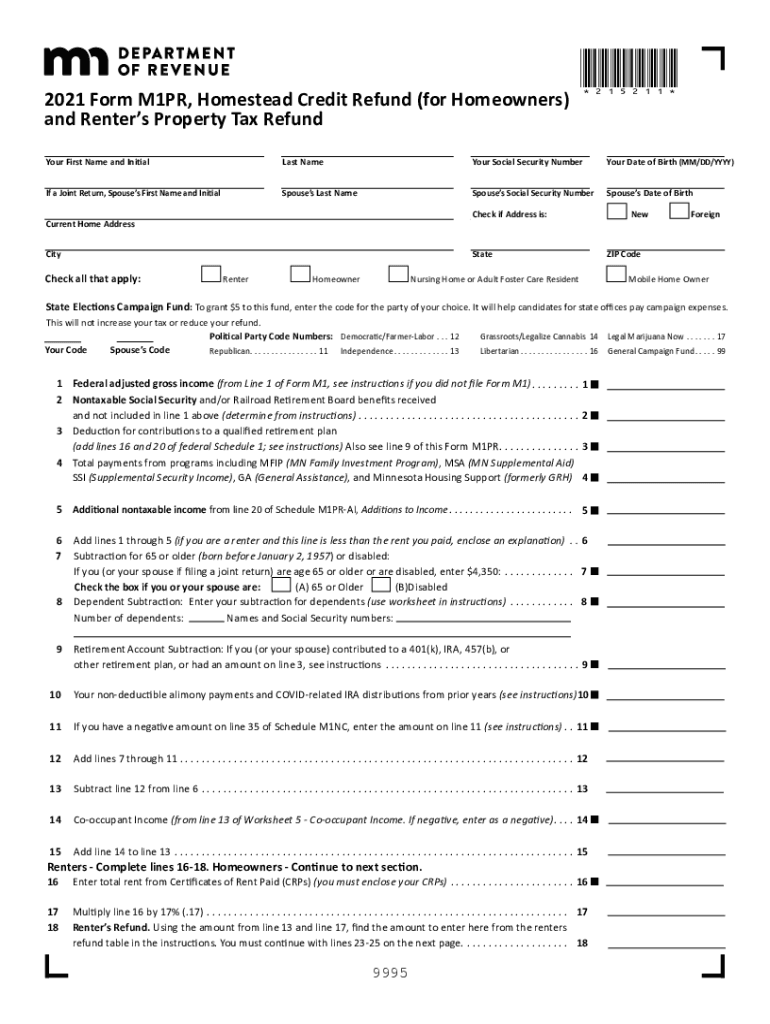

Steps to Complete the Minnesota M1PR Form

Filling out the Minnesota M1PR form, which is the official application for the renters rebate, involves several steps:

- Gather necessary documents, including proof of income and rent payments.

- Complete the M1PR form, providing accurate information about your income, residency, and rental history.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form by the deadline, which is typically August 15 of the year following the tax year.

Using digital tools can streamline this process, allowing for easier completion and submission of the form.

Required Documents for Submission

When applying for the renters rebate, specific documents are necessary to support your application. These may include:

- Proof of income, such as W-2 forms or pay stubs.

- Documentation of rent payments, like lease agreements or rent receipts.

- Identification, which may include a driver's license or state ID.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods

The Minnesota M1PR form can be submitted through various methods to accommodate different preferences:

- Online submission via the Minnesota Department of Revenue website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated state offices, if preferred.

Choosing the right submission method can help ensure timely processing of your application.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for applicants. The typical deadline for submitting the Minnesota M1PR form is August 15 of the year following the tax year. It is advisable to mark this date on your calendar to avoid missing out on potential rebates.

Legal Use of the Minnesota M1PR Form

The Minnesota M1PR form is legally recognized as the official application for the renters rebate. To ensure compliance, it is important to complete the form accurately and submit it within the designated timeframe. Electronic signatures are accepted, provided they meet legal standards for eSignatures, ensuring that your application is valid and binding.

Quick guide on how to complete same department new look forms and instructionsform

Complete SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centered process today.

The easiest way to edit and electronically sign SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM with ease

- Obtain SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhaustive form searches, or mistakes that require renaming new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct same department new look forms and instructionsform

Create this form in 5 minutes!

People also ask

-

What is the mn renters rebate and how does it work?

The mn renters rebate is a program designed to provide financial assistance to eligible renters in Minnesota. It helps reduce the overall rent burden by offering refunds based on the amount paid in rent during the year. To qualify, applicants need to meet certain income and residency requirements.

-

How can I apply for the mn renters rebate?

To apply for the mn renters rebate, you can complete the application form available on the Minnesota Department of Revenue website. Ensure that you have all necessary documentation handy, including your income details and proof of rent payments. The application process is straightforward, and assistance is available if you have questions.

-

What are the eligibility requirements for the mn renters rebate?

Eligibility for the mn renters rebate primarily depends on your income, age, and rental situation. Generally, at least 18 years old and a resident of Minnesota during the year are essential qualifications. Additionally, your annual income must be within certain limits as defined by the program guidelines.

-

What benefits does the mn renters rebate offer?

The mn renters rebate offers signNow financial relief by providing cash refunds to eligible renters. This rebate aims to alleviate housing costs and make renting more affordable in Minnesota. Additionally, this program encourages residential stability and helps improve overall community welfare.

-

When can I expect to receive my mn renters rebate?

Once your mn renters rebate application is processed, you can typically expect to receive your refund within 8 to 12 weeks. Processing times may vary depending on the volume of applications received. Keeping an eye on your application status through the Minnesota Department of Revenue website can keep you informed.

-

Is there a cost associated with applying for the mn renters rebate?

No, there is no cost to apply for the mn renters rebate. The application process is free of charge, making it accessible for all eligible renters in Minnesota. Ensure that you complete the process accurately to avoid delays.

-

How can airSlate SignNow help with the mn renters rebate application process?

airSlate SignNow simplifies the process of preparing and signing necessary documents for the mn renters rebate application. With its easy-to-use e-signature features, you can quickly secure signatures and submit your paperwork without delays. Utilizing our solution can streamline your experience and ensure all documents are in order.

Get more for SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM

- Single member limited liability company llc operating agreement north dakota form

- North dakota will form

- North dakota lien form

- Quitclaim deed from individual to husband and wife north dakota form

- Warranty deed from individual to husband and wife north dakota form

- Quitclaim deed from corporation to husband and wife north dakota form

- Warranty deed from corporation to husband and wife north dakota form

- Quitclaim deed from corporation to individual north dakota form

Find out other SAME DEPARTMENT NEW LOOK FORMS AND INSTRUCTIONSFORM

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament