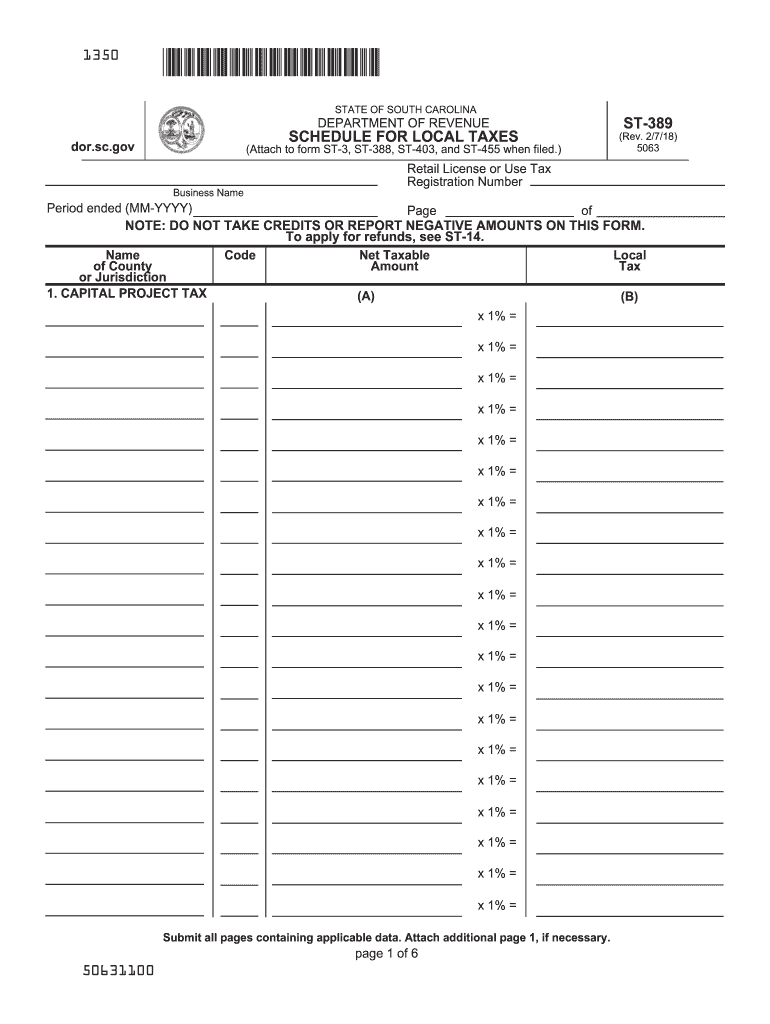

St 389 Form 2018

What is the SC Form 389?

The SC Form 389, also known as the South Carolina Sales and Use Tax Form, is a document used by businesses to report and pay sales and use taxes collected from customers. This form is essential for maintaining compliance with state tax laws and ensuring that businesses fulfill their tax obligations accurately. The form captures various details, including the total sales, taxable sales, and the amount of tax due. Understanding the purpose and requirements of the SC Form 389 is crucial for any business operating in South Carolina.

How to Use the SC Form 389

Using the SC Form 389 involves several key steps. First, gather all necessary sales records for the reporting period. This includes receipts, invoices, and any documentation that supports the sales figures. Next, complete the form by entering the total sales, taxable sales, and the calculated sales tax. Ensure that all figures are accurate to avoid discrepancies. After completing the form, it can be submitted either online or via mail, depending on your preference. Familiarity with the form's layout and requirements will facilitate a smoother filing process.

Steps to Complete the SC Form 389

Completing the SC Form 389 requires attention to detail. Follow these steps for accurate submission:

- Collect all sales data for the reporting period.

- Fill in the business information, including name, address, and tax identification number.

- Report total sales and taxable sales in the designated fields.

- Calculate the sales tax due based on the applicable tax rate.

- Double-check all entries for accuracy.

- Submit the form online or mail it to the appropriate tax authority.

Key Elements of the SC Form 389

The SC Form 389 includes several key elements that must be accurately filled out to ensure compliance. These elements consist of:

- Business Information: Name, address, and tax identification number.

- Total Sales: The total amount of sales made during the reporting period.

- Taxable Sales: Sales that are subject to sales tax.

- Sales Tax Due: The calculated amount of sales tax owed based on taxable sales.

- Signature: The form must be signed by an authorized representative of the business.

Filing Deadlines / Important Dates

Filing deadlines for the SC Form 389 are critical for compliance. Typically, businesses must submit the form on a monthly, quarterly, or annual basis, depending on their sales volume. It is essential to be aware of the specific due dates to avoid penalties. Generally, forms are due on the 20th of the month following the reporting period. Keeping a calendar of these deadlines will help ensure timely submissions and maintain good standing with state tax authorities.

Form Submission Methods

The SC Form 389 can be submitted through various methods, offering flexibility to businesses. Options include:

- Online Submission: Businesses can file electronically through the South Carolina Department of Revenue's website, which is often the quickest method.

- Mail: Completed forms can be printed and mailed to the appropriate tax office.

- In-Person: Some businesses may choose to deliver their forms directly to a local tax office.

Quick guide on how to complete st 389 2018 2019 form

Your assistance manual on how to prepare your St 389 Form

If you’re curious about how to finalize and submit your St 389 Form, here are a few straightforward instructions on how to make tax declaration less challenging.

To begin, you simply need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, produce, and complete your income tax paperwork with ease. Utilizing its editor, you can fluctuate between text, check boxes, and eSignatures, and return to adjust responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and accessible sharing.

Adhere to the steps below to finish your St 389 Form in a few minutes:

- Sign up for your account and start working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to open your St 389 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally binding eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can increase return errors and defer refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 389 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the st 389 2018 2019 form

How to generate an electronic signature for your St 389 2018 2019 Form online

How to make an electronic signature for your St 389 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the St 389 2018 2019 Form in Gmail

How to generate an eSignature for the St 389 2018 2019 Form from your smart phone

How to create an eSignature for the St 389 2018 2019 Form on iOS devices

How to create an eSignature for the St 389 2018 2019 Form on Android

People also ask

-

What is the St 389 Form and why is it important?

The St 389 Form is a crucial document used for tax exemption purposes within various states. Understanding the St 389 Form is essential for businesses looking to make tax-exempt purchases. By properly completing this form, companies can save money and ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the St 389 Form?

airSlate SignNow simplifies the process of completing and signing the St 389 Form electronically. With our user-friendly platform, you can easily fill out, sign, and send the St 389 Form, eliminating the need for cumbersome paper processes. This ensures that your documents are processed efficiently and securely.

-

What features does airSlate SignNow offer for managing the St 389 Form?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and document tracking specifically for the St 389 Form. These tools help streamline your workflow and ensure that your form is completed accurately and on time. Additionally, our platform allows for easy collaboration with team members.

-

Is there a cost associated with using airSlate SignNow for the St 389 Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options for managing the St 389 Form. We provide a cost-effective solution that scales based on your usage and requirements. You can choose a plan that fits your budget while still accessing all the necessary features.

-

Can I integrate airSlate SignNow with other software for the St 389 Form?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications, allowing for easy management of the St 389 Form alongside other business tools. This integration helps maintain your workflow efficiency and keeps all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for the St 389 Form?

Using airSlate SignNow for the St 389 Form offers numerous benefits, including reduced processing time, improved accuracy, and enhanced compliance. Our platform ensures that your forms are signed and tracked electronically, minimizing the risk of errors associated with manual handling. Additionally, you’ll enjoy increased accessibility and convenience.

-

How secure is airSlate SignNow when handling the St 389 Form?

airSlate SignNow prioritizes security, especially when it comes to handling sensitive documents like the St 389 Form. Our platform employs advanced encryption protocols and complies with industry standards to protect your data. You can trust us to keep your information safe while you complete and sign your forms.

Get more for St 389 Form

- Licensee application form

- Acf 01 201301 application for pip benefits fromatted for pdf form

- Mt199799 form

- Brasada ranch design review committee application form

- Crush player info sheet swi crush volleyball form

- Bimbo bakeries usa healthy focus screening physician form

- Akeed abaya shampoo msds mashalchemicalscom form

- Personal information worksheet bob lucy ministries boblucyministries

Find out other St 389 Form

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed