Search Page Mn Gov Minnesota's State PortalSearch Page Mn Gov Minnesota's State PortalSearch Page Mn Gov Minnesota's State Porta 2022-2026

Understanding the Minnesota Revenue M1MA Form

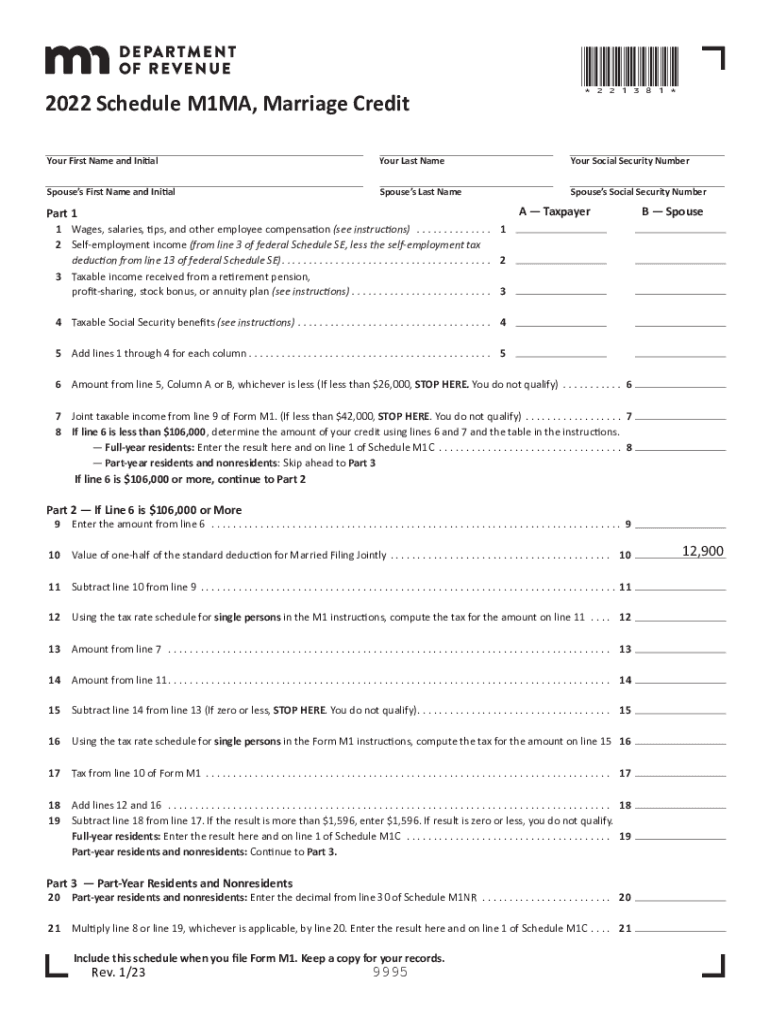

The Minnesota Revenue M1MA form, also known as the marriage credit form, is designed for couples who are eligible for a marriage credit in the state of Minnesota. This form allows married couples to claim a credit based on their combined income, potentially reducing their overall tax liability. The M1MA form is essential for ensuring that couples receive the appropriate tax benefits associated with their marital status.

Eligibility Criteria for the M1MA Form

To qualify for the Minnesota Revenue M1MA, couples must meet specific eligibility requirements. These include:

- Both spouses must be legally married and file a joint tax return.

- Couples must have a combined income that falls within the required limits set by the Minnesota Department of Revenue.

- Applicants should not have claimed the marriage credit in previous years for the same tax period.

Steps to Complete the Minnesota Revenue M1MA Form

Completing the M1MA form involves several straightforward steps:

- Gather all necessary financial documents, including W-2s and other income statements.

- Calculate your combined income and determine your eligibility for the marriage credit.

- Fill out the M1MA form accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form along with your joint tax return to the Minnesota Department of Revenue.

Form Submission Methods

The Minnesota Revenue M1MA can be submitted through various methods:

- Online submission via the Minnesota Department of Revenue's e-file system.

- Mailing a paper copy of the completed form along with your tax return.

- In-person submission at designated tax offices, if applicable.

Legal Use of the M1MA Form

The M1MA form is legally binding when completed and submitted according to Minnesota state regulations. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies could lead to penalties or delays in processing. The form must be signed by both spouses to validate the submission.

Filing Deadlines and Important Dates

To ensure timely processing of the Minnesota Revenue M1MA form, it is vital to adhere to filing deadlines. Typically, the deadline for submitting the form coincides with the federal tax filing deadline, which is usually April 15. However, it is advisable to check the Minnesota Department of Revenue's website for any updates or changes to these dates.

Quick guide on how to complete search page mngov minnesotas state portalsearch page mngov minnesotas state portalsearch page mngov minnesotas state

Complete Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Manage Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to edit and electronically sign Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta with ease

- Find Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form retrieval, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct search page mngov minnesotas state portalsearch page mngov minnesotas state portalsearch page mngov minnesotas state

Create this form in 5 minutes!

People also ask

-

What is the Minnesota Revenue M1MA form and why is it important?

The Minnesota Revenue M1MA form is a tax document required for Minnesota residents to report income and claim tax credits. Understanding this form is crucial for ensuring compliance with state tax regulations. By utilizing tools like airSlate SignNow, you can easily manage and eSign your M1MA form, streamlining the process.

-

How can airSlate SignNow help with completing the Minnesota Revenue M1MA?

airSlate SignNow offers a user-friendly platform that allows you to fill out and eSign the Minnesota Revenue M1MA form efficiently. With our solution, you can access templates, auto-fill information, and securely send documents. This helps to accelerate the submission process and ensures accuracy.

-

What are the pricing options for using airSlate SignNow for M1MA forms?

Our pricing for using airSlate SignNow is competitive, offering several tiers to fit different business needs. You can choose a plan that provides the best value for managing your Minnesota Revenue M1MA forms without breaking the bank. Each plan comes with comprehensive features, ensuring you get the most out of our eSigning solution.

-

What features does airSlate SignNow offer for managing Minnesota tax forms?

airSlate SignNow offers various features specifically designed to facilitate the management of Minnesota tax forms like the M1MA. Key features include document templates, audit trails, and secure storage, all aimed at improving efficiency and compliance. These tools make navigating tax documents easier than ever.

-

Can I integrate airSlate SignNow with other software for handling M1MA?

Yes, airSlate SignNow supports integration with various popular software applications that can enhance your workflow for managing Minnesota Revenue M1MA forms. Integrating with tools like accounting software or document management systems can streamline your process signNowly. This allows for a more cohesive experience when handling your tax documents.

-

Is eSigning the Minnesota Revenue M1MA legally binding?

Yes, eSigning the Minnesota Revenue M1MA form through airSlate SignNow is legally binding. Our platform complies with eSignature laws, ensuring that your signed documents are recognized by the state and federal agencies. This helps provide peace of mind when submitting important tax forms.

-

What are the benefits of using airSlate SignNow for Minnesota tax documents?

Using airSlate SignNow for your Minnesota tax documents, including the M1MA, offers numerous benefits such as enhanced security, faster processing times, and ease of use. You can manage your documents from anywhere and complete required forms promptly. This efficiency helps you avoid penalties and ensures timely submissions.

Get more for Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return nebraska form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return nebraska form

- Letter from tenant to landlord containing request for permission to sublease nebraska form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497318099 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent nebraska form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable nebraska form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497318102 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497318103 form

Find out other Search Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State PortalSearch Page Mn gov Minnesota's State Porta

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template