Missouri Form MO 941 Employers Return of Income TaxesMO 941 Employer's Return of Income Taxes WithheldMO 941 Employer' 2022-2026

What is the Missouri Form MO 941?

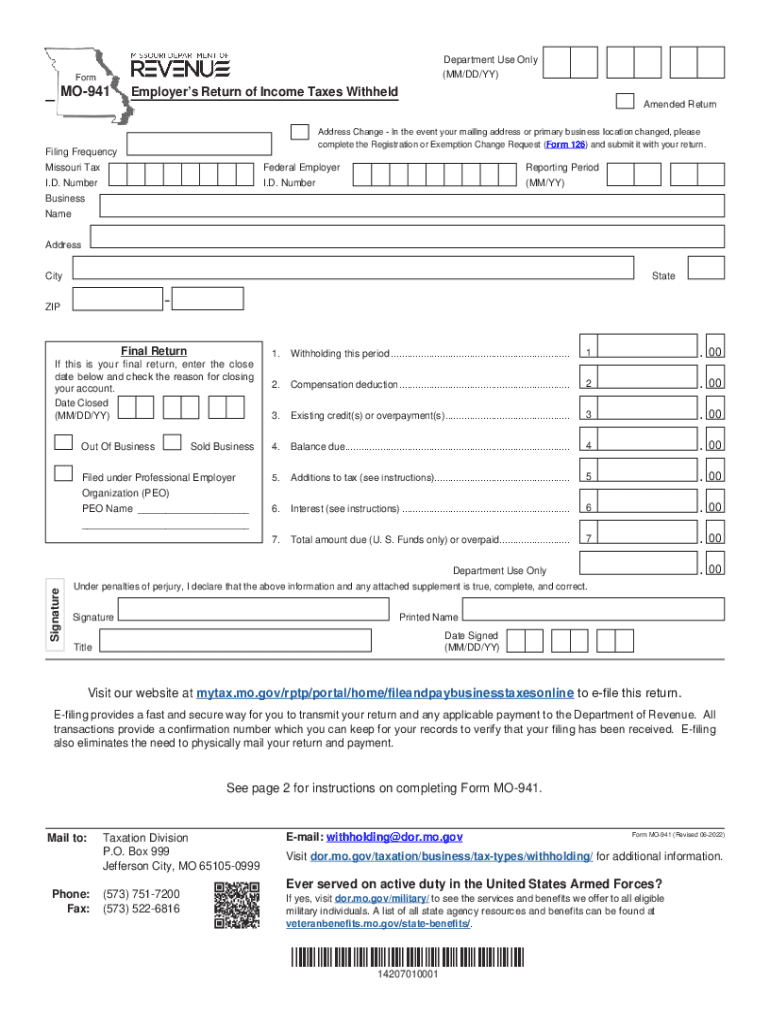

The Missouri Form MO 941 is an essential document used by employers to report income taxes withheld from employees' wages. This form, officially known as the Employer's Return of Income Taxes Withheld, is a crucial part of the state's tax compliance system. Employers must accurately complete and submit this form to the Missouri Department of Revenue to ensure that the correct amount of state income tax is remitted on behalf of their employees. The MO 941 form is typically filed quarterly, reflecting the amount of taxes withheld during that period.

Steps to Complete the Missouri Form MO 941

Completing the Missouri Form MO 941 involves several key steps to ensure accuracy and compliance. First, employers should gather all necessary payroll records for the reporting period. This includes total wages paid, the amount of state income tax withheld, and any adjustments for prior periods. Next, employers fill out the form by entering the required information in the designated fields, including the employer identification number, total wages, and tax amounts withheld. After completing the form, it is essential to review it for accuracy before submission. Finally, the completed form can be submitted online or by mail to the Missouri Department of Revenue, depending on the employer's preference.

Filing Deadlines for the Missouri Form MO 941

Employers need to be aware of the filing deadlines associated with the Missouri Form MO 941 to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For instance, the deadlines for the 2023 tax year are as follows:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Employers should ensure timely submission to maintain compliance with state tax regulations.

Legal Use of the Missouri Form MO 941

The Missouri Form MO 941 is legally binding when completed and submitted in accordance with state regulations. To ensure the form's legal validity, employers must adhere to the guidelines set forth by the Missouri Department of Revenue. This includes maintaining accurate payroll records and ensuring that the amounts reported on the form match the amounts withheld from employee wages. Additionally, using a secure and compliant platform for electronic submission can enhance the form's legal standing, as it may provide an audit trail and digital certificates that validate the submission process.

Key Elements of the Missouri Form MO 941

Understanding the key elements of the Missouri Form MO 941 is vital for accurate completion. The form requires specific information, including:

- Employer identification number (EIN)

- Total wages paid to employees during the reporting period

- Total amount of state income tax withheld

- Adjustments for any prior periods, if applicable

Each of these elements plays a critical role in ensuring that the form is completed correctly and that the employer remains compliant with state tax laws.

How to Obtain the Missouri Form MO 941

The Missouri Form MO 941 can be easily obtained through the Missouri Department of Revenue's official website. Employers can access the form in PDF format, allowing for easy printing and completion. Additionally, many payroll software programs include the MO 941 form as part of their services, which can streamline the process of filling out and submitting the form. It is important for employers to ensure they are using the most current version of the form to comply with any changes in tax regulations.

Quick guide on how to complete missouri form mo 941 employers return of income taxesmo 941 employers return of income taxes withheldmo 941 employers return of

Complete Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer' effortlessly on any device

Digital document management has gained increasing popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer' on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and electronically sign Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer' with ease

- Obtain Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer' and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure confidential details with the tools that are specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your changes.

- Choose how you wish to share your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer', ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form mo 941 employers return of income taxesmo 941 employers return of income taxes withheldmo 941 employers return of

Create this form in 5 minutes!

People also ask

-

What is the Missouri form MO 941?

The Missouri form MO 941 is a tax return form used by employers to report state income tax withheld from employees. This form is crucial for businesses operating in Missouri to remain compliant with state tax regulations.

-

How can airSlate SignNow help with the Missouri form MO 941?

airSlate SignNow streamlines the process of completing and submitting the Missouri form MO 941 by allowing businesses to eSign documents quickly and securely. Our user-friendly interface simplifies document management, making it easier for employers to comply with state tax requirements.

-

Is airSlate SignNow a cost-effective solution for handling tax forms like the Missouri form MO 941?

Yes, airSlate SignNow offers a cost-effective solution for handling tax forms, including the Missouri form MO 941. Our pricing plans are designed to fit businesses of all sizes, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for managing the Missouri form MO 941?

AirSlate SignNow features include document editing, eSigning, and secure storage, allowing you to manage the Missouri form MO 941 seamlessly. You can also track document status and receive notifications for your submissions to ensure timely filing.

-

Can I integrate airSlate SignNow with other software for the Missouri form MO 941?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, enabling you to manage the Missouri form MO 941 more efficiently. This helps streamline your workflow and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for the Missouri form MO 941?

Using airSlate SignNow for the Missouri form MO 941 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive information. Our platform helps businesses save time and focus on what matters most.

-

How secure is eSigning the Missouri form MO 941 with airSlate SignNow?

AirSlate SignNow prioritizes security, ensuring that your eSigning process for the Missouri form MO 941 is safe and compliant. We implement strong encryption protocols and adhere to industry standards to protect your data during transactions.

Get more for Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer'

- Roofing contract for contractor new hampshire form

- Electrical contract for contractor new hampshire form

- Sheetrock drywall contract for contractor new hampshire form

- Flooring contract for contractor new hampshire form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new hampshire form

- Notice of intent to enforce forfeiture provisions of contact for deed new hampshire form

- Final notice of forfeiture and request to vacate property under contract for deed new hampshire form

- Buyers request for accounting from seller under contract for deed new hampshire form

Find out other Missouri Form MO 941 Employers Return Of Income TaxesMO 941 Employer's Return Of Income Taxes WithheldMO 941 Employer'

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free