1350 STATE of SOUTH CAROLINA DEPARTMENT of REVENUE SCDOR 111 TAX 2022-2026

Understanding the SCDOR Form ST-389

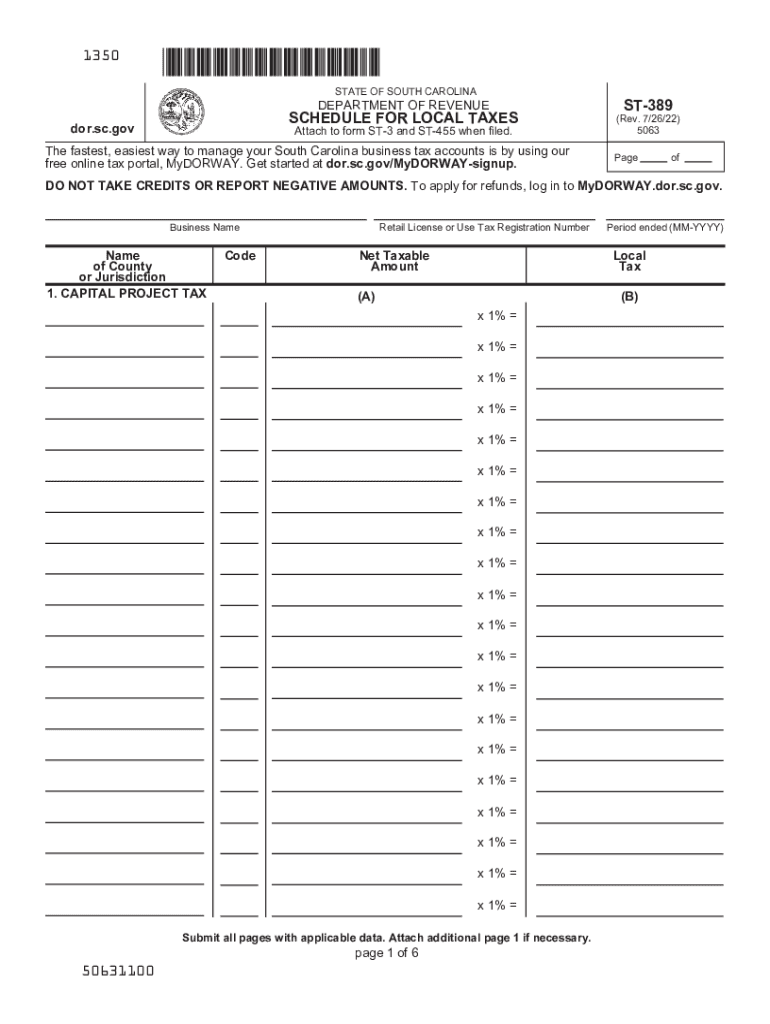

The SCDOR Form ST-389 is a crucial document used for South Carolina sales and use tax purposes. This form is essential for businesses that need to report and remit sales tax collected from customers. It serves as a declaration of the sales tax owed to the state and ensures compliance with South Carolina tax regulations. Understanding the purpose and requirements of this form is vital for businesses to avoid penalties and maintain good standing with the South Carolina Department of Revenue.

Steps to Complete the SCDOR Form ST-389

Completing the SCDOR Form ST-389 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary sales records, including total sales and tax collected during the reporting period. Next, fill out the form with the required information, including your business details, the total sales amount, and the tax amount owed. Be sure to double-check all entries for accuracy before submission. Once completed, the form can be filed online, by mail, or in person, depending on your preference and the specific requirements of the South Carolina Department of Revenue.

Legal Use of the SCDOR Form ST-389

The SCDOR Form ST-389 is legally binding when completed and submitted according to state regulations. It must be filed by businesses that collect sales tax, ensuring they comply with the South Carolina sales and use tax laws. Proper completion of this form is essential for businesses to avoid legal issues, including fines or audits. Understanding the legal implications of this form helps businesses maintain compliance and fosters trust with customers and regulatory bodies.

Filing Deadlines for the SCDOR Form ST-389

Timely filing of the SCDOR Form ST-389 is critical to avoid penalties. The filing deadline typically aligns with the end of the reporting period, which can be monthly, quarterly, or annually, depending on your business's sales volume. It is essential to check the specific deadlines set by the South Carolina Department of Revenue to ensure compliance. Late submissions may result in additional fees or interest on the unpaid tax amount.

Form Submission Methods for the SCDOR Form ST-389

The SCDOR Form ST-389 can be submitted through various methods, providing flexibility for businesses. Options include online submission through the South Carolina Department of Revenue's website, mailing a paper form, or delivering it in person to a local office. Each method has its advantages, such as immediate processing for online submissions or the ability to retain a physical copy when mailed. Choosing the right submission method can streamline the filing process and enhance record-keeping.

Required Documents for the SCDOR Form ST-389

When completing the SCDOR Form ST-389, certain documents are necessary to support your submission. These may include sales records, tax collection reports, and any relevant invoices. Having these documents on hand ensures that you can accurately report your sales and tax amounts. It also helps in case of audits or inquiries from the South Carolina Department of Revenue, as proper documentation substantiates your claims and calculations.

Penalties for Non-Compliance with the SCDOR Form ST-389

Failure to comply with the requirements of the SCDOR Form ST-389 can result in significant penalties. Businesses that do not file on time or fail to accurately report sales tax may face fines, interest on unpaid taxes, and potential audits. Understanding these consequences emphasizes the importance of timely and accurate filing. Businesses should prioritize compliance to avoid financial repercussions and maintain a positive relationship with tax authorities.

Quick guide on how to complete 1350 state of south carolina department of revenue scdor 111 tax

Complete 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX effortlessly on any device

Online document management has gained signNow popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX on any device using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX effortlessly

- Locate 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1350 state of south carolina department of revenue scdor 111 tax

Create this form in 5 minutes!

People also ask

-

What is ST 389 and how does it relate to airSlate SignNow?

ST 389 is a document management standard that helps ensure compliance and efficient handling of electronic signatures. airSlate SignNow utilizes this standard to provide a secure and reliable platform for eSigning documents, making the process seamless for users.

-

How much does it cost to use airSlate SignNow with ST 389 compliance?

airSlate SignNow offers competitive pricing plans that cater to different business needs, all while maintaining ST 389 compliance. You can choose a subscription that fits your budget and requirements, ensuring you get the best value for your eSigning solution.

-

What features does airSlate SignNow offer that are aligned with ST 389?

AirSlate SignNow provides a variety of features that comply with ST 389 standards, including secure electronic signatures, customizable templates, and real-time tracking of document statuses. These features ensure that all your signing processes remain efficient and compliant.

-

What are the benefits of using airSlate SignNow in accordance with ST 389?

Using airSlate SignNow with ST 389 compliance enhances document security, increases efficiency, and simplifies the eSigning process. Businesses can streamline operations while ensuring that their electronic agreements meet industry standards.

-

Can airSlate SignNow integrate with other software while being ST 389 compliant?

Yes, airSlate SignNow supports various integrations with other software applications while adhering to ST 389 compliance. This flexibility allows businesses to use their preferred tools alongside our platform for a more integrated workflow.

-

Is airSlate SignNow suitable for small businesses looking for ST 389 solutions?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses in need of ST 389 compliant eSigning solutions. Our platform empowers small businesses to manage their document workflows efficiently without compromising on security.

-

How does airSlate SignNow ensure security in ST 389 compliant eSigning?

AirSlate SignNow employs advanced encryption protocols and authentication measures to secure documents in accordance with ST 389 standards. We prioritize the safety of your data, giving you peace of mind when eSigning important documents.

Get more for 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497318242 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497318243 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497318244 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497318245 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497318246 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497318248 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497318249 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497318250 form

Find out other 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SCDOR 111 TAX

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement