File Fillable Forms HelpInternal Revenue Service 2020

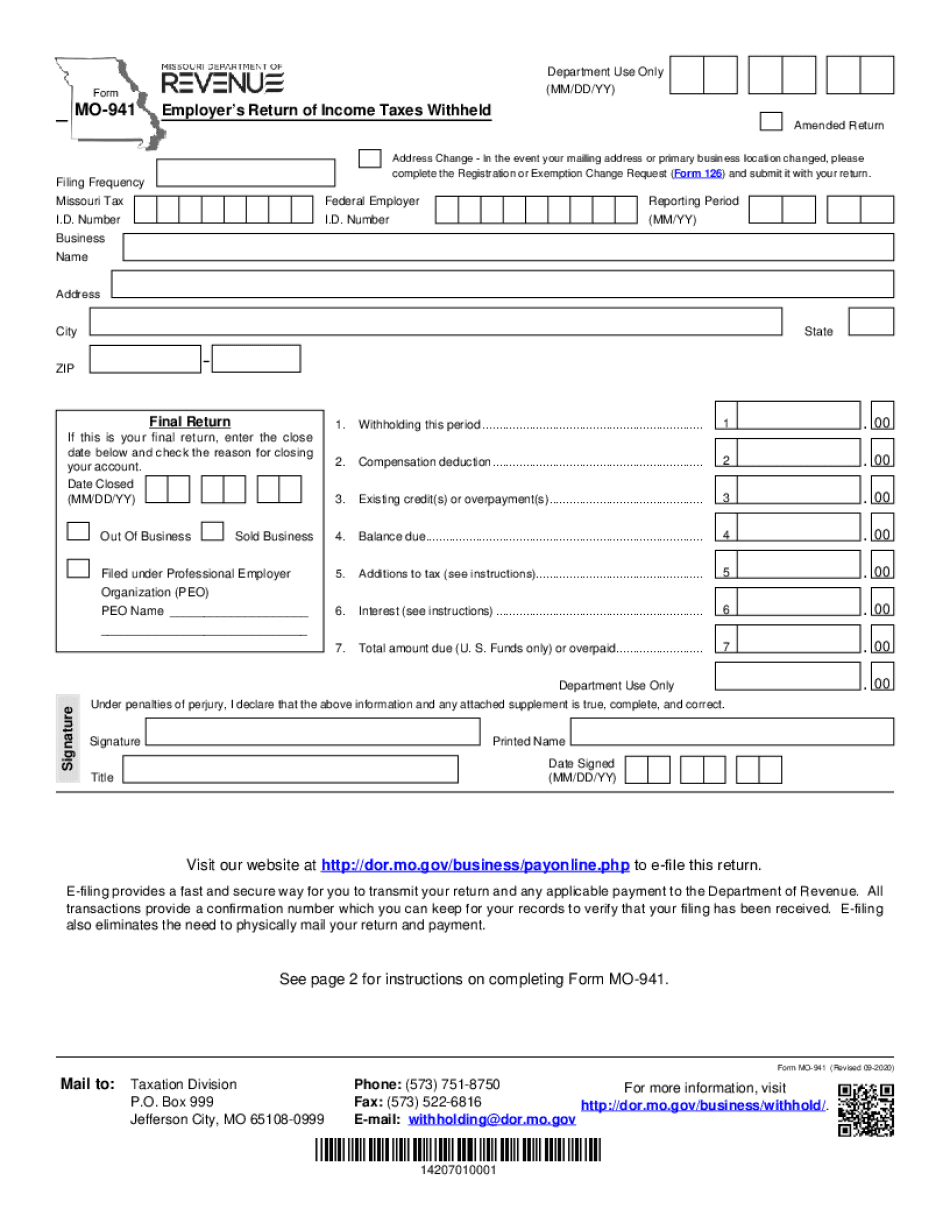

Understanding the Missouri 941 Form

The Missouri 941 form, also known as the MO 941, is a crucial document for employers in Missouri. It is used to report state income taxes withheld from employees' wages. This form is essential for ensuring compliance with state tax laws and helps employers accurately report their tax liabilities to the Missouri Department of Revenue. Understanding the details of this form can assist businesses in managing their payroll responsibilities effectively.

Steps to Complete the Missouri 941 Form

Filling out the Missouri 941 form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your employer identification number (EIN), total wages paid, and the amount of taxes withheld. Follow these steps:

- Enter your business information at the top of the form, including your name, address, and EIN.

- Report the total wages paid to employees in the designated section.

- Calculate the total amount of Missouri taxes withheld and enter it in the appropriate field.

- Complete any additional sections required for specific deductions or credits.

- Review the form for accuracy before submission.

Filing Deadlines for the Missouri 941 Form

It is important to be aware of the filing deadlines associated with the Missouri 941 form. Employers must submit this form on a quarterly basis. The due dates for filing are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal Use of the Missouri 941 Form

The Missouri 941 form serves as a legal document for reporting state taxes withheld from employees. To ensure its legal validity, it must be completed accurately and submitted on time. Compliance with state regulations is essential, as failure to file or inaccuracies can lead to penalties and interest charges. Employers should retain copies of submitted forms for their records, as they may be required for audits or other inquiries.

Required Documents for Filing the Missouri 941 Form

When preparing to file the Missouri 941 form, certain documents are necessary to ensure accurate reporting. Employers should have the following documents ready:

- Payroll records detailing employee wages and hours worked

- Records of taxes withheld from employee paychecks

- Employer identification number (EIN)

- Any relevant documentation for deductions or credits claimed

Form Submission Methods for the Missouri 941

The Missouri 941 form can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online submission through the Missouri Department of Revenue's e-filing system

- Mailing a paper copy of the form to the appropriate state office

- In-person submission at designated state offices

Penalties for Non-Compliance with the Missouri 941 Form

Failure to comply with the requirements associated with the Missouri 941 form can result in significant penalties. Common penalties include:

- Late filing penalties for forms submitted after the due date

- Interest charges on unpaid taxes

- Potential legal action for persistent non-compliance

Employers are encouraged to stay informed about their filing obligations to avoid these penalties and maintain good standing with the state.

Quick guide on how to complete free file fillable forms helpinternal revenue service

Easily Prepare File Fillable Forms HelpInternal Revenue Service on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage File Fillable Forms HelpInternal Revenue Service on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Effortlessly Alter and eSign File Fillable Forms HelpInternal Revenue Service

- Locate File Fillable Forms HelpInternal Revenue Service and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds exactly the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether through email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign File Fillable Forms HelpInternal Revenue Service and ensure seamless communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct free file fillable forms helpinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the free file fillable forms helpinternal revenue service

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is mo 941 and how does it relate to airSlate SignNow?

The mo 941 is a quarterly tax form used by employers in Missouri to report wages and withholding. With airSlate SignNow, you can easily eSign and send your mo 941 forms, ensuring a smooth submission process to meet your tax obligations on time.

-

How can airSlate SignNow help with filing the mo 941?

airSlate SignNow offers a streamlined solution to fill out and securely eSign your mo 941 forms. Our platform ensures compliance and keeps your data safe, allowing you to efficiently manage your payroll documents and tax submissions.

-

Is there a cost associated with using airSlate SignNow for the mo 941?

Yes, airSlate SignNow has various pricing plans tailored for businesses of all sizes. The cost-effective solution allows you to manage your mo 941 and other business documents without compromising on quality or security.

-

What features does airSlate SignNow offer for managing mo 941 documents?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking for your mo 941 forms. These tools enhance productivity, making it simple to track the status of your documents at any time.

-

Can airSlate SignNow integrate with my accounting software for mo 941 submissions?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to sync your financial data. This integration simplifies the process of preparing your mo 941 forms, as it automatically pulls in necessary information.

-

What are the benefits of using airSlate SignNow for eSigning mo 941?

Using airSlate SignNow for eSigning your mo 941 offers numerous benefits, including time-saving, increased efficiency, and enhanced security. By digitizing the process, you can reduce paper waste and securely store your documents for easy access.

-

Is it easy to learn how to use airSlate SignNow for mo 941?

Absolutely! airSlate SignNow features an intuitive interface that is user-friendly. Even if you're unfamiliar with eSigning, you will find that navigating the platform for your mo 941 forms is straightforward and hassle-free.

Get more for File Fillable Forms HelpInternal Revenue Service

- Motion extension file form

- Notice of election by spouse vermont form

- Rights surviving spouse form

- Vermont rights in form

- Conditional waiver and release of claim of lien upon final payment vermont form

- Quitclaim deed by two individuals to corporation vermont form

- Vermont warranty deed 497428706 form

- Vermont order form

Find out other File Fillable Forms HelpInternal Revenue Service

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement