Www Revenue State Mn Us Sites Default Files 07 M1 2021

What is the 2021 Minnesota M1MA?

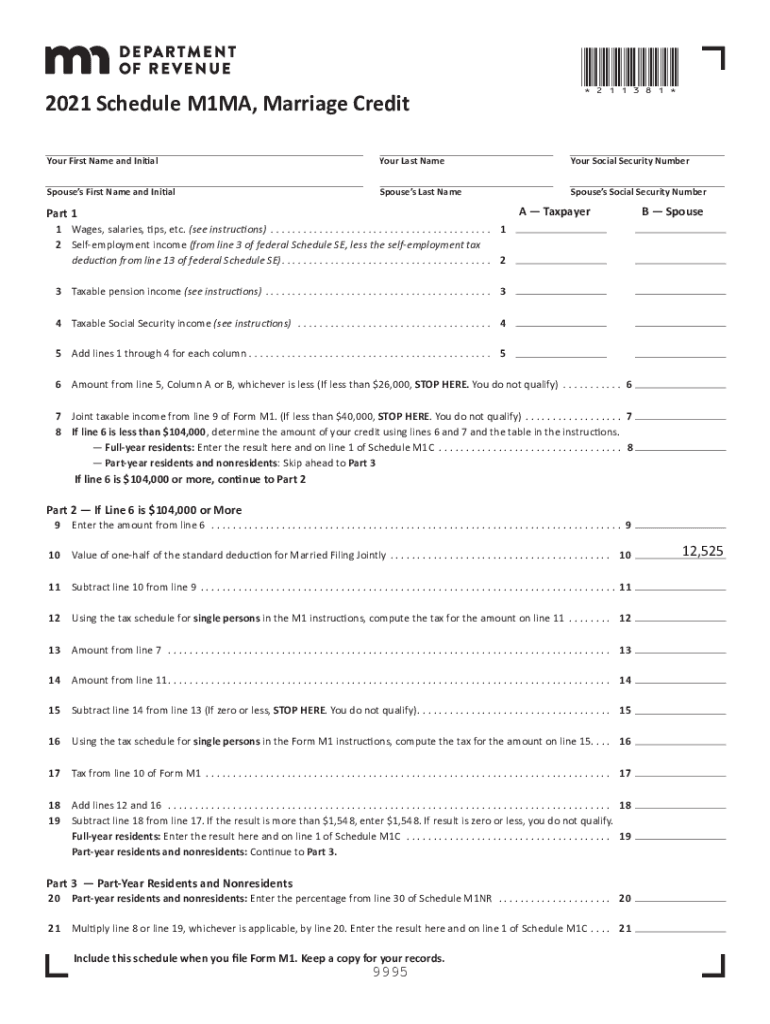

The 2021 Minnesota M1MA is a tax form used by residents of Minnesota to claim the marriage credit. This credit is designed to provide financial relief to married couples who file their taxes jointly. The form allows taxpayers to calculate the amount of credit they are eligible for based on their combined income and other qualifying criteria. The M1MA form is essential for ensuring that couples benefit from the tax advantages available to them under Minnesota state law.

Steps to Complete the 2021 Minnesota M1MA

Completing the 2021 Minnesota M1MA involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including your federal tax return and any relevant income statements. Next, fill out the form by entering your personal information, including your names, Social Security numbers, and filing status. Calculate your combined income and determine your eligibility for the marriage credit. Finally, review the form for any errors before submitting it to the Minnesota Department of Revenue.

Eligibility Criteria for the 2021 Minnesota M1MA

To qualify for the marriage credit on the 2021 Minnesota M1MA, couples must meet specific eligibility criteria. Both spouses must be residents of Minnesota for the entire tax year. Additionally, couples must file their federal taxes jointly to be eligible for this state credit. The credit is available to married couples with a combined income below a certain threshold, which is adjusted annually. It is important to check the latest guidelines from the Minnesota Department of Revenue to confirm your eligibility.

Form Submission Methods for the 2021 Minnesota M1MA

Taxpayers have several options for submitting the 2021 Minnesota M1MA. The form can be completed and submitted online through the Minnesota Department of Revenue's e-file system, which offers a convenient way to file your taxes electronically. Alternatively, couples may choose to print the completed form and mail it to the appropriate address provided by the Department of Revenue. In-person submissions are also an option, though they are less common. Ensure you follow the specific submission guidelines to avoid delays in processing.

Required Documents for the 2021 Minnesota M1MA

When preparing to file the 2021 Minnesota M1MA, certain documents are required to support your claim. These include your federal tax return, which provides essential information about your income and filing status. Additionally, you may need W-2 forms, 1099 forms, and any other documentation that verifies your income and deductions. Having these documents ready will streamline the completion of the form and help ensure that you accurately calculate your marriage credit.

Filing Deadlines for the 2021 Minnesota M1MA

It is crucial to be aware of the filing deadlines for the 2021 Minnesota M1MA to avoid any penalties or interest on unpaid taxes. Typically, the deadline for submitting your state tax return, including the M1MA, aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check the Minnesota Department of Revenue's official announcements for any updates regarding filing deadlines.

Quick guide on how to complete www revenue state mn us sites default files 2021 07 m1

Complete Www Revenue State Mn Us Sites Default Files 07 M1 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as a superior eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Www Revenue State Mn Us Sites Default Files 07 M1 on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Www Revenue State Mn Us Sites Default Files 07 M1 with ease

- Acquire Www Revenue State Mn Us Sites Default Files 07 M1 and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark signNow portions of your documents or obscure sensitive details with tools specifically designed for that purpose, offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Www Revenue State Mn Us Sites Default Files 07 M1 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www revenue state mn us sites default files 2021 07 m1

Create this form in 5 minutes!

How to create an eSignature for the www revenue state mn us sites default files 2021 07 m1

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

What is the 2021 MN credit and how does it work?

The 2021 MN credit is a tax credit designed to support Minnesota residents, particularly in response to economic challenges. It provides financial relief by allowing eligible taxpayers to reduce their state tax liability. airSlate SignNow can help businesses streamline the process of submitting necessary documentation for claiming this credit.

-

How can airSlate SignNow assist with claiming the 2021 MN credit?

AirSlate SignNow empowers users to send and eSign essential documents required for claiming the 2021 MN credit efficiently. By using our platform, businesses can eliminate paperwork delays and ensure that all forms are signed promptly. This expedites the process of handling tax credits and enhances overall efficiency.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers several pricing plans tailored to meet the needs of different users, starting with a free trial for new customers. Each plan is designed to provide value while ensuring that users can effectively manage their document workflows, including those related to the 2021 MN credit. Our transparent pricing structure makes it easy to choose the right fit for your business.

-

What features does airSlate SignNow offer that relate to the 2021 MN credit?

AirSlate SignNow offers features such as customizable templates, document tracking, and eSigning that are particularly beneficial for handling paperwork associated with the 2021 MN credit. These functionalities ensure that all required documents are completed accurately and on time. This way, businesses can focus more on completion and less on paperwork.

-

Can airSlate SignNow integrate with other software for managing 2021 MN credit-related tasks?

Yes, airSlate SignNow integrates seamlessly with various software solutions, including CRM tools and accounting software. This integration capability helps streamline workflows and simplifies the management of documentation needed for the 2021 MN credit. By connecting different tools, businesses can create a cohesive approach to tax credit claims.

-

What benefits does airSlate SignNow provide for small businesses filing for the 2021 MN credit?

AirSlate SignNow offers small businesses a cost-effective way to manage documentation, thus facilitating the filing process for the 2021 MN credit. By reducing the time spent on paperwork, businesses can allocate resources to other important tasks. Furthermore, the user-friendly interface ensures that even those with limited technical skills can navigate the platform effectively.

-

Is airSlate SignNow compliant with legal standards for eSigning regarding credits like the 2021 MN credit?

Absolutely. AirSlate SignNow is fully compliant with legal standards for eSignature laws, including those applicable for documents related to the 2021 MN credit. This compliance ensures that all electronically signed documents are legally binding and accepted by authorities, providing peace of mind to users during their application process.

Get more for Www Revenue State Mn Us Sites Default Files 07 M1

Find out other Www Revenue State Mn Us Sites Default Files 07 M1

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast