Sba Form 770

What is the SBA Form 770

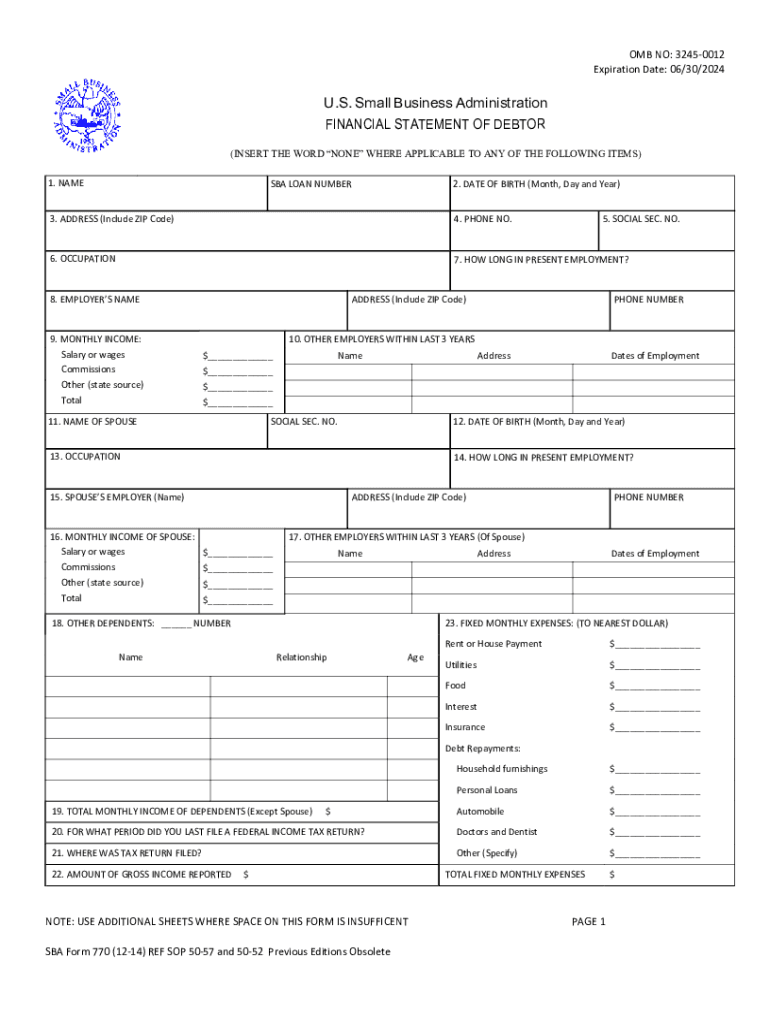

The SBA Form 770 is a financial document used by businesses applying for loan assistance under the Small Business Administration (SBA) programs. This form collects essential financial information from applicants, enabling the SBA to assess their eligibility for various funding options. The form requires detailed disclosures about the applicant's financial status, including assets, liabilities, income, and expenses. Proper completion of the SBA Form 770 is crucial for ensuring that the application process runs smoothly and efficiently.

Steps to Complete the SBA Form 770

Completing the SBA Form 770 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including balance sheets, profit and loss statements, and tax returns. Next, fill out the form with accurate and up-to-date financial information. Pay close attention to each section, as incomplete or incorrect information can delay processing. After filling out the form, review it thoroughly to ensure all details are correct. Finally, submit the form through the appropriate channels, whether online or via mail, as specified by the SBA.

Key Elements of the SBA Form 770

The SBA Form 770 includes several key elements that are critical for evaluating a business's financial health. These elements typically encompass:

- Business Information: Name, address, and contact details of the business.

- Financial Statements: Detailed income statements and balance sheets.

- Debt Obligations: Information on existing debts and liabilities.

- Cash Flow Projections: Estimates of future cash inflows and outflows.

- Owner Information: Personal financial details of the business owners.

Providing accurate and comprehensive information in these areas is essential for a successful application.

Legal Use of the SBA Form 770

The SBA Form 770 is legally binding and must be completed with integrity and honesty. Misrepresentation or omission of financial information can lead to severe penalties, including denial of loan applications or legal consequences. The form must comply with all relevant laws and regulations governing financial disclosures, ensuring that the information provided is truthful and reflective of the business's actual financial condition. Understanding the legal implications of submitting this form is crucial for applicants.

Form Submission Methods

Submitting the SBA Form 770 can be done through various methods, depending on the applicant's preference and the specific requirements of the SBA. Common submission methods include:

- Online Submission: Many applicants prefer to submit the form electronically through the SBA's online portal, which allows for faster processing.

- Mail Submission: Applicants may also choose to print the form and send it via postal mail to the designated SBA office.

- In-Person Submission: Some applicants opt to deliver the form in person at their local SBA office, providing an opportunity for immediate assistance.

Choosing the right submission method can impact the speed and efficiency of the application process.

Required Documents

When completing the SBA Form 770, several supporting documents are typically required to substantiate the financial information provided. These documents may include:

- Tax Returns: Business and personal tax returns for the past three years.

- Financial Statements: Recent balance sheets and income statements.

- Debt Schedules: Detailed lists of all current debts and obligations.

- Cash Flow Statements: Projections of future cash flows to demonstrate financial viability.

Providing these documents alongside the form helps ensure a thorough review by the SBA.

Quick guide on how to complete sba form 770 100652593

Handle Sba Form 770 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Sba Form 770 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Sba Form 770 effortlessly

- Acquire Sba Form 770 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Sba Form 770 to ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How does airSlate SignNow protect my financial information?

airSlate SignNow utilizes advanced encryption and security protocols to ensure that your financial information is protected at all times. We comply with industry standards and regulations to safeguard sensitive data during the signing process. You can trust that your financial information remains confidential and secure.

-

What features does airSlate SignNow offer to manage financial documents?

airSlate SignNow provides various features to help manage financial documents efficiently. With our platform, you can create, send, and eSign documents seamlessly, ensuring that all your financial information is organized and easily accessible. The intuitive interface simplifies the process, allowing you to focus on your business.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial, allowing you to experience our features without commitments. During the trial, you can test how easily you can manage your financial information and document workflows. This helps you understand the value we provide before making a purchase.

-

How does airSlate SignNow integrate with other financial tools?

airSlate SignNow integrates seamlessly with a variety of financial tools and applications. This integration allows you to streamline your workflows and manage your financial information across platforms effortlessly. By connecting airSlate SignNow with your existing systems, you enhance efficiency and reduce manual data entry.

-

What pricing plans are available for airSlate SignNow?

AirSlate SignNow offers several pricing plans to cater to different business needs. Each plan is designed with features that help you manage your financial information effectively while remaining budget-friendly. You can choose the plan that best suits your requirements and scale as your business grows.

-

Can airSlate SignNow help with compliance related to financial information?

Absolutely! airSlate SignNow is built with compliance in mind, ensuring that your financial information adheres to relevant regulations. Our platform features audit trails and document security that assist in maintaining compliance, providing peace of mind as you manage sensitive data.

-

What are the benefits of using airSlate SignNow for financial documentation?

Using airSlate SignNow for your financial documentation streamlines the entire process, saving you time and reducing errors. With electronic signatures, you can quickly send and receive documents, which accelerates transactions. Additionally, our platform keeps your financial information organized and easily retrievable.

Get more for Sba Form 770

- Amendment of lease package north dakota form

- Annual financial checkup package north dakota form

- Nd bill sale form

- Living wills and health care package north dakota form

- Last will and testament package north dakota form

- Subcontractors package north dakota form

- North dakota protecting form

- North dakota identity form

Find out other Sba Form 770

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist