Topic No 556 Alternative Minimum TaxInternal Revenue Service 2022-2026

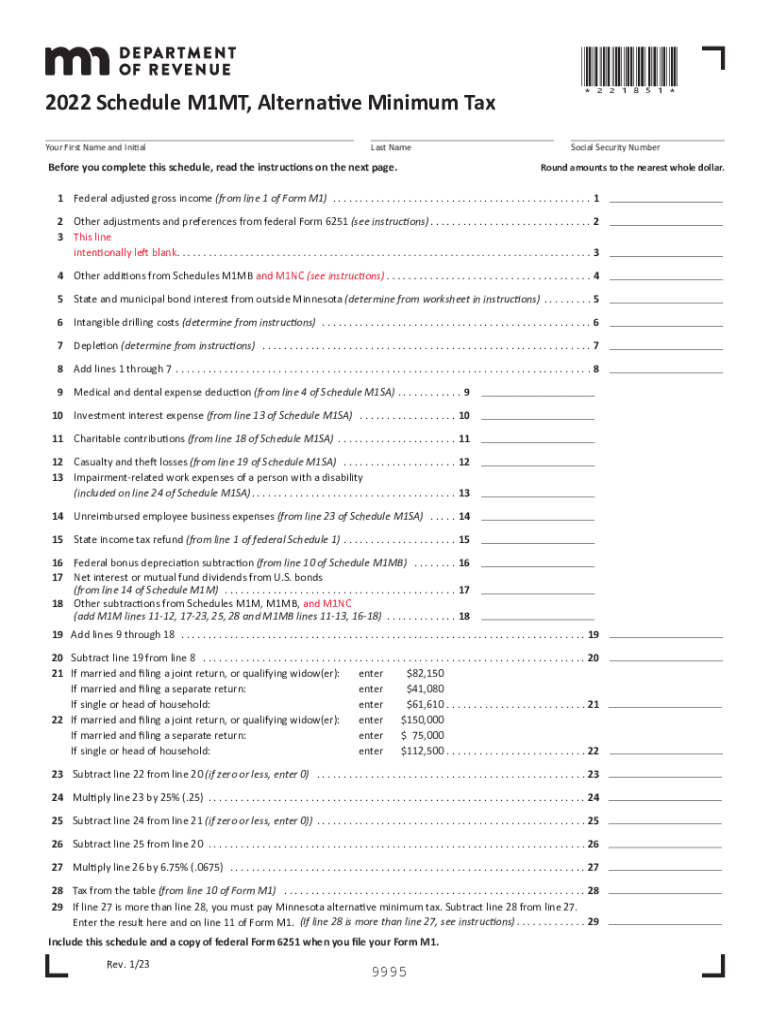

Understanding the Schedule M1MT

The Schedule M1MT is a vital form used for reporting the alternative minimum tax in Minnesota. This form is specifically designed for individuals who may be subject to the alternative minimum tax, which is a parallel tax system that ensures that taxpayers pay at least a minimum amount of tax, regardless of deductions or credits. The M1MT form helps calculate the alternative minimum tax liability and is essential for accurate tax filing in the state.

Steps to Complete the Schedule M1MT

Completing the Schedule M1MT involves several steps to ensure accuracy and compliance with Minnesota tax regulations. Begin by gathering all necessary financial documents, including income statements, deductions, and any relevant tax credits. Next, follow these steps:

- Determine your total income and adjustments.

- Calculate your alternative minimum taxable income (AMTI) by making necessary adjustments to your regular taxable income.

- Apply the appropriate exemption amount based on your filing status.

- Use the tax rates provided in the instructions to compute your alternative minimum tax.

- Complete the form by entering your calculated amounts and any additional required information.

Legal Use of the Schedule M1MT

The Schedule M1MT is legally recognized as a necessary component of Minnesota tax filings. To ensure that the form is considered valid, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is crucial, as failure to file the form correctly can result in penalties or additional tax liabilities.

Filing Deadlines for the Schedule M1MT

It is important to adhere to the filing deadlines for the Schedule M1MT to avoid penalties. The due date for filing this form typically aligns with the standard tax filing deadline for Minnesota residents. Taxpayers should be aware of any extensions that may apply and ensure that the form is submitted on time to maintain compliance with state regulations.

Required Documents for the Schedule M1MT

When completing the Schedule M1MT, certain documents are necessary to provide accurate information. These include:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Documentation of deductions and credits claimed.

- Any previous tax returns that may be relevant.

Having these documents ready will facilitate a smoother completion process and help ensure that all information is accurate.

Penalties for Non-Compliance with the Schedule M1MT

Failing to file the Schedule M1MT or submitting it inaccurately can lead to significant penalties. The Minnesota Department of Revenue may impose fines or interest on unpaid taxes. It is essential for taxpayers to understand the implications of non-compliance and to take proactive steps to ensure that their filings are accurate and timely.

Quick guide on how to complete topic no 556 alternative minimum taxinternal revenue service

Effortlessly Prepare Topic No 556 Alternative Minimum TaxInternal Revenue Service on Any Device

Managing documents online has increasingly gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your paperwork swiftly, without delays. Handle Topic No 556 Alternative Minimum TaxInternal Revenue Service on any device through airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and eSign Topic No 556 Alternative Minimum TaxInternal Revenue Service with Ease

- Obtain Topic No 556 Alternative Minimum TaxInternal Revenue Service and select Get Form to begin.

- Leverage the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools specifically designed by airSlate SignNow for those purposes.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Topic No 556 Alternative Minimum TaxInternal Revenue Service and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct topic no 556 alternative minimum taxinternal revenue service

Create this form in 5 minutes!

People also ask

-

What is the process to schedule m1mt using airSlate SignNow?

To schedule m1mt with airSlate SignNow, you can easily create a signing request by uploading your document, setting the recipient, and selecting the appropriate signing fields. After that, you simply send the request to your recipient for eSignature. The platform ensures a seamless and fast scheduling process.

-

Are there any costs associated with scheduling m1mt on airSlate SignNow?

Scheduling m1mt can be done through various pricing plans tailored to meet different business needs. Each plan offers a range of features, with options that provide the best value based on your usage. airSlate SignNow provides transparency in pricing so you can choose the best option for your organization.

-

What features does airSlate SignNow offer for users looking to schedule m1mt?

When you schedule m1mt on airSlate SignNow, you benefit from features such as customizable templates, automatic reminders, and real-time tracking. The platform also allows you to integrate with other applications, thereby enhancing your workflow and productivity.

-

Can I integrate third-party applications while scheduling m1mt?

Yes, airSlate SignNow allows you to integrate various third-party applications seamlessly. This enables you to schedule m1mt while working with tools like CRM systems, cloud storage services, and project management software. These integrations help streamline your document management process.

-

How secure is the process of scheduling m1mt on airSlate SignNow?

The security of your documents is a priority at airSlate SignNow. When you schedule m1mt, your data is protected through advanced encryption protocols and compliance with industry standards. This ensures that all sensitive information remains confidential throughout the signing process.

-

What benefits can businesses expect when scheduling m1mt with airSlate SignNow?

By scheduling m1mt with airSlate SignNow, businesses experience increased efficiency and reduced turnaround time for document signing. The user-friendly interface simplifies the eSigning process, ultimately enhancing productivity and ensuring timely completion of important paperwork.

-

Is training available for new users when scheduling m1mt?

Absolutely! airSlate SignNow offers comprehensive training resources and customer support to help new users get accustomed to scheduling m1mt effectively. You can access tutorials, live webinars, and a dedicated support team to assist you in mastering the platform.

Get more for Topic No 556 Alternative Minimum TaxInternal Revenue Service

- Nebraska forest products timber sale contract nebraska form

- Ne easement form

- Assumption agreement of deed of trust and release of original mortgagors nebraska form

- Nebraska small estate affidavit form

- Small estate affidavit for personal property of estates not more than 50000 nebraska form

- Summary administration package for small estates nebraska form

- Nebraska damages form

- Nebraska eviction form

Find out other Topic No 556 Alternative Minimum TaxInternal Revenue Service

- Complete Sign Document Myself

- Complete Sign Form Now

- Complete Sign Form Free

- Complete Sign Form Secure

- Complete Sign Form Android

- Complete Sign Form iPad

- Complete Sign Presentation Computer

- Request Sign PDF Myself

- Request Sign PDF Free

- Request Sign PDF Android

- How To Request Sign Word

- Request Sign Document Online

- Can I Request Sign Document

- Request Sign Form iPad

- Add Sign PDF Online

- Add Sign PDF Free

- Add Sign PDF Android

- Add Sign PDF iPad

- How To Add Sign PDF

- How Can I Add Sign PDF