Ph 1040 City of Port Huron Individual Income Tax Return 2021

What is the Ph 1040 City Of Port Huron Individual Income Tax Return

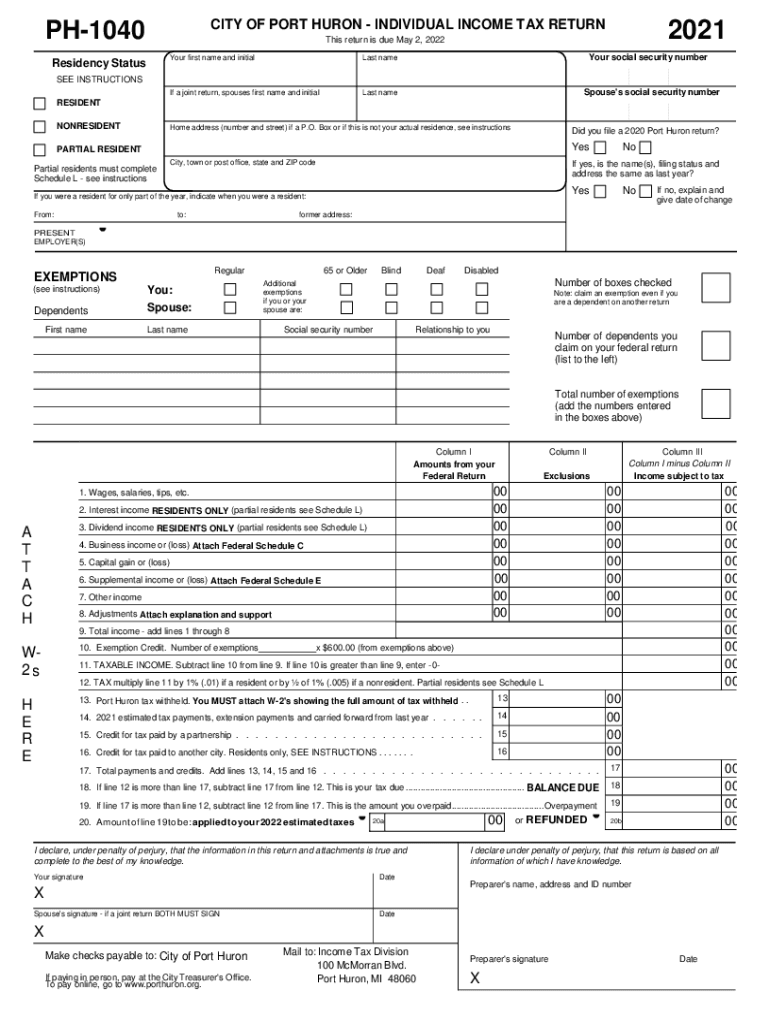

The Ph 1040 City Of Port Huron Individual Income Tax Return is a tax form specifically designed for residents of Port Huron, Michigan, to report their individual income to the city. This form is essential for individuals to calculate their local income tax liability based on their earnings during the tax year. It is important for taxpayers to understand the specific requirements and regulations associated with this form to ensure compliance with local tax laws.

Steps to complete the Ph 1040 City Of Port Huron Individual Income Tax Return

Completing the Ph 1040 City Of Port Huron Individual Income Tax Return involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Download the form from the official city website or obtain a physical copy from the local tax office.

- Fill out the form accurately, ensuring that all income sources are reported and deductions are applied where applicable.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to validate it.

- Submit the form either electronically or by mailing it to the appropriate city tax office.

Legal use of the Ph 1040 City Of Port Huron Individual Income Tax Return

The Ph 1040 City Of Port Huron Individual Income Tax Return is a legally binding document when completed correctly. To ensure its legality, the form must be signed by the taxpayer, and any electronic submission must comply with relevant eSignature laws. The form serves as an official record of income and tax obligations, and it may be used in legal contexts to verify a taxpayer's financial situation.

Required Documents

To complete the Ph 1040 City Of Port Huron Individual Income Tax Return, taxpayers must gather several documents, including:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation of any additional income sources, such as rental income or dividends.

- Records of deductions and credits that may apply, such as charitable contributions or education expenses.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Ph 1040 City Of Port Huron Individual Income Tax Return. Typically, the deadline aligns with the federal tax return due date, which is usually April fifteenth each year. However, it is advisable to check for any specific local extensions or changes that may apply for the current tax year.

Form Submission Methods (Online / Mail / In-Person)

The Ph 1040 City Of Port Huron Individual Income Tax Return can be submitted through various methods:

- Online submission via the city’s official tax portal, which allows for electronic filing and faster processing.

- Mailing a printed copy of the completed form to the designated city tax office.

- In-person submission at the local tax office, where taxpayers can receive assistance if needed.

Quick guide on how to complete ph 1040 city of port huron individual income tax return

Complete Ph 1040 City Of Port Huron Individual Income Tax Return effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without issues. Manage Ph 1040 City Of Port Huron Individual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign Ph 1040 City Of Port Huron Individual Income Tax Return with ease

- Obtain Ph 1040 City Of Port Huron Individual Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ph 1040 City Of Port Huron Individual Income Tax Return to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ph 1040 city of port huron individual income tax return

Create this form in 5 minutes!

People also ask

-

What is the Ph 1040 City Of Port Huron Individual Income Tax Return?

The Ph 1040 City Of Port Huron Individual Income Tax Return is a tax form used by residents of Port Huron, Michigan, to report their income and calculate their municipal tax liabilities. It is essential for compliance with local tax regulations, ensuring you pay the correct amount of taxes to the city.

-

How can airSlate SignNow help with the Ph 1040 City Of Port Huron Individual Income Tax Return?

With airSlate SignNow, you can easily eSign and send your Ph 1040 City Of Port Huron Individual Income Tax Return electronically. The platform simplifies the document signing process, allowing you to finalize your tax documents quickly and securely.

-

Is airSlate SignNow a cost-effective solution for submitting the Ph 1040 City Of Port Huron Individual Income Tax Return?

Yes, airSlate SignNow is a cost-effective solution that streamlines the submission of the Ph 1040 City Of Port Huron Individual Income Tax Return. By reducing the need for paper and postage, it saves you money while ensuring your tax return is processed efficiently.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a variety of features for tax document management, including customizable templates, secure eSigning, and document tracking. These tools make it easy to manage your Ph 1040 City Of Port Huron Individual Income Tax Return efficiently.

-

Can I integrate airSlate SignNow with other accounting software for my Ph 1040 City Of Port Huron Individual Income Tax Return?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enhancing the efficiency of your tax preparation process, including the Ph 1040 City Of Port Huron Individual Income Tax Return. This ensures a smooth flow of data between platforms, simplifying your workflow.

-

How secure is airSlate SignNow for sending my Ph 1040 City Of Port Huron Individual Income Tax Return?

airSlate SignNow prioritizes security, implementing advanced encryption and compliance with regulatory standards to protect your documents. Your Ph 1040 City Of Port Huron Individual Income Tax Return will be safe and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for my tax returns?

Using airSlate SignNow for your tax returns, including the Ph 1040 City Of Port Huron Individual Income Tax Return, allows for faster processing, reduced paper usage, and enhanced organization. You'll save time and avoid delays, ensuring your tax obligations are met promptly.

Get more for Ph 1040 City Of Port Huron Individual Income Tax Return

- Sample cover letter for filing of llc articles or certificate with secretary of state nebraska form

- Supplemental residential lease forms package nebraska

- Nebraska tenant form

- Ne name form

- Nebraska name change instructions and forms package for a minor nebraska

- Ne change name form

- Nebraska change form

- Nebraska change 497318293 form

Find out other Ph 1040 City Of Port Huron Individual Income Tax Return

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT