M1pr Form 2017

What is the M1pr Form

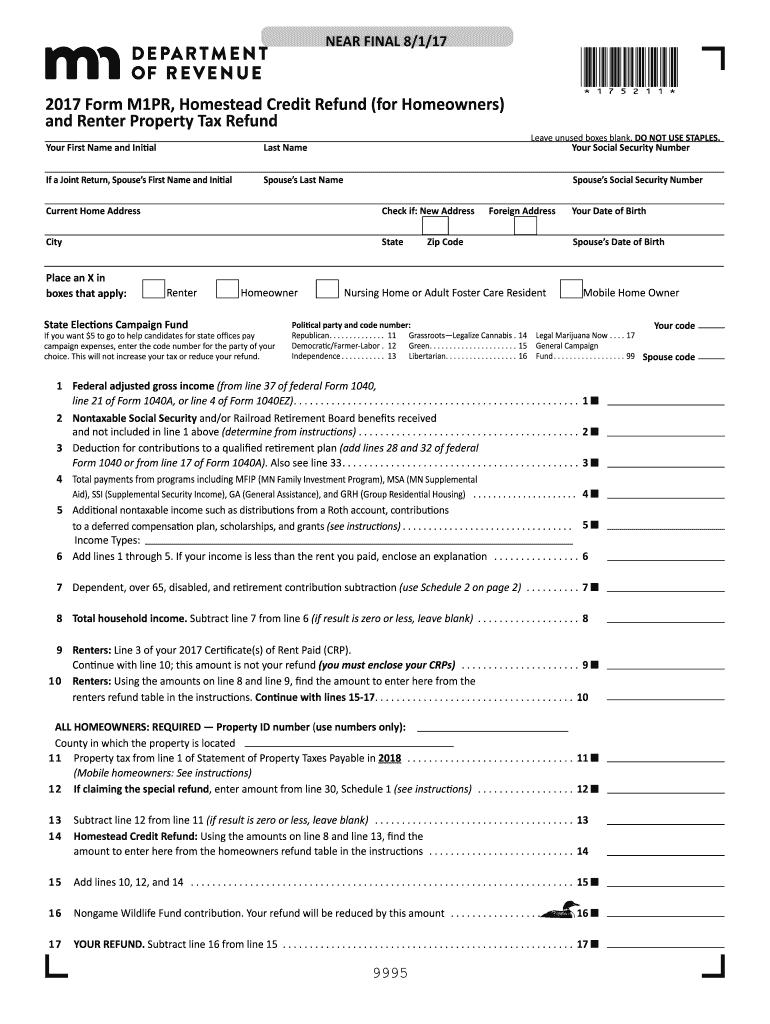

The M1pr Form is a specific tax form used in the United States for reporting income and calculating tax liabilities. It is primarily utilized by individuals and businesses to ensure compliance with federal tax regulations. This form is essential for accurately reflecting income, deductions, and credits, which ultimately determine the amount of tax owed or refunded. The M1pr Form is designed to facilitate the tax filing process, making it easier for taxpayers to report their financial information in a structured manner.

How to use the M1pr Form

Using the M1pr Form involves several key steps. First, gather all necessary financial documents, including income statements and records of deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to double-check calculations to avoid errors that could lead to penalties or delays in processing. Once completed, the form can be submitted electronically or via traditional mail, depending on the taxpayer's preference. Utilizing electronic filing methods can streamline the process and provide immediate confirmation of submission.

Steps to complete the M1pr Form

Completing the M1pr Form requires a systematic approach. Begin by downloading the latest version of the form from an official source. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including name, address, and Social Security number.

- Report all sources of income, ensuring to include W-2s and 1099s.

- List any deductions or credits you are eligible for, following the guidelines provided.

- Review all entries for accuracy, checking calculations and ensuring all required fields are completed.

- Sign and date the form before submission.

Legal use of the M1pr Form

The M1pr Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and accurately reporting financial information. The form is legally binding, meaning that any discrepancies or inaccuracies could result in penalties or audits. It is advisable to keep copies of submitted forms and supporting documents for record-keeping purposes. Understanding the legal implications of using the M1pr Form is crucial for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the M1pr Form vary depending on the tax year and the taxpayer's specific circumstances. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain conditions. It is essential to stay informed about any changes to deadlines, especially during tax season, as these can impact the timely filing of the M1pr Form. Marking important dates on a calendar can help ensure compliance and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The M1pr Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which allows for quicker processing and confirmation.

- Mail: The form can be printed and mailed to the appropriate IRS address, though this method may take longer for processing.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, especially if they require assistance.

Choosing the right submission method depends on individual preferences and circumstances, as each has its own advantages and considerations.

Quick guide on how to complete m1pr 2017 form

Your instructional manual on how to prepare your M1pr Form

If you’re wondering how to finalize and transmit your M1pr Form, here are some brief guidelines on how to make tax submission easier.

Initially, you simply need to create your airSlate SignNow profile to transform how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, produce, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to amend answers as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your M1pr Form in just a few minutes:

- Create your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to launch your M1pr Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct m1pr 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the m1pr 2017 form

How to generate an electronic signature for your M1pr 2017 Form in the online mode

How to make an eSignature for the M1pr 2017 Form in Chrome

How to create an eSignature for putting it on the M1pr 2017 Form in Gmail

How to create an electronic signature for the M1pr 2017 Form from your smart phone

How to make an electronic signature for the M1pr 2017 Form on iOS

How to generate an eSignature for the M1pr 2017 Form on Android

People also ask

-

What is the M1pr Form and how does it work with airSlate SignNow?

The M1pr Form is a specific document used for various administrative purposes, and with airSlate SignNow, you can easily create, send, and eSign it. Our platform streamlines the process, allowing you to fill out the M1pr Form electronically, ensuring accuracy and efficiency.

-

How much does it cost to eSign the M1pr Form using airSlate SignNow?

airSlate SignNow offers competitive pricing tailored to meet various business needs. You can eSign the M1pr Form and other documents with plans starting at a low monthly fee, which includes unlimited document signing and customizable templates.

-

Can I integrate the M1pr Form into my existing workflow with airSlate SignNow?

Yes! airSlate SignNow allows seamless integration of the M1pr Form into your existing workflow. You can connect it with popular applications like Google Drive, Dropbox, and CRM systems to enhance your document management process.

-

What are the key features of using airSlate SignNow for the M1pr Form?

When using airSlate SignNow for the M1pr Form, you benefit from features such as customizable templates, automated reminders, and real-time tracking. These features help ensure that your documents are signed promptly and efficiently.

-

Is it safe to use airSlate SignNow for the M1pr Form?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your M1pr Form and other documents. You can trust that your data is safe and compliant with industry standards.

-

How can I track the status of my M1pr Form sent for eSignature?

With airSlate SignNow, you can easily track the status of your M1pr Form. The platform provides real-time updates and notifications, so you know exactly when your document has been viewed and signed.

-

Can I customize the M1pr Form templates in airSlate SignNow?

Yes, you can customize the M1pr Form templates to suit your specific requirements in airSlate SignNow. Our intuitive editor allows you to add fields, adjust formatting, and incorporate your branding for a professional look.

Get more for M1pr Form

- Dhec 0520 form

- Form of application for pointing out the boundaries of registered

- Sc department of revenue 1040x form

- City of atwater business license form

- Recreational activity release of liability waiver of claims express form

- Business tax cert app infofinal doc form

- Owner statement and acknowledgment of compliance form

- City of auburn dog license application form

Find out other M1pr Form

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA